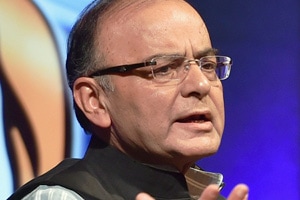

Finance minister Arun Jaitley said on Sunday that the government would amend the stringent land acquisition law, even without the support of the opposition.

Speaking ahead of the oath-taking ceremony of new ministers at Rashtrapati Bhavan, Jaitley also expressed hope that reforms, including the passage of the long-pending Insurance Laws Amendment Bill that seeks to raise the FDI cap in the sector to 49 per cent, and the new indirect tax regime, the Goods and Services Tax, would be rolled out soon.

“Some changes (in the Land Acquisition Act) may be necessary. We will first try to reach a consensus and if that is not possible we will go ahead and take the decision. We have opened up investments in various sectors. I do hope this (winter) session I will be able to pass the Insurance Bill,” he said at the India Global Forum meeting in Delhi.

The “obstacles” to land laws would have to be removed in order to implement the concept of smart cities in India, Jaitley said.

Smart cities have been a part of Prime Minister Narendra Modi’s development vision, and Jaitley kept aside Rs 7,060 crore for 100 smart cities in the 2014-15 budget.

The Land Acquisition Act was passed during the previous UPA regime after the BJP, then in opposition, backed it in Parliament.

The Act provides for “fair compensation” for acquiring farmland for industrial projects. However, states and corporates have been demanding a relaxation in the law which, they argue, has made acquisition very difficult, and hurt infrastructure projects.

The rural development ministry has already suggested a number of amendments to the Land Acquisition Act to ease the process of acquisition.

The finance minister also promised a “reasonable and rational” tax policy which, he said, would restore investor confidence and help make India a global manufacturing hub.

“One of the greatest challenges we have is the manufacturing sector. The economy had touched a new low and therefore the manufacturing sector itself is delicately poised in India. We have to eventually try and make India a hub of low-cost manufacturing,” he said.

One of the “principal challenges” before the government, the minister said, was to “restore confidence, expand economic activity and move towards increasing the growth rate”.

A “reasonable and rational tax policy” is needed, which “can’t be ultra-aggressive with the taxpayers”.

On the Goods and Services Tax (GST), the government’s most ambitious tax reform, Jaitley said the Centre was in the final stages of talks with states, and indicated that the Constitution Amendment Bill may be introduced in the upcoming session beginning November 24.

“I do hope that my friends in the opposition parties, particularly the principal opposition, after a wasted opportunity when they were in government, spend a more fruitful tenure when they are in opposition,” Jaitley said.

The minister also said the government’s disinvestment programme would unfold in the next couple of days, and that the government was aiming to bring down its equity in public sector banks to 52 per cent.