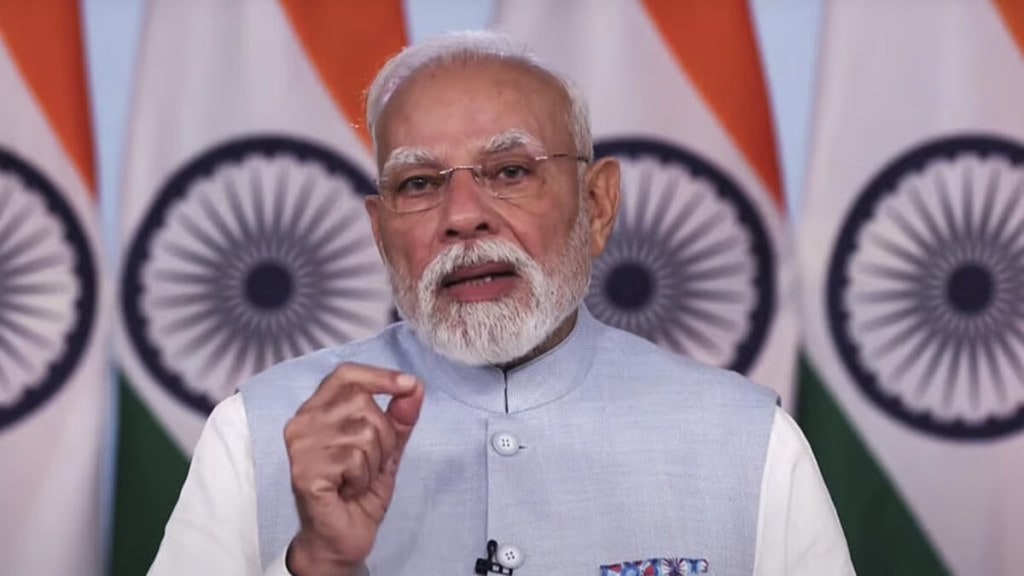

Calling the next-generation Goods and Services Tax (GST) reforms being implemented from today as a ”saving festival” and a “double bonaza” for the middle-class, for prime minister Narendra Modi on Sunday said the combined benefit of this and the major income tax reliefs announced in the last Budget to the “Citizen God” would be to the tune of Rs 2.5 lakh crore.

Boost for Middle Class and MSMEs

Addressing the nation on the eve of GST 2.0, Modi also made a fervent appeal to the people to make a pledge to buy “swadeshi goods and services,” and underlined that to the extent possible, goods should be manufactured locally.

The prime minister’s assertion of the concept of Atmanirbharata (self-reliance) for the second consecutive day after the steep hike in annual fee for H-1B worker visas unveiled by the Donald Trump administration in the US carried a powerful message.

The GST cuts for a wide gamut of every-day use and mass-consumption items would accelerate India’s growth story, increase ease of doing business and attract more investors, he said.

He also foresaw immense benefits to MSMEs from the reforms both in terms of reduced tax incidence and easier compliance. The prime minister expressed the confidence that this vital segment of the economy, a major job creator, would regain its past glory soon, by consolidating its presence in the world markets with products of indisputable quality.

Noting that 250 million people have been lifted out of poverty in the last 12 years, Modi said these people, now constituting a “neo-middle class” with enhanced aspirations, would be helped to realise their dreams thanks to the price cuts for a wide variety of goods enabled by the lower GST rates. “You will be able to buy things you like more easily. The poor, middle class, neo middle class, youths, farmers, women, traders and shopkeepers will benefit from this,” he said.

Swadeshi Push and Reform Momentum

The prime Minister stated that reform is a continuous process, and as times change and national needs evolve, next-generation reforms become equally essential. He emphasised that the reforms are being implemented keeping in view the current requirements and future aspirations of the country.

He stressed all states will be equal stakeholders in the development race and urged them to give pace to manufacturing with the swadeshi campaign in mind.

“On the first day of Navratri, the country is going to take an important and big step for Atmanirbhar Bharat. With the sunrise tomorrow, the next generation GST reforms will come into effect. A ‘GST bachat utsav (savings festival)’ will begin tomorrow,” he said.

Just as the way the country’s Independence movement was spearheaded by the Swadeshi movement, its all-round progresso will be empowered by the Swadeshi mantra, he iterated.

Recalling that India took its first steps towards GST reform in 2017, marking the end of an old chapter and the start of a new one in the country’s economic history, Modi highlighted that for decades, citizens and traders were entangled in a complex web of taxes—octroi, entry tax, sales tax, excise, VAT, and service tax—amounting to dozens of levies across the nation. Transporting goods from one city to another required crossing multiple checkpoints, filling numerous forms, and navigating a maze of differing tax rules at every location.

He said it was the result of joint efforts by the Centre and the states that the country was liberated from the maze and “One Nation-One Tax” was realized.

On September 3, the GST Council approved a major restructuring of the indirect tax by pruning the number of main slabs to two — 5% and 18% — and introducing a special 40% rate for sin goods, a move that will lower the tax incidence on a wide section of businesses and benefit the end-consumers. The 12% and 28% rates have been abolished.