The Reserve Bank of India (RBI) on Thursday announced that its balance sheet for the financial year ended March 31, 2025 increased by 8.20 per cent on-year to Rs 76.25 lakh crore as against Rs 70.47 lakh crore as on March 31, 2024. The RBI’s balance sheet reflects its activities related to currency issuance, monetary policy, and reserve management.

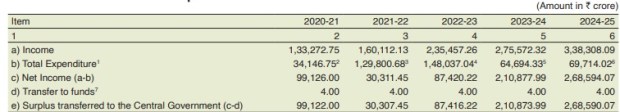

The key financial results for 2024-25 showed an increase in both income and expenditure compared to the previous year. While income for the year increased by 22.77 per cent, expenditure increased by 7.76 per cent. The year ended with an overall surplus of Rs 2.68 lakh crore as against Rs 2.10 lakh crore in the previous year, resulting in an increase of 27.37 per cent.

After making provisions, this surplus, the central bank said, is payable to the Central Government. A provision of Rs 44,861.70 crore was made and transferred to Contingency Fund (CF). The FY25 Annual Report maintained that no provision was made towards Asset Development Fund (ADF).

Earlier on May 23, the RBI had announced the dividend payout worth Rs 2.69 lakh crore for the central government for the fiscal year 2024-25.

In its Annual Report for FY25, the central bank said that the increase on the assets side was led by a rise in gold, domestic investments and foreign investments by 52.09 per cent, 14.32 per cent and 1.70 per cent, respectively.

Domestic assets, it added, constituted 25.73 per cent while foreign currency assets, gold (including gold deposit and gold held in India). Loans and advances to financial institutions outside India constituted 74.27 per cent of total assets as on March 31, 2025.

On the liabilities side, expansion was due to increase in notes issued, revaluation accounts, and other liabilities by 6.03 per cent, 17.32 per cent and 23.31 per cent, respectively.