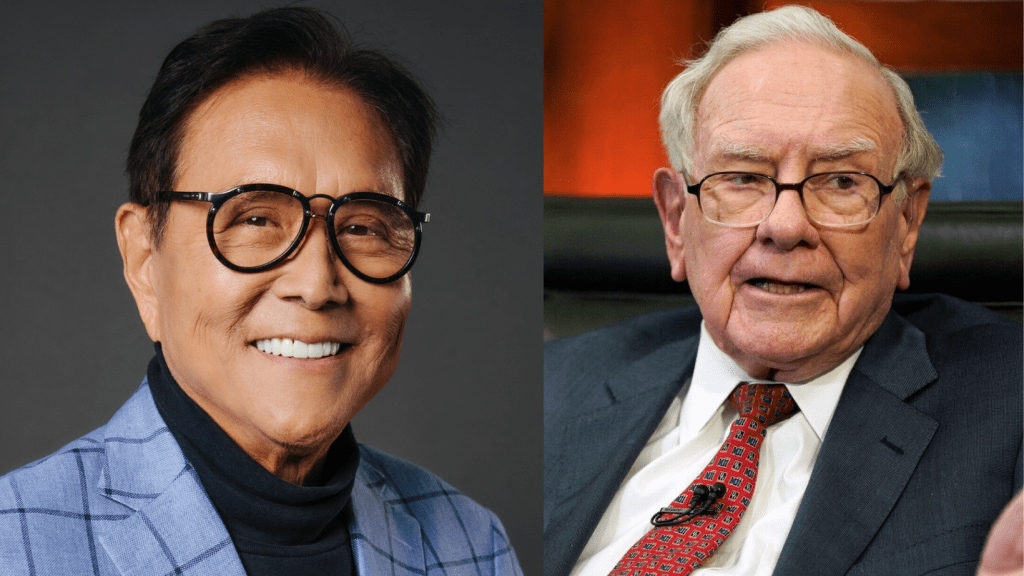

Rich Dad Poor Dad author Robert Kiyosaki has brought out something interesting. He has written about Warren Buffett’s recent warning about global markets and AI boom on Facebook. Lately, the “Oracle of Omaha” who retired on 31st December has been unusually cautious about what he sees in global markets and AI boom.

It is not Artificial intelligence itself that worries him. In fact, he has acknowledged that AI is powerful, transformative, and even world-changing. His concern lies elsewhere, in how investors behave when new technology meets excessive optimism and record levels of debt. As Buffett has seen repeatedly across decades, the danger is never innovation. The danger is speculation.

What exactly is the problem?

Kiyosaki explains that Buffett has lived through more bubbles, crashes, and debt cycles than almost anyone alive. From railroads to radio, television to the internet, every major technological leap followed a familiar pattern. The technology delivered enormous value. Investors, however, rushed in too fast, paid too much, and confused stories with sustainable earnings. Buffett has openly compared today’s AI excitement to the early internet era.

The internet reshaped the world, but most investors still lost money because they bought excitement rather than cash flow. The lesson, he suggests, has not changed. AI will likely transform industries. That does not mean every AI-linked company is worth its current price.

According to Kiyosaki, what makes this moment more dangerous than past technology booms is the backdrop against which it is unfolding. Today’s AI enthusiasm is colliding with something far more fragile than hype: historic global debt. Governments, corporations, and consumers are more leveraged than ever before.

Debt levels have crossed $300 trillion globally, deficits continue to grow, and interest costs are rising at a pace many governments are struggling to manage. Buffett has warned that when speculation meets leverage, even small shocks can turn into systemic crises. History offers plenty of reminders from 1929 to 2000 to 2008. Each time, excessive confidence combined with borrowed money magnified the damage.

Why this cycle is more dangerous than the Dot-Com era

During the dot-com bubble, governments carried far less debt. Central banks had room to cut rates aggressively. Inflation was not a dominant threat, and monetary credibility remained largely intact. Today, the situation is different. Governments are already weighed down by debt.

Central banks have printed trillions just to stabilise the last crisis. Inflation has exposed the limits of endless money creation. The system now has far less flexibility. That lack of room to maneuver is what makes this cycle especially risky.

Buffett doesn’t issue dramatic warnings. He teaches through behaviour, says Kiyosaki. In recent years, he has built massive cash reserves, avoided overheated technology narratives, focused on businesses with durable cash flow, and repeatedly cautioned against fiscal irresponsibility and currency risk.

‘This time is different’

Kiyosaki frames Buffett’s message through a lesson he learned early in life. As his rich dad used to say, “The biggest losses happen when everyone thinks this time is different.” AI will change the world. That does not mean today’s valuations are justified. Debt will amplify the next downturn. That does not mean it will come with a warning label.

The danger, as Buffett sees it, isn’t technological progress. It’s financial complacency. Buffett is not telling people to panic. He is telling them to pay attention. To separate innovation from speculation. To value cash flow over narratives. To understand debt cycles instead of ignoring them. Kiyosaki explains that this is why he continues to hold real assets, cash-flowing investments, gold and silver as insurance, and education as his most important asset. Because when bubbles deflate, those who understand the system don’t panic. They prepare and they survive”.

Disclaimer: The content in this article is based on a viral social media discussion and is intended for informational and entertainment purposes only. The financial figures and strategies mentioned are personal to the user and have not been independently verified. This story does not constitute financial advice or an endorsement of any specific investment strategy. Readers are advised to consult a SEBI-registered investment advisor before making financial decisions.