By Sonal Varma & Aurodeep Nandi

Consumption indicators continue to show endemic weakness, with auto sales slumping across passenger car, two-wheeler and tractor sales (the latter two being indicators of poor rural demand). Automakers are attributing this to a broader economic slowdown, consumer pessimism, high interest rates, and tight financial conditions from the shadow bank credit crisis. There are other tell-tale signs of consumption slowdown in weak rural wages, diesel consumption and cellular subscription.

Non-financial services have also slowed, with a sharp fall in commercial vehicles sales growth, although it could also be reflective of new norms introduced for axles of heavy and medium trucks. A slowdown is also observed in other transportation sectors, particularly in the aviation and railways sectors. Within financial services, there is a dichotomy between bank credit and deposit growth, the latter being unable to keep pace with the credit growth pickup. While much of the credit growth is limited to personal loans and credit to non-bank financial sector, the high credit-deposit ratio effectively throws a spanner in the transmission of RBI’s rate cuts.

Industrial indicators have comparatively held up well, although we observed some weakness creeping into industrial production, including coal and electricity output growth. Rather inexplicably, PMI readings continue to be robust, although they are not robust indicators for signalling GDP growth.

ALSO READ: India among fastest growing large economies in the world, says IMF; here’s what’s needed to sustain growth

Investment indicators remained broadly stable thus far, but capital goods production has fallen sharply in January and public capex continues to contract sharply as the government looks to limit fiscal deficit target slippage.

The year 2019 will remain an uncertain year for public capex owing to aggressive revenue assumptions in the budget. External sector indicators have deteriorated in February, with slowing export growth due to weaker global demand, and contracting core imports (non-oil, gold), reflective of weak domestic demand conditions and lagged effect of currency depreciation. Growth in visitor arrivals—another proxy for external demand—also continues to underwhelm.

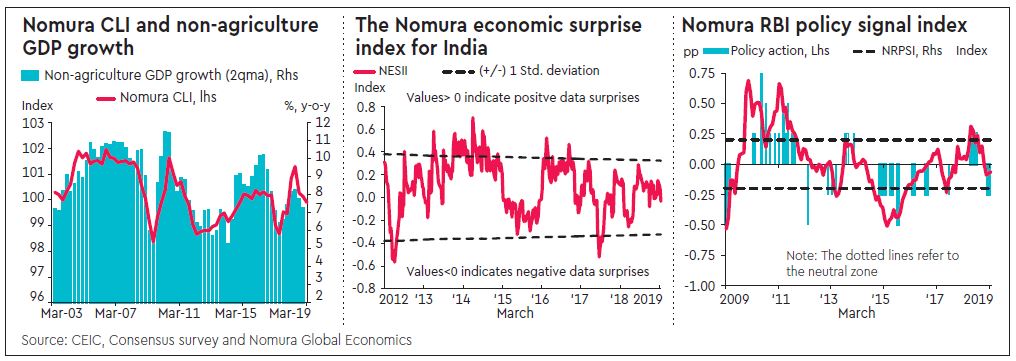

The Nomura Composite Leading Index, which has a one-quarter lead over non-agricultural GDP growth, moderated to 99.9 in Q1 2019 from 100.1 in Q4 2018 and has consistently fallen from its peak in mid-2018. The moderation is due to the slowing external sector (visitor arrivals, non-oil imports), lower real M2 money supply growth and a weakening trend in industrial production. This further supports the view that a cyclical slowdown is well under way. Based on the Nomura Economic Surprise Index for India observations, the index does not signal any clear direction for economic data surprises over the coming months.

The latest GDP reading for Q4 reflected a dichotomy—while the slowdown was driven by government consumption, agriculture, and to some extent, private consumption, growth was supported by investment, industry, private services and net exports. The latest prints of concurrent indicators seem to suggest that Q1 will mimic Q4, but with deterioration also spreading to services, industrial and investment demand.

Expect GDP growth to slow further to 6.0-6.5% in H1 2019 and average 6.6% y-o-y in 2019 vs 7.3% in 2018. The slowdown is likely despite fiscal and monetary easing, which won’t be enough to ward off growth headwinds. If this growth outlook is right, then there could be an inevitable knock-on effect on core inflation, which still remains sticky and high owing to a lagged pass-through of supply side shocks from H2 2018.

ALSO READ: How FED’s rate hold decision may impact rupee, RBI’s monetary policy

Inflationary pressures will remain capped this year, with headline inflation remaining sub-4% in 2019, below RBI’s inflation target. The minutes for the Monetary Policy Committee’s deliberations for the February policy amply articulate that it is ready to accommodate growth as long as inflation, particularly of food, remains benign. Expect both growth and inflation to undershoot RBI’s projected path. Along with a benign global backdrop, this should provide more space for easing. Nomura also estimates that there will be a 25 bps rate cut at both April and June’s policy meetings, which will result in a cumulative 75 bps worth of repo rate cuts in 2019.

-Edited excerpts from Nomura’s Asia Insights, India (March 21). Authors are research analysts with Nomura Holdings