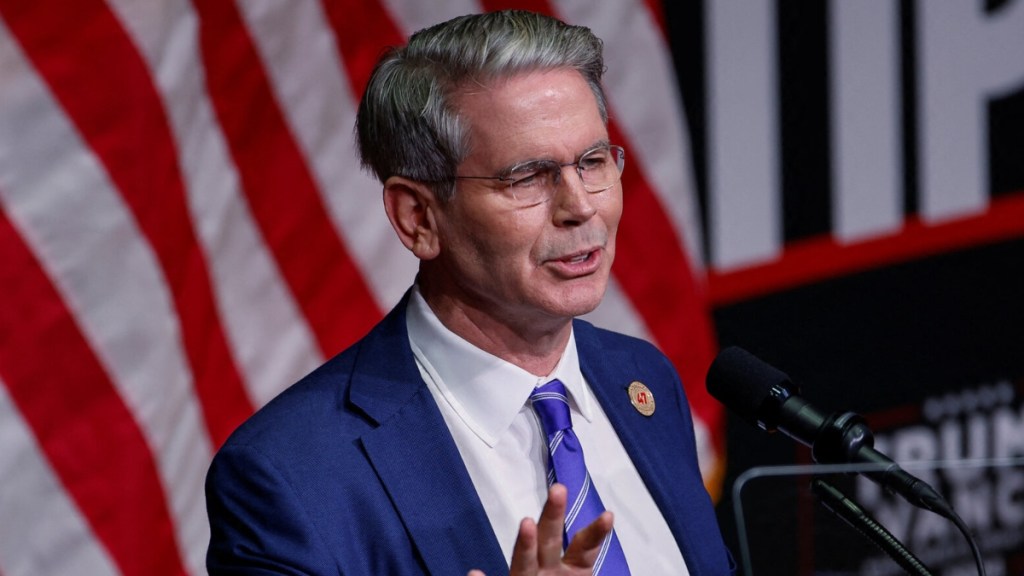

Americans could be heading toward the biggest tax refund season the country has ever seen, according to Treasury Secretary Scott Bessent. Speaking on the All-In Podcast on Tuesday, Bessent said the law’s retroactive tax changes could lead to refunds of around “$1,000 to $2,000” for many households when they file their taxes next year. Bessent is also currently serving as the acting commissioner of the Internal Revenue Service.

Why these refunds matter to American families

For many Americans, a tax refund is the biggest single payment they receive all year. The Trump administration has repeatedly hinted at these expected refunds as a major financial boost. This is the time when families in America are struggling with high costs and tight budgets, so a ‘gigantic’ refund, as hinted, would bring major relief.

“I also had the honour of being the IRS commissioner, and I can see that we’re gonna have a gigantic refund year in the first quarter because the working Americans do not change their withholdings,” Bessent said on All-In Podcast.

Supporters of the bill say the refunds could offer short-term relief and put more cash in people’s hands at the start of the year.

The US tax filing season begins in January, with most Americans submitting their returns before the April 15 deadline. Refunds are usually issued within 21 days after a return is filed. Frank Bisignano, the first CEO of the Internal Revenue Service and also the commissioner of the Social Security Administration, said people should expect exactly what President Donald Trump has been promising. He made the remarks during an appearance on Mornings with Maria on Tuesday.

Who will receive benefits

Bessent said the size of the refund will depend on income levels, as well as how much a person earns from tips and overtime pay. However, independent analysts, cited by Newsweek, have raised concerns about the long-term impact of the law, known as the One Big Beautiful Bill Act, or OBBBA.

Groups tracking federal spending said the bill will increase the US budget deficit. They also argued that most of the benefits will go to higher-income Americans and large businesses, rather than low-income households.

The Congressional Budget Office has estimated that households in the top 10 percent of earners will gain an average of $12,000 between 2026 and 2034. In comparison, the poorest 10 percent are expected to lose about $1,600 a year, largely due to cuts to Medicaid and food assistance programs.

Piper Sandler economist Don Schneider, during a podcast, said that in a normal year, the US issues about $270 billion in individual income tax refunds. With the new law in place, that figure could jump by another $90 billion. If that happens, the 2026 tax season could become one of the largest refund periods in US history.

Why refunds could be bigger than usual

Trump signed the OBBBA into law in July, but its tax provisions apply retroactively from the start of 2025. That timing is key. Bessent has said before that this retroactive structure means refunds in 2026 could be much larger than normal, since most workers did not adjust how much tax was taken out of their paychecks during the year.

The White House has supported this claim by citing research from financial services firm Piper Sandler. According to estimates cited by CBS, the average refund could rise by about $1,000 compared to the 2025 tax season. It might reach roughly $4,151 per filer.