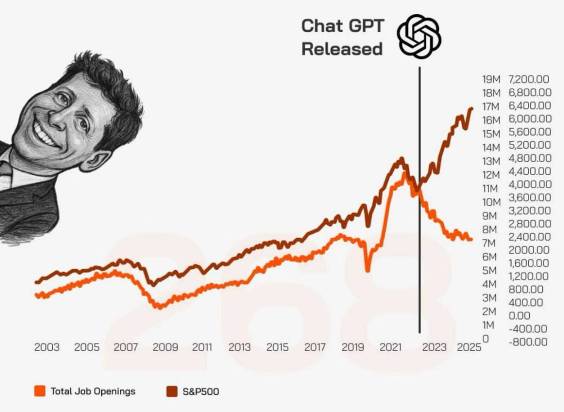

In the past few days, one chart has been haunting people online. It has been called “the scariest chart in the world”. Two lines in which one is showing job openings in the US and the other, S&P 500, shorthand for how the stock market is doing.

For nearly twenty years, they danced together; when the economy grew, both rose, and when recessions hit, both dipped. They moved like twins, but not until now.

Since the release of ChatGPT in late 2022, the lines have broken apart. The stock market has raced to record highs, while job openings have fallen. For many, it feels like a picture of two different worlds, one where investors and companies ride the AI wave, and another where ordinary workers are watching opportunities quietly shrink.

As reported by Derek Thompson, since ChatGPT’s debut, job postings have dropped by roughly one-third. S&P 500, meanwhile, has jumped more than 70 per cent. It is an extraordinary split, one we have never seen before in modern data. And even if AI is not the only cause, it has become the symbol of the moment in which we can say, Technology soaring, people worrying.

Is AI the villain?

It is tempting to point the finger at artificial intelligence. After all, the timing looks uncanny: ChatGPT takes off, and job openings start to crumble.

The real slowdown began months earlier, in early 2022, when the Federal Reserve started raising interest rates to cool inflation. That move made borrowing more expensive and slowed down investments and, predictably, hiring too. Add in other factors, including trade tariffs, slower immigration, and higher input costs, and the picture gets messy, reports Derek Thompson.

Why is Wall Street still so cheerful?

If hiring is slowing, why is the stock market still performing well. Because investors see gold in algorithms. AI-linked companies including chipmakers, cloud platforms, and a handful of tech giants, have increased the bulk of Wall Street’s gains.

JPMorgan estimates that AI-related firms alone have driven 75 percent of the S&P 500’s rise and 80 percent of its earnings growth since ChatGPT’s launch.

That is not so much a broad economic boom as it is an AI fever a concentrated surge of belief (and money) in one transformative technology.

Why is it ‘the scariest chart in the world’?

The chart does not predict doom, but it surely reflects a transition. The US economy is being reshaped by technology, by high interest rates, and by shifting priorities in where companies choose to invest.

It is possible the two lines will meet again, as innovation creates new kinds of work. or, they might stay apart, telling us a deeper inequality between capital and labour.

‘We are so stuck in AI bubble’

Blind users are debating online over this graph. A user noted, ” Because we’re in an AI bubble which is absolutely not matching the health of the country’s economy. The market value is false and it will correct. “

Another added, “It will be interesting to see if the looming AI crash will drag the rest of the markets down or if it will be a siloed event.”

A user noted, “Great Depression is going to come in comparison when the dust settles after the crash.”

“Job openings chart is more of a coincidence. The real economy, sectors like non-tech services, health care, manufacturing hasn’t been doing well since the COVID high. Companies aren’t hiring due to overhiring during 2022 and the following economic uncertainty from inflation and Trump policies,” noted another user.

(This story is based on a post shared by a social media user. The details, opinions, and statements quoted herein belong solely to the original poster and do not reflect the views of Financialexpress.com. We have not independently verified the claims.)