Heard of the Nigerian 419 scam? If you have used internet and email for a while, you have most likely received occasional emails from a desperate millionaire from unheard-of lands looking for a place to park his riches. The writer would give you some commission if you agree to park his money in your account for a while. But first, you must wire some money abroad, and the whole bounty will be transferred to you. Whoever sent money saw none of it again.

Gone are the days of Charles Ponzi and others of his ilk who had to win over customers through physical meetings and impress them with luxurious offices. With internet penetration across the developing world expanding faster than financial literacy, more and more gullible web-users fall prey to scams offering get-rich-quick schemes. With promises to ‘change your life’, ‘realise your dreams?and ‘touch the sky’, the scamsters have cast the net wide, across the web. In most cases, the promoters are untraceable or invisible, there are no physical offices or government registrations, there is no offcial who can be contacted, and there is no complaint-redressal mechanism. Most of them use the multi-level marketing format, which is used by some direct selling companies and many fraudulent operators. The ‘products?are pedddled through professional-looking websites, which outline complex payment mechansims designed to confuse the user. Apart from the worthless products sold at a steep price, one gets to make a lot of money by recruiting more distributors.

The latest MLM sensation is Speak Asia, which promotes itself as a company conducting surveys for large corporates. The company claims to be based in Singapore as a market research company, though its Indian lawyer says it is not into research. The website says it is a survey company, while earlier it has been touted an e-magazine company. Essentially, you buy a subscription for the company’s e-magazine Surveys Today for R11,000 or R6,000, that entitles you to fill up online surveys, which the company claims it conducts for corporates like ICICI Bank, Bata and Nestle. Apart from the fee you receive for filling up surveys, you must also get more people to join the scheme, which will bring you ‘handsome?rewards. Speak Asia has made a splash with ads on TV and in the print media, organising events and touting impressive figures. It says it has 17 lakh users in India, and that it plans to take it to 1 crore. However, the company’s business model is suspect and its founders invisible. Its press conferences are conducted by a lawyer, where press releases thin on facts are released. The companies named by Speak Asia as clients have denied having any connections with them. Many subscribers say they have neither received any magazine nor got any money. A slew of government agencies have started probing the functioning of this ?Singapore-based? company.

The format used here is called multi-level marketing, where a company sells you goods and also makes you recruit fresh distributors. The MLM model has similarities with pyramid schemes and Ponzi schemes, which intend to defraud customers. FE gives you an outline of the several schemes which work on the multi-level format and some of the major MLM-based scams of the past.

US FEDERAL TRADE COMMISSION ON MLM

Keep high vigil

Not all multi-level marketing plans are legitimate. Some are pyramid schemes. It?s best not to get involved in plans where the money you make is based primarily on the number of distributors you recruit and your sales to them, rather than on your sales to people outside the plan who intend to use the products.

If you sign up as a distributor, you may be promised commissions or other rewards — for both your sales of the plan’s goods or services and those of other people you recruit to become distributors. These plans, often called ?multilevel marketing plans,? sometimes promise commissions or rewards that never materialize. What’s worse, consumers are often urged to spend or ?invest? money in order to make it.

Steer clear of multilevel marketing plans that pay commissions for recruiting new distributors. They’re actually illegal pyramid schemes.

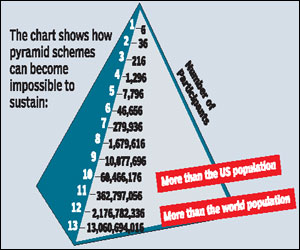

Why is pyramiding dangerous? Because plans that pay commissions for recruiting new distributors inevitably collapse when no new distributors can be recruited. And when a plan collapses, most people-except perhaps those at the very top of the pyramid-end up empty-handed.

If you decide to become a distributor, remember that you’re legally responsible for the claims you make about the company, its product and the business opportunities it offers. That applies even if you’re simply repeating claims you read in a company brochure or advertising flyer.

