Paper mills in India are feeling the pinch from both demand and supply sides, after the market compression due to Covid-19 and the menace of cheap paper imports from China and ASEAN. In exasperation, the major paper mills have written to the Union government seeking that the import tariff walls on paper are up 25% from the present 10% to stop the avalanche of cheap paper imports from China.

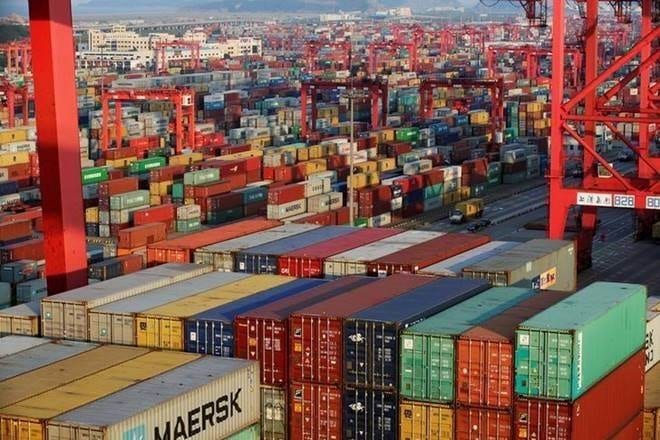

There is no let up in imports, “even in an economically challenged year” as 2020, Indian Paper Manufacturers Association (Ipma) has pointed out in its letter to Union commerce ministry. Even in the current situation of border tensions, there is no hint of slowdown in paper imports from China.

According to the latest directorate general of commercial intelligence and statistics (DGCI&S) data, Rs 1,773-crore worth paper imports have landed from China in April-February (11 months) period in FY20, against Rs 1,831 crore in the entire 12 months of FY19. Similarly, against an import of Rs 1,830 crore from ASEAN in FY19, imports of paper have gone up to 1,870 crore in the first 11 months of FY20.

“Market intelligence from Ipma points out that even , at present, the paper imports from China are going up,” said an Ipma spokesperson.

The harshest part is that cheap Chinese imports flow in at a time, when paper industry is facing severe demand compression due to Covid-induced lockdown. As schools and colleges are closed, there are few takers for notebooks and paper for printing text books.

China and Indonesia are using this opportunity to push their excess inventory to India at very low prices, AS Mehta, president, Ipma, told FE. “We have urged the Centre to hike basic customs duty on paper import to 25%. Again, paper should be placed in the Negative List for all existing and future FTAs (free trade agreements),” he says.

Farmers engaged in agro-forestry, those supplying wood to paper mills and several players in rural economy will be in trouble, besides the mills themselves if the present shocks in supply and demand continue.

“Even a few large paper mills have been forced to shut down their operations due to commercial unviability,” said Rohit Pandit, secretary general, Ipma. Sadly, the go-ahead to imports is when the country’s own paper production capacity lies underutilised, he adds.