Latest in India-pakistan news, the current IMF bailout for Pakistan exceeding $1 billion is the 24th bailout by the International Monetary Fund since 1958. Over the last 7 decades, Pakistan has resorted to a continuous cycle of debt, policy inertia, and geopolitical tension, giving rise to more reasons for further bailout.

In the current context of ongoing tension between India and Pakistan in the aftermath of the heinous terror attacks in Pahalgam on April 22, there have been questions about the rationale of the bailout at the current juncture. While it is factually correct that bailout developments were finalised weeks before the current geopolitical tension, one cannot ignore the pattern since Pakistan was created in 1947 and got its first bailout from IMF in 1958. It has received close to 24 bailout packages thus far. However, the corresponding growth cycle shows little to cheer about. Also, in taking a look at only macro-economic indicators, is the IMF missing the big picture and ignoring the impact of security on the economy?

Pakistan: Cycle of bailout

If we get back to the pages of history, Pakistan, after being created in 1947, has constantly grappled with fragile economic conditions, and it’s been exacerbated as a result of continuous military engagement with India in 1947, 1965, and 1971 and even the creation of Bangladesh. The first bailout from the IMF was in 1958 and decades later, Pakistan’s economic trajectory hasn’t seen a whole lot of alteration. A quick scan of data indicates that between 1958 and 2020, Pakistan has received a bailout package almost every third year. While external debt continues to mount, the country’s economic vulnerabilities deepen even further.

In many ways the IMF bailout is a paradox of sorts too. The key objectives of bailouts have been about stabilising macroeconomic indicators and achieving long-term reforms in the economy. However, one also needs to focus on the underlying triggers leading to the economic vulnerabilities.

Following the IMF Executive Board discussion on bailout for Pakistan, Nigel Clarke, Deputy Managing Director and Chair, said, “Risks to the outlook remain elevated, however, particularly from global economic policy uncertainty, rising geopolitical tensions, and persistent domestic vulnerabilities. Against this backdrop, the authorities need to maintain sound macroeconomic policies and accelerate reforms to safeguard the macroeconomic gains and underpin stronger and sustainable, private sector-led medium-term growth.”

India, Pakistan, rest of South Asia- Picture of contrasts and impact of terrorism

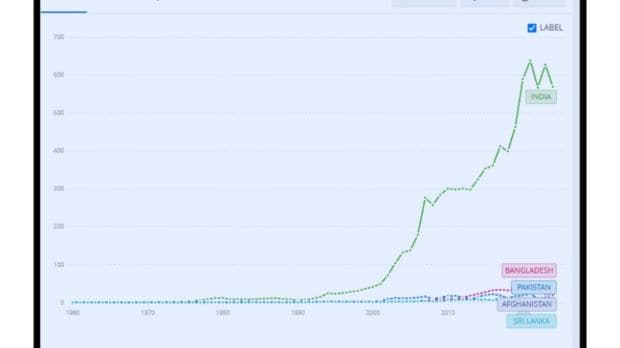

The 2024 data from IMF, World Bank and Pakistan official sources indicate that the country’s economy continues to depend on global largess—the 2024 data shows the current account balance is in the negative, -0.5% of GDP, FDI is just 0.6% of GDP, Gross reserves are just $9,390 million. As of World Bank data in 2024, Pakistan’s total reserves, including gold and $, are $12.98 billion. Just to put it in perspective, India’s reserves are at $569.54 billion, Afghanistan’s at $9.75 billion, Bangladesh’s at $46.17 billion and Sri Lanka’s at $6.05 billion. Though most economists that Financial Express.com got in touch with indicated that they do not actively track Pakistan’s economic trajectory, they were unanimous in seeing a “pattern of bailouts and more debt and the greater focus on army and military engagement with neighbours compared to structural economic development and better quality of life in the country.” Additionally, the comparison of the key South Asian economies also underscored the importance of military and political stability to achieve economic growth.

Is Pakistan’s debt sustainable?

Given the high amount of debt that Pakistan now carries in its accounts, is it sustainable? As per IMF policy slippages continue to be a worry, “Pakistan’s debt is assessed as sustainable despite its high level, provided that the authorities remain committed to implementing sound policies and reforms that strengthen the economy and foster sustained growth. However, the path to debt sustainability is narrow and could be undermined by policy slippages, particularly in implementing necessary revenue measures, or by reduced external financing. If these challenges materialize, they may exert pressure on the exchange rate and crowd out the private sector, potentially weakening growth.”

IMF further puts the focus on the need for “improving the quality of public spending and better managing the substantial gross financing needs through improved debt management and extended maturities are also crucial.”

In fact anti-corruption measures have been a key focus of IMF programmes. Nigel Clarke, IMF Deputy Managing Director and Chair put the focus back on structural reforms, “Accelerating structural reforms will unlock Pakistan’s competitiveness, creating conditions to attract high-impact private investment. Reform priorities include reducing trade and investment barriers, advancing SOE reforms, and decisively strengthening governance and anti-corruption institutions.”

What does the future hold?

At this juncture, with Pakistan‘s military offensives continuing against India, it would not be very wrong to question economic sustainability in Pakistan. It definitely faces challenges with close to $100 billion repayment due in 2027, and even in the face of a fresh bailout by IMF, there is a $30 billion repayment coming up in 2025. Without reforms, it’s been a continuous cycle of bailouts, austerities, and further pushback in terms of economic growth. Fiscal health and geo-political security go hand in hand. There is also a need to look at redirecting military budgets for ground-level economic enhancement and improving quality of life with greater focus on human resources.