FAQS ON MLM

Money for the topline

Multi-level marketing (MLM) is considered as a form of direct selling. Here, a company sells goods to a distributor (you), who sells it, and also recruits other distributors to sell the same. Apart from profits on the sales you make, you also stand to receive commissions for the fresh distributor recruits. You also get commissions when those sub-distributors find their own sub-distributors. Usually, there is a high entry price for joining as a distributor, which is compensated as more distributors join below you, forming a ‘downline’. MLM is also called network marketing and matrix selling.

MLM is illegal in some countries, and restricted in many others. It is seen as having similarities with pyramid schemes and money circulation schemes, which dupe investors. In the US, multi-level marketing formats which mandate that distributors recruit others into the network are illegal. Also, if you have become a distributor for the MLM company, you are also responsible for the sales pitch and claims made by the company, whether they are genuine or fake. Some MLM companies bar you from returning unsold products. Usually, only a fraction of distributors of MLM products/services get to make profits, and that too after the downline grows substantially. Those who join the MLM chain at the top are the ones most likely to make money, while those further down are unable to win commissions and often lose all their investment. Keep an eye out for companies which sell more to distributors and less to actual customers — they are most likely pyramid schemes. If you are promised that you will make more money from distributing more than selling, again it is likely to be an illegal pyramid scheme. Not all MLM companies are illegal either. However, many potential customers are unable to make the distinction between genuine MLM companies and pyramid schemes which are designed to collapse. Most sign up for the attractive commissions offered, and lose their investment when they are unable to grow the downline.

PYRAMID SCHEMES

Old as the hills

A pyramid scheme is a time-tested fraud where gullible investors are fooled into handing over their money, in return for the promise of getting easy commissions for recruting more like him/her. Such schemes are often peddled as get-rich-quick schemes, where one can work from home and earn millions. No pyramid scheme can grow forever, and all of them ultimately collapse.

The people at the top of the pyramid — those who cooked up the scheme or those who got in early — either vanish with the money before the scheme collapses or are arrested and prosecuted by law enforcement agencies. Those at the bottom levels lose all the money they paid into the scheme. Many modern pyramid schemes mask their true nature by ‘selling?worthless products or services. A dummy product, say a ?valuable coin? or an ?e-bulletin? is sold at a steep price which gullible investors pick up, along with the condition that they recruit more distributors. Pyramid schemes are illegal in many countries. Some countries do not specifically ban pyramid schemes, but catch those who indulge in such forgery through other legislation. In India, the Prize Chits and Money Circulation Schemes (Banning) Act, 1978 is used to book offenders.

The people at the top of the pyramid — those who cooked up the scheme or those who got in early — either vanish with the money before the scheme collapses or are arrested and prosecuted by law enforcement agencies. Those at the bottom levels lose all the money they paid into the scheme. Many modern pyramid schemes mask their true nature by ‘selling?worthless products or services. A dummy product, say a ?valuable coin? or an ?e-bulletin? is sold at a steep price which gullible investors pick up, along with the condition that they recruit more distributors. Pyramid schemes are illegal in many countries. Some countries do not specifically ban pyramid schemes, but catch those who indulge in such forgery through other legislation. In India, the Prize Chits and Money Circulation Schemes (Banning) Act, 1978 is used to book offenders.

US FTC on pyramid schemes:

?Beware of any plan that offers commissions for recruiting new distributors, particularly when there is no product involved or when there is a separate, up-front membership fee. At the same time, do not assume that the presence of a purported product or service removes all danger. The Commission has seen pyramids operating behind the apparent offer of investment opportunities, charity benefits, off-shore credit cards, jewelry, women’s underwear, cosmetics, cleaning supplies, and even electricity… If a plan purports to sell a product or service, check to see whether its price is inflated, whether new members must buy costly inventory, or whether members make most ?sales? to other members rather than the general public. If any of these conditions exist, the purported ?sale? of the product or service may just mask a pyramid scheme that promotes an endless chain of recruiting and inventory loading.?

JAPANLIFE MATTRESSES

Way to lose life?s savings

In the late 1990s and early 2000s, a company called Frontier Trading started retailing JapanLife magnetic mattresses in India, at prices as high as R1 lakh apiece. The miracle mattresses were apparently good to cure many ailments, and were intially imported under the medicinal category paying less import duty. Buyers were also required to rope in other buyers, thereby becoming distributors in a typical multi-level marketing format. According to a statement in Parliament, the company is estimated to have sold R800 crore worth of JapanLife mattresses. Complaints were numerous: Distributors did not get the promised commissions, some buyers paid up but did not get the mattresses, and those who got the mattresses said it had no curative value. Meanwhile, finding that the beds were luxury items with no medical value, customs seized the imported goods, cutting off the supplies. The company’s proprietor Vasant Pandit was arrested. The matter was raised in the Lok Sabha by S Jaipal Reddy, who said gullible buyers were cheated of their money in his own constituency, and pointed to the political connections of Japan Life. The company agreed to repay the money taken from bed-buyers, but had no financials to do so. Few, if any, made profits from Japan Life, except those at the top of the pyramid.

GOLDQUEST

The alchemist?s dream

Based in Hong Kong, GoldQuest International sold gold medallions from Mayers Mint in Germany to customers mostly in developing countries, including India, Sri Lanka, Nepal and Iran. The medallions sported engravings of holy figures as well as logos of international sporting events. These were not coins, and hence not legal tender, but they were promoted as coins. GoldQuest claimed that these were limited edition collectors?items of high numismatic value. Neither numistatic associations nor any mint or holy figure ever endorsed the products. The price of medallions was several times the actual cost of the bullion that went into it. Customers were told that the ‘limited-edition?coins would appreciate in value over time. Also, each buyer was supposed to recruit two more distributors to earn commissions in typical MLM fashion. In India, the company was headquartered in Chennai. Several agents of the company were arrested after cust-omers complained to police that they were cheated. The company changed its name several times across years. GoldQuest was banned in Iran, Nepal and Sri Lanka.

TVI Express

Travel tricks

Travel Ventures International claims to be a travel company incorporated in London, though inquiries made by customers revealed that there is no company by that name at the address listed on the company website. There are no details about the founders or promoters of the company, in typical pyramid fashion. When you sign up with TVI by paying a fixed sum, say $250, TVI sends you a travel voucher, which is supposed to make you eligible for an international vacation for 6-7 days a year at a 3-5 star hotel with travel agent discounts, with the MLM condition that you should recruit more people to join the scheme and take the network forward. TVI has already been named in Australia, South Africa, Namibia and other countries as a pyramid scheme, and its distri-butors have been barred from promoting the scheme. However, TVI contnues in many other countries under the regulatory radar. Like its peers, TVI promoters are invisible, their helpline numbers unreachable, their addresses fake and their physical offices non-existent.

BERNARD MADOFF

Modern-day Ponzi

Bernard Lawrence Madoff perpetrated the largest and longest-running ponzi scheme in history, with a size of $65 billion. The former Nasdaq chairman and an office-bearer of several securities organisations in the US, Madoff was a hedge fund manager who became iconic for all the wrong reasons. The Madoff enterprise offered steady returns over decades, through ups and downs of the market, convincing many of the success of what he called his proprietary ?split-strike conversion strategy?. Instead of doing any kind of securities trading, Madoff simply deposited clients?money into his own bank account. Returns were paid out of fresh investments pouring in. However, during the market downturn of 2008, many customers tried to withdraw, and Madoff’s vehicle started creaking. When his sons questioned him why he wanted to pay bonuses before paying investors, he confessed to them that the whole operation was a giant Ponzi scheme. The sons reported him to law enforcement agencies. Madoff was arrested, charged with 11 counts of offences and sentenced to 150 years in jail with $170 billion in restitution.

CHARLES PONZI

Serial scamster

Ponzi schemes predated Charles Ponzi, though it was this Italian settler in the US at the turn of the 19th century whos modus operandi made it world-famous. After trying his hand at several minor swindles in Canada and the US and serving his prison term, Ponzi opened a new scheme in Boston, claiming he could cash in on the arbitrage between international reply coupons for postage stamps. Ponzi solicited deposits promising 50% returns in 45 days and 100% returns in 90 days, and he kept his word with the depositors, making the scheme wildly popular. However, the returns he gave were not from any business as he claimed but by simply transferring money from the new deposits to pay old depositors. Ponzi’s scheme collapsed, and he was arrested, tried and imprisoned for multiple offences at the federal prison and the state prison.