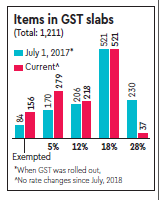

As the Goods and Services Tax (GST) Council meets here on Saturday for its 31st session, expectations are that the highest tax slab of 28% will get pruned further. Among the 31 items that are now taxed at 28% (of the 1,211 items under GST including those for which the tax rate is nil), about 10 items like digital cameras, ACs, large screen TVs, dishwasher and pneumatic tyres are likely to be brought under the 18% rate.

While the idea is to keep only the so-called sin/luxury items in the highest slab, revenue considerations may prevent the council from going the whole hog. Bringing down GST on cement from 28% to 18% may be deferred as revenue loss is estimated at a whopping Rs 14,000 crore/year.

The 28% slab consisted of 230 items when GST was launched. It has since seen the sharpest trimming, in line with the objective of moderating burden on industries and end-consumers (see chart).

Archit Gupta, founder & CEO of ClearTax, said, “A cut in GST rates for under-construction property may be likely to give the sector a boost. With the focus being on a several rate cuts, we also hope that government will take a re-look at GSTR-9 (annual return form) as filing of this return in the current circumstances is going be tedious for taxpayers.”

Since the GST was launched, the council had undertaken several rate reductions till the July 2018 meeting. In all, rates were reduced for 384 commodities and 68 services while there hasn’t been a single instance of a rate increase.

Prime minister Narendra Modi recently said 99% of items will soon be in GST slab of 18% or lower.

Since the roll-out of GST from July 1 last year, the council has undertaken four rounds of rate rationalisation —October 6, November 10, January 18 and July 21. While initially 178 items out of a total 1211 were in the highest bracket of 28%, the number currently stands at 37 – 3% of the goods and services under GST. The rate reductions have estimated annual revenue implications of Rs 70,000 crore.

Finance minister Arun Jaitley wrote in his blog in July this year:“Thus within a record period of 13 months, the GST Council has almost phased out the 28% category.” While the Congress has opposed GST rates above 18%, Jaitley argued that the high rate is a “Congress legacy issue,” he is trying to resolve.

“The pre-GST tariff was a Congress Party legacy. The standard rate for central excise plus VAT plus CST was 12% + 14% + 2%. To this, if the cascading effect of tax on tax was added, the eventual tax payable on a commodity was 31%,” Jaitley had written. He added the high tax rate applied even to products used by households such as mineral water, hair oil, toothpaste, soap, dairy as well as goods including construction material and white goods. “The total number of goods falling in this category was 235.”

Experts have been clamouring for a simpler GDT structure with fewer slabs and benign rates. In principle, the Centre and most states have also supported this idea, although there is still a long way to go before the plan is implemented. Recently, writing in a daily, former finance secretary Hasmukh Adhia, who oversaw GST’s implementation, expressed the view that a two-slab structure should be in place by the fifth year from now.

While a panel headed by former chief economic adviser Arvind Subramanian, which had estimated a revenue-neutral rate (RNR) of 15-15.5%, had suggested a range of ‘standard’ tax rate of 17-18 per cent for bulk of goods and services, while recommending 12% for ‘low rate goods’ and 40% for demerit goods like luxury car, aerated beverages, pan masala and tobacco. Recently, Subramanian said that structure could be even simpler

Overall GST collections are likely to miss the target. While the average monthly collection required to avoid the need for compensating the states and for the Centre to meet its budget estimate is around Rs 1.12 lakh crore, the average monthly collections for April-November period have been only Rs 97,000 crore.

According to sources, the Council is also likely to take stock of the progress on the simplified return filing system approved earlier this year. It is, however, unlikely that the new filing system would be deployed before a new government takes charge after the general elections next year.

A clutch of ‘sin/luxury goods”, including pan masala, tobacco items, aerated drinks and high-end cars, attract cesses over and above 28% GST.