Global markets are witnessing severe turbulence, with concerns mounting over what could be the biggest financial crash in history. Economic distress in the United States, Germany, and Japan has fueled fears that the downturn might surpass the 1929 stock market crash that led to the Great Depression.

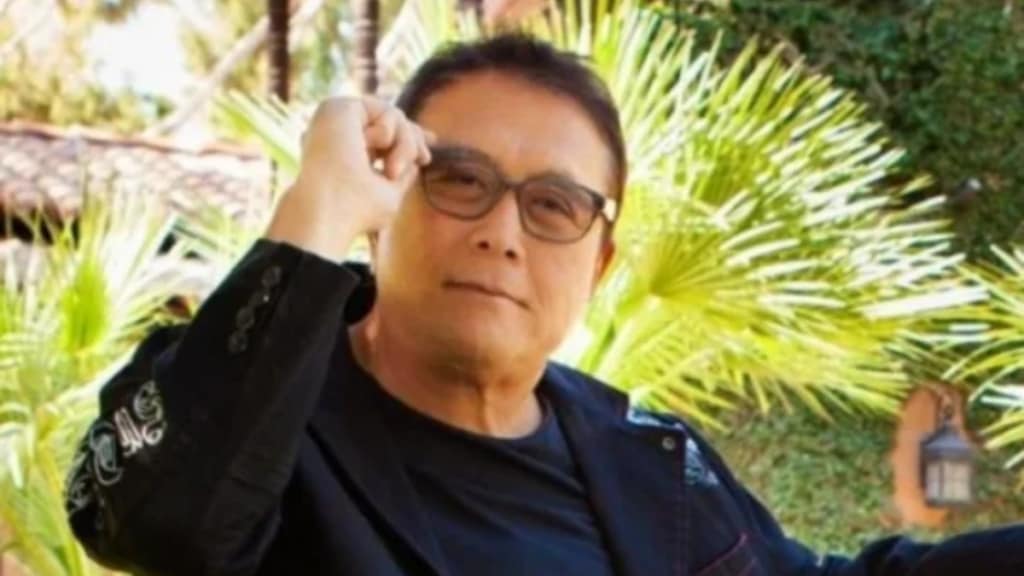

Renowned financial educator and author Robert Kiyosaki, best known for his bestselling book Rich Dad Poor Dad,, has reiterated his warning about an impending collapse, citing the bursting of what he calls the “Everything Bubble.” In a recent tweet, Kiyosaki blamed global economic mismanagement for the crisis but urged investors to stay calm and seek opportunities amid the chaos.

“It is normal to be disturbed and fearful, but do not panic,” he advised. Kiyosaki emphasized the importance of strategic investing, highlighting real estate, gold, silver, and Bitcoin as key assets to acquire during the downturn.

Drawing parallels to the 2008 financial crisis, Kiyosaki pointed out that market crashes often present deep discounts on valuable assets, creating opportunities for those who act wisely.

As markets reel, analysts are closely monitoring central bank interventions and government policies to mitigate the fallout. While millions could face economic hardship, experts stress the importance of resilience and strategic financial planning in navigating the crisis.