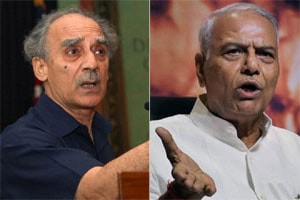

Prime Minister Narendra Modi will likely approve in a couple of weeks who, in a list topped by former finance minister Yashwant Sinha and former disinvestment minister Arun Shourie, would head the New Development Bank (NDB) being set up by the five BRICS nations to channelise funds for infrastructure and sustainable development needs of emerging economies.

Also Read: Arun Shourie attacks PM Narendra Modi: Economic policy ‘directionless’, minorities anxious

The NDB, modeled on the lines of the World Bank, is the first such multilateral lender being created after the Bretton Woods institution was established 71 years ago in 1944. According to a July 2014 agreement among BRICS nations — Brazil, Russia, India, China and South Africa — the NDB would be headquartered in Shanghai in China while its first president would be an Indian.

India has to suggest a candidate for the post of NDB president when the BRICS finance ministers meet on the sidelines of the spring meeting of the World Bank Group in Washington on April 17-19.

The names of Sinha and Shourie have been doing the rounds.Sources said the government would nominate a person with strong leadership qualities keeping in mind the stature of such institutions.

For example, the incumbent IMF managing director general Christine Lagarde was finance minister of France while Haruhiko Kuroda was an advisor to Japan’s Cabinet before heading ADB in 2005.

“The government has to select a person who has the best chance of success as the person has to shape up the new institution,” a source said.

Given the profile, PM Modi would decide the name in consultation with finance minister Arun Jaitley without going through the usual search panel process, another source said.

The NDB president would start the process of setting up an office, forming the rules and regulations and getting professionals for the bank to start operations in a year or so.

Analysts see the NDB as competition to the World Bank. With the emerging countries having very little say in the functioning of the World Bank and IMF, India took the lead at the BRICS summit in New Delhi in 2012 to suggest formation of the NDB for pooling surplus resources from around the world to fund massive development requirements of emerging economies.

To start with, the NDB would begin with $50-billion subscribed capital, split equally among the BRICS countries. It will scale up later by inducting more countries as members and raise resources from the market. India, which needs to $1-trillion investment in five years through 2017, could be one of the big beneficiaries of the new bank.

Emerging bank

* India has to nominate a candidate for the post of the New Development Bank president when BRICS finance ministers meet in Washington over April 17-19

* The NDB president would start the process of setting up an office, forming the rules and getting professionals for the bank, which will start operations in a year or so