By Anubhuti Sahay

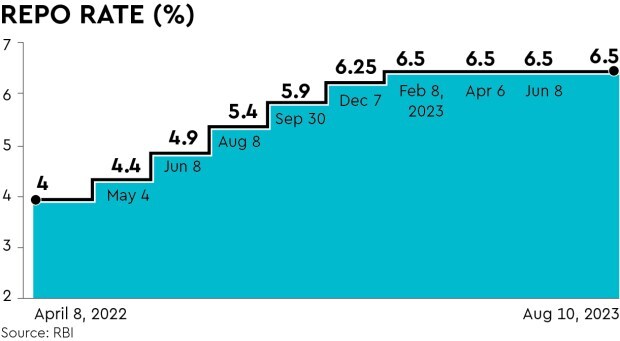

IIndia’s Monetary Policy Committee (MPC) can be expected to keep the repo rate unchanged at 6.5% at its October 4-6 meeting. The domestic inflation outlook has improved with a plunge in tomato prices. September CPI is likely to ease below 6%, moderating further to 5.0-5.5% in H2-FY24 (ending March 2024); a few prints below 5% are also likely. Contained core inflation at c.5% since April 2023 is comforting too. However, MPC members will very likely remain cautious on upside risks to inflation from three factors.

First, even as vegetable prices have fallen, upside risk to pulses and cereals inflation exists on uneven monsoon distribution. Area under coverage for pulses remains 6-8% below last year amid all-time-high market prices. Unlike rice, where any output shortfall can be managed by offloading of government stocks, pulse prices can remain high for a prolonged period in case of any crop shortfall.

Wheat stocks are below the buffer norms, and a good winter crop will be crucial in keeping prices contained unless we see increased imports over the next few months.

While rainfall has increased since the beginning of September, water reservoir levels are at multi-year lows and its progress will therefore need to be monitored closely to assess implications for the winter crop. Hence, vigilance on food inflation will remain high, despite the recent improvement in the inflation outlook.

Second, crude oil prices above $90/barrel (bbl) pose inflationary risk via the currency channel. Our sensitivity analysis shows that for every $10/bbl increase in crude oil prices, India’s net crude oil import can move higher by $15 billion.

A high level of FX reserves and doubling of services exports since the pre-pandemic period have clearly reduced the Indian rupee’s (INR’s) vulnerability to higher crude oil prices.

However, policy makers are likely to remain vigilant of any impact from a prolonged period of elevated crude oil prices on the currency and thus inflation.

The direct impact on retail fuel products via higher prices is unlikely to be an immediate concern, in our view. Indian retail fuel prices did not see any reduction when crude oil prices traded in the $70-75/bbl handle. Therefore, one can expect prices to remain unchanged unless higher crude oil prices are sustained for longer.

Even in such a scenario, the government can insulate the economy from a price hike by reducing excise duty.

Third, the impact of higher-for-longer US rates on the INR and inflation could also remain a key consideration for policy makers. The US Federal Reserve indicated at its latest meeting that rate cuts in the US are unlikely to begin before the later part of 2024.

While India’s monetary policy will be determined by domestic growth-inflation dynamics, potential pressure on the currency and thus inflation amid higher-for-longer global rates cannot be overlooked.

The latest data for balance of payments and external debt suggests that higher global rates are discouraging debt-raising in dollar rates.

Reasonably strong domestic growth momentum allows the MPC to stay focused on managing inflation risks over the next few meetings. Our in-house composite economic activity indicator (comprising 25 high-frequency data points) shows an uptick in activity in August 2023, probably due to a drier-than-usual month.

With India entering the busy festival season and credit growth still strong, economic momentum is likely to stay supported, enabling a sharp focus on inflation risks. The MPC can be expected to maintain its FY24 (ending March 2024) GDP growth forecast at 6.5%.

It will likely raise its Q2 FY24 inflation forecast towards 6.6% from the current 6.2%, as the actual data for August was worse than expected. However, we expect its Q3 and Q4 FY24 forecasts to remain unchanged at 5.7% and 5.2%, respectively, as incremental information on the price outlook since August 2023 has not been adverse enough to change the baseline scenario.

Risks need to be monitored, but a change in the MPC’s view on H2-FY24 inflation can probably wait for the December meeting, in our view.

Besides the cautious commentary on inflation and a unanimous pause, the market will closely watch for any guidance on liquidity.

At the last MPC meeting, the unexpected announcement on the incremental cash reserve ratio (I-CRR) took the market by surprise. With India entering the busy festival season, currency in circulation is likely to increase, leading to tighter liquidity conditions.

This is likely to occur against a backdrop of dollar sales by the RBI amid a wider trade deficit, portfolio investment outflows and a stronger dollar continuing to drain liquidity. While unwinding of the I-CRR is widely expected, any guidance on how the RBI plans to manage liquidity over the next quarter will be closely watched by the rates market.

Anubhuti Sahay, Head (South Asia), economics research, Standard Chartered Bank