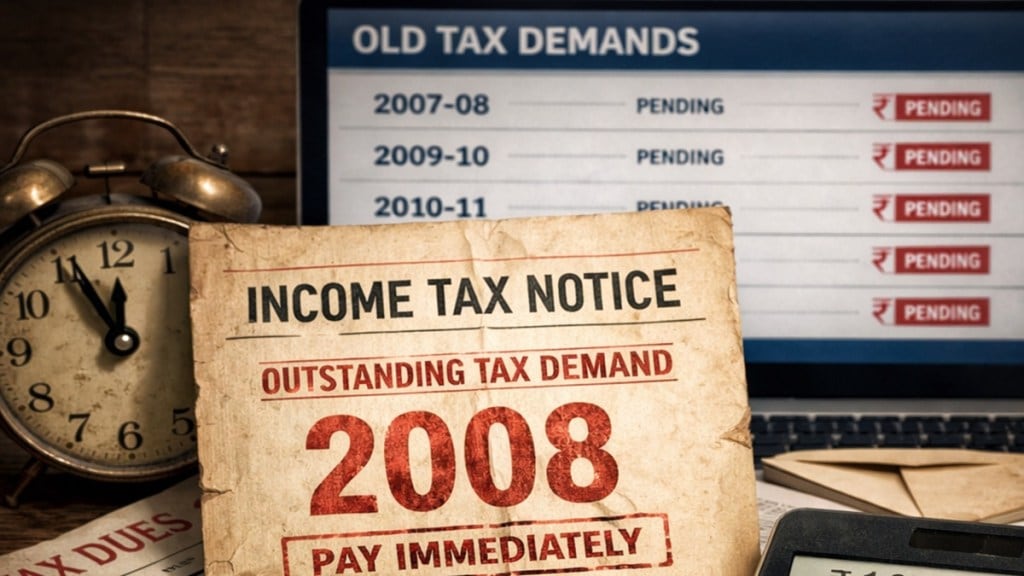

Income tax demands from very old years, such as 2005 to 2011, have suddenly started appearing on the income tax portal, according to a report by ‘The Economic Times’. This is a complete shock for many taxpayers, as many of them had neither received any notice nor were aware of the assessment orders at the time.

According to the ET report, in many of these cases, the interest amount has exceeded the principal tax amount, significantly increasing the taxpayers’ problems.

Why are old tax demands surfacing on the portal?

The report suggests that the Income Tax Department is in the process of digitizing and integrating old and scattered records into a digital system. During this exercise, assessment orders from many years ago and the associated tax demands are now being uploaded to the income tax portal. The problem is that taxpayers who never received the order – or whose order was sent to the wrong address – are now seeing the outstanding amount directly and are expected to pay.

Interest charges exacerbate taxpayers’ concerns

The biggest problem in these old cases is the interest. Due to the arrears accumulating over the years, the interest amount has often become equal to or even greater than the principal tax amount. Taxpayers argue that if they had received the assessment order or demand notice on time, they could have appealed and avoided this heavy burden of interest.

How did the opportunity to appeal lapse?

For example, for the financial year 2009-10 (according to the then-prevailing rules), the last date for sending a notice for escaped income exceeding ₹1 lakh was March 31, 2017, and the deadline for issuing the assessment order was December 31, 2017. Generally, the demand notice is issued immediately after the assessment order. According to the rules, taxpayers can appeal to the CIT (Appeals) within 30 days of receiving the assessment order. However, in cases where the order was never received, this constitutional right to appeal could not be exercised, and interest continued to accrue year after year.

A difficult challenge for the department as well

While the tax demands may be legitimate, proving that notices and assessment orders were sent on time to the correct address in cases 10-15 years old will not be easy for the Income Tax Department either. On the other hand, it is practically difficult for taxpayers to preserve such old documents.

Crackdown on fraudulent deductions: Nationwide investigation

Meanwhile, the Income Tax Department launched a large-scale verification drive across several states on July 14, 2025. According to the Finance Ministry, this action was taken in response to cases of fraudulent deductions and misuse of exemptions in income tax returns.

The investigation revealed that some ITR preparers and intermediaries systematically claimed fraudulent deductions and exemptions. In several cases, attempts were also made to obtain excess refunds by filing false TDS returns. