– By Suman Chowdhury

India’s total forex reserves have reclaimed USD 600 bn mark (as on Jul 14, 2023) after a gap of almost thirteen months. The sequential increase of USD 31 bn in forex reserves in FY24 so far appears impressive. Going by the current trend, the reserves can scale a new record high of USD 650 bn before the end of FY24.

The total forex reserves held globally is estimated to be around USD 14.1 trillion in 2022, out of which India accounted for 4% share. This makes India the fifth largest holder (excluding USA) of official forex reserves in the world (after China, Japan, Switzerland and Russia). Before the end of 2023, India may become the fourth largest holder, given the impact of the Ukraine war on Russia.

Forex reserves play an important role in the macro-prudential stability toolkit of the holder nations, being driven primarily by three motives: (i) Transactional: Facilitate regular flows for external trade and capital movement (ii) Precautionary: Buffer creation against BoP shocks; mitigate excess volatility in currency markets. (iii) Speculative: Absorption of excess dollars from the market to prevent appreciation of domestic currency and maintain export competitiveness.

India’s nightmarish experience with the 1991 BoP crisis, followed by global shocks like the 1997 Asian Financial Crisis, the 2008 Global Financial Crisis, the 2013 Taper Tantrum episode, and the 2020 Covid Pandemic has institutionalised the accumulation of forex reserves as a natural defence mechanism, thereby underpinning the precautionary motive. Could speculative motive be an additional factor for India to hold forex reserves (the US Treasury had placed India on a watchlist for currency manipulation in 2021)? We find scant and inconclusive evidence in this regard.

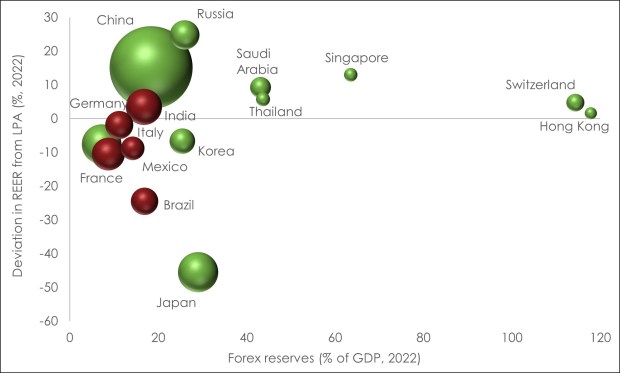

- India’s Forex Reserves/GDP ratio was close to 17% in 2022, lower than the median of ~26% seen in case of major holders of forex reserves.

- Moreover, the real effective exchange rate (REER) seems closely aligned with the fair value (as of Dec-22, rupee was just 3.5% overvalued vis-à-vis its long period average as per BIS), in contrast to that in some other nations.

While there is no line in the sand as far as reserve adequacy is concerned, India appears to be maintaining higher than adequate forex reserves to guard against sudden BoP shocks, as shown by the following indicators:

| Reserve Adequacy Indicator | Benchmark/Best | Current Position |

| Import Cover (No. of months of total import) | 3.0 | 8.2 |

| FXR/ GDP Ratio (%) | 25.8* | 16.9 |

| FXR/ Total External Debt Ratio (%) | 138.5* | 92.6 |

| Modified Guidotti-Greenspan Rule | 1.0 | 1.89** |

Being a current account deficit economy dependent upon global capital for funding, India (deriving lessons from its past experiences) has erred on the side of caution. This strategy could prevail in the near term amidst the backdrop of elevated geopolitical uncertainty. However, from a longer-term perspective, India’s chronic deficit on current account could see a marked reduction, as:

- The gradual transition towards green energy globally would reduce India’s dependence on fossil fuel imports

- Policy thrust on ‘atmanirbharta’ will continue to emphasize new age production capabilities in sectors like electronics, speciality chemicals, etc. This in conjunction with the China Plus One strategy of diversification of global value chains can help in structural reduction of India’s merchandise trade deficit in the longer term.

- The post Covid focus on digitization and cost optimization has boosted India’s services exports, which clocked more than 20% growth for two consecutive years in FY22 and FY23.

Such a transformation could potentially lower India’s precautionary demand for forex reserves amidst slow-moving longer-term shifts like efforts to internationalize the INR. Amidst such an outturn, India has to seek a better balance in its reserves with a more nuanced approach towards cost-benefit analysis and policy trade-offs.

(Suman Chowdhury is the chief economist and head of research at Acuite Ratings and Research.)

(Disclaimer: Views expressed are personal and do not reflect the official position or policy of Financial Express Online. Reproducing this content without permission is prohibited.)