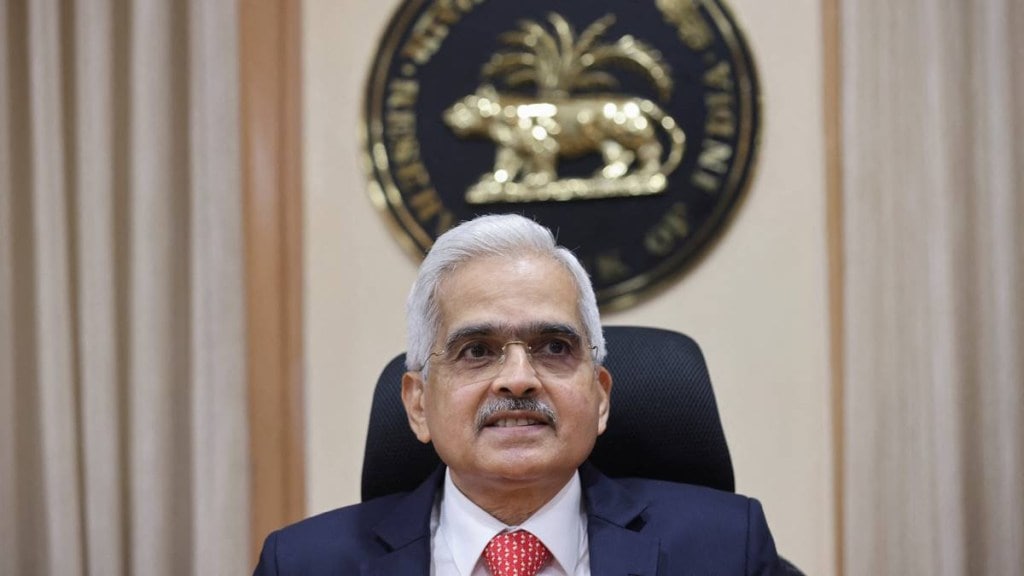

RBI MPC Meeting August 2023 Live Updates: The RBI will declare its monetary policy today. It is the third bi-monthly RBI Monetary Policy Committee meeting. The six-member Monetary Policy Committee meeting is headed by Governor Shaktikanta Das. Overall, there is an expectation that the Central Bank may maintain rates at the current level given the borrowing cost, which started rising in May last year, has stabilised.

The Reserve Bank of India may look to tighten domestic liquidity to rein in inflationary pressures but analysts believe RBI may refrain from permanent cash withdrawal. Cutting down the liquidity in the market is one way of Hawkish signalling by the RBI. Policy repo rate has been increased by 250 basis points since May 2022.

The RBI in its last statement had said that it will be monitoring inflation numbers closely. Das in his statement after the last MPC on June 8 had outlined that “there is no room for complacency.” He had also highlighted that, “Therefore, close and continued vigil on the evolving inflation outlook is absolutely necessary, especially as the monsoon outlook and the impact of El Nino remain uncertain.”

Retail inflation based on Consumer Price Index (CPI) rose to a three-month high of 4.81 per cent in June, mainly on account of higher food prices. Though it is within RBI’s comfort level of below 6 per cent, it remains to be seen if there are any spillover impacts in inflation data for July, which will be released on August 14.

RBI Monetary Policy August 2023 Live Updates

Home loan borrowers have several strategies at their disposal to reduce their interest costs on home loans. Implementing these strategies can lead to significant savings over the life of the loan. READ MORE

RBI has done well to keep rates unchanged despite the recent US Fed rate hike. We have seen 250 bps rate hike past 2 years and that impact is still permeating into various sectors. While the RBI policy also emphasized on withdrawal of accommodation, its intention to support growth is encouraging and augurs well for overall industry including the manufacturing and the NBFC sector.

Has your lender increased the home loan EMI tenure even without asking you? It is no more a surprise as banks have been increasing the repo rate-linked home loan EMI terms in the wake of rising key policy rates. In many cases, it has been reported earlier this year, that home loan EMI tenures are running beyond the retirement age for many borrowers. READ MORE

The RBI’s decision to maintain status quo in the repo rates augurs well for the real estate sector. It is important to note that the macro-economic fundamentals of the country are strong and the economy is performing well. The real estate market has seen a strong rebound in in the recent past driven primarily by end-users and we see this up-cycle continuing in 2023.

Also, the strong fundamentals for housing demand will keep the momentum upwards for realty sales where buyers are carefully filtering out projects and looking for the right product mix in terms of affordability, accessibility and quality of living. The continuation of existing policy rates and undoubtedly, a further reduction in interest rates in the near future would be preferred to bolster overall market confidence and make it more enticing for home buyers.

Moreover, as the festive season approaches, it presents a golden opportunity to reinvigorate the real estate market with reduced interest rates ahead of the festive season. It also has to be kept in view that real estate is considered as the safest bet for investment compared to other instruments. All of this will boost real estate and enhance economic growth in the larger context.

Overall, we are optimistic that the government would shape its policy actions to promote demand even further and incentivise people to buy more properties, as the sector is the primary contributor to economic growth.

While in line with consensus RBI has kept its policy rate unchanged, in view of the surplus liquidity and perhaps to deliver an implicit hike (of lesser impact), RBI has temporarily increased the CRR levels by 10% of incremental NDTL of banks. This in effect takes out the 10% of surplus in the accumulated from INR 2000 note withdrawal and FX operations (~INR 300-350 bn). Notably, inflation estimates, especially near term estimates (Q2, Q3) have been revised upwards meaningfully, while growth estimates are retained.

Furthermore, Q1FY25 inflation estimate of 5.2% and governor reiterating, commitment to align to 4% on a durable basis, suggests that rate cuts are out of way beyond the near term. Higher for longer is not just for the external world but also for India. Domestic growth resilience is countered by external risks and inflation. RBI is not ruling out hikes if necessary, clearly cuts are out of sight.

Following the recent RBI MPC Meeting, the outcomes were largely in line with my expectations. While we've noted that interest rates have remained stable, the escalating oil prices present a palpable concern. This will undeniably intensify the pressure on our government to craft and sustain robust economic growth strategies.

Additionally, with clear signs of the US trending towards a recession, there's an impending challenge for our government to steadfastly maintain our GDP growth. These global and domestic cues serve as reminders of the interconnected nature of our economies and the necessity for agile, forward-thinking strategies.

With a stance maintained of no change in the last two meetings, the MPC decisions have been shaped by a blend of current economic conditions and past stances mainly governed by Inflation Outlook(currently a bit above threshold), Economic growth, liquidity measures, and global factors. Considering the above factors, the stance has been made to keep the repo rate unchanged.

However, markets would have hoped for a lowering of the repo rate, as it can stimulate economic activity and boost corporate profits, which often leads to a rally in stock markets. For Banks and financial institutions, lower interest rates can stimulate demand for loans but can also squeeze net interest margins.

RBI holding rates will provide continued stability to lending rates and help to support economic activity, particularly during the upcoming festive season. This is a welcome move, as it will help to keep borrowing costs low and encourage businesses and consumers to spend. Indian FPI flows at $20 billion this year is near a decadal high and show the overall macroeconomic sentiment of the economy and the attractiveness of the Indian market.

The public debt platform to be launched by RBI Innovation Hub may be a game changer and is similar to the UPI moment for Credit in India" This new initiative aims to make it easier for small businesses and individuals to access government bonds. This could help to boost investment and economic growth and has the potential to be a major game changer for financial inclusion in India.

The MPC voted in 5:1 majority to maintain the ‘withdrawal of accommodation’ stance to ensure that inflation progressively aligns with the target, while supporting growth, said Shaktikanta Das. “Consequently, the standing deposit facility (SDF) rate remains at 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent,” the RBI governor said. READ MORE

RBI to allow offline payment of UPI by using near-field communication; raises payment limit via UPI lite to Rs 500 from Rs 200.

Due to current monsoon situation vigil on evolving inflation heightened. Inflation has moderated, but job still not done, said RBI Governor.

RBI projects Q2 retail inflation at 6.2 per cent, Q3 at 5.7 per cent and Q4 at 5.2 per cent in FY 2023-24.

Analysts expect inflation to have reached 6.4 per cent in July, moving out of the RBI's 2%-6% comfort band.

The MPC preferred to remain on a wait-and-watch mode along expected lines. We believe the seasonal uptick along with erratic weather conditions will continue to keep the hawkish bias of the MPC intact in the upcoming meetings as well. However, we expect the rates to remain unchanged through the rest of the year as they evaluate the impact of earlier monetary tightening in growth and inflation.

Shaktikanta Das said that the spike in tomato prices and rise in cereal, pulses contributed to inflation. He also highlighted that vegetable prices may see significant correction.

RBI ups retail inflation projection to 5.4 per cent during FY24 from earlier estimate of 5.1 per cent due to vegetable price shocks. Das said headline inflation still remains above RBI's target of 4 per cent.

MPC will remain watchful of inflation and remains resolute to its commitment to align inflation to the targeted level.

RBI Governor Shaktikanta Das said global economy continues to face daunting challenges of inflation and geo political uncertainty.

Das highlighted that monetary policy transmission still underway, headline inflation remains higher than 4 per cent target.

RBI Governor Das said the decision to keep policy interest rate unchanged was unanimous.

RBI maintains repo rate unchanged at 6.5 per cent. Highlighted significant progress in controlling inflation.

Need to continue effort to maintain macro financial growth trajectory; India can become the new growth engine for the world, says Das.

Shaktikanta Das started the RBI Monetary Policy August 2023 meeting. He said economy continuous to grow.

Core CPI inflation is expected to remain steady at ~5.1% for the rest of FY 2024. This should be a source of comfort for the RBI & we expect RBI to keep rates unchanged and continue with “withdrawal of accommodation” monetary policy stance.

Industry speakers believe that while the Reserve Bank of Bank may adopt a more hawkish stance a rate hike may not be on the cards this time.

Rupee was little changed before the Reserve Bank of India's policy decision, which will be followed by the US inflation data. The rupee, similar to how it has been over the last two days, was in a narrow range.

In December 2022, the MPC has increased the policy repo rate under the liquidity adjustment facility (LAF) by 35 basis points to 6.25 per cent.

RBI is expected to remain data dependent going forward, though the increase in inflation prints in June and what we expect in July, the chances of interest rate cut in 2023 looks lower. Overall, We expect to remain in a ‘Higher for longer’ interest rate regime with the withdrawal of accommodation stance to continue in the August policy meet.

In the last quarter of FY23, on February 8, the RBI increased the policy repo rate under the liquidity adjustment facility (LAF) by 25 basis points to 6.50 per cent.

Earlier in June, the Monetary Policy Committee had decided to keep the key policy repo rate unchanged at 6.5 per cent. “MPC also decided by a majority of five out of 6 members to remain focused on withdrawal of accommodation to ensure inflation aligns with the target while supporting growth,” RBI Governor Shaktikanta Das had stated.