The month of December was full of shocks and developments in terms of economic affairs, including release of growth numbers, slowdown, inflation data, interest rate updates, and GST Council announcements. While Q2 GDP growth slowed to 5.4 per cent, marking its lowest in nearly two years from 8.1 per cent recorded during the same period last year, retail inflation, which had surged to a 14-month high of 6.21 per cent in October 2024, eased to 5.48 per cent in November.

Due to these factors, the Reserve Bank of India (RBI)’s Monetary Policy Committee (MPC), after its December meet, decided to keep the key rates unchanged at 6.50 per cent. The then RBI governor, Shaktikanta Das had said that maintaining price stability is a crucial factor. He added that maintaining macro economic stability and creating buffers is important for the economy and India is well positioned to benefit from emerging trends globally.

Further, according to data released by the commerce and industry ministry, a big surge in imports to a record $70 billion, driven by inbound shipments of gold, pushed the monthly merchandise trade deficit to the highest-ever level of $37.84 billion in November.

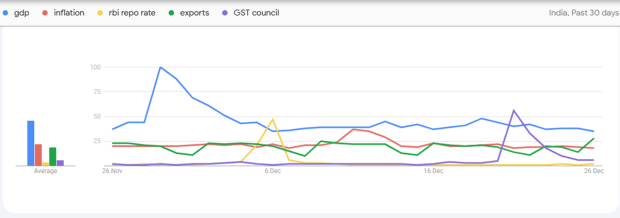

Let us look at the top 5 trending economy-related topics in Google in the month of December.

GDP growth: India’s economic growth slumped to a seven-quarter low of 5.4 per cent in the July to September 2024 quarter, marking its lowest growth rate in nearly two years. During the same period last year, GDP growth was recorded at 8.1 per cent. However, according to a paper in the Reserve Bank of India’s monthly bulletin, several high-frequency indicators for the third quarter of FY25 show that the Indian economy is recovering from the slowdown. The recovery in Q3 is being driven by strong festival activity and sustained upswing in rural demand and consumption on the back of brisk expansion of rabi sowing and positive prospects for the agriculture sector. However, the paper cautioned that global headwinds continue to pose risks to the evolving outlook for growth and inflation.

Inflation: Inflation has been a key area of concern since October 2024 when retail inflation, based on the Consumer Price Index (CPI), surged to a 14-month high of 6.21 per cent during the month, driven by a sharp rise in food prices. However, later in November, the inflation showed some signs of easing. The CPI inflation came down to 5.48 per cent during the month. A dip in prices of food items and beverages has been ascribed as the main reason for the drop in inflation numbers in November. According to the data released by the Ministry of Statistics, November food inflation dropped to 9.04 per cent from 10.87 per cent in October. This is considered as the primary reason for the elevated inflation print in October.

RBI Repo Rate: The December RBI MPC meet, which ended on Dec 6, decided to keep the repo rate unchanged with focus on reining in inflation. The standing deposit facility (SDF) rate stayed at 6.25 per cent, and the marginal standing facility (MSF) rate and Bank Rate were steady at 6.75 per cent. Further, the then RBI Governor Shaktikanta Das announced that the MPC decided to maintain a neutral stance, aiming to keep inflation under control while promoting growth. The target is to achieve 4 per cent CPI inflation (with a margin of ±2 per cent) over the medium term, ensuring both price stability and economic growth. The RBI MPC also revised its GDP growth rate with FY25 growth projected at 6.6 per cent, Q3 at 6.8 per cent, Q4 at 7.2 per cent, and for H1 2025-26 at 6.9 per cent (Q1) and 7.3 per cent (Q2). CPI inflation for 2024-25, meanwhile, is projected at 4.8 per cent, with Q3 at 5.7 per cent, Q4 at 4.5 per cent, and for H1 2025-26 at 4.6 per cent (Q1) and 4.0 per cent (Q2). The MPC also announced a 50 basis points reduction in the Cash Reserve Ratio (CRR), bringing it down to 4 per cent.

Exports: According to data released by the commerce and industry ministry, India’s merchandise trade deficit widened to a record-high of $37.84 billion in November from $27.14 billion in the previous month due to a sharp rise in inbound shipments of gold. The trade deficit last month was higher on-year as well versus $21.31 in November 2023. Merchandise exports fell 4.9 per cent YoY to a 25-month low of $32.11 billion in November, while imports shot up, rising 27.04 percent to $69.95 billion during the same period.

GST Council Meet: The GST Council had met on December 21 under Finance Minister Nirmala Sitharaman. The finance minister said that no decision has been taken on bringing ATF under the GST umbrella and a proposal to tweak rates on insurance products has been deferred. The proposal to lower GST on delivery charges for food ordered via e-commerce platforms has also been postponed. The GST Council proposed reducing the tax on fortified rice kernels (FRK) from 18 per cent to 5 per cent. The Council announced that pre-packed and labelled ready-to-eat popcorn will attract a 12 per cent tax while caramelized popcorn would attract an 18 percent GST. In the automotive sector, the GST Council approved a hike in the GST rate on the sale of old and used cars, including electric vehicles (EVs), by businesses, raising it from 12 per cent to 18 per cent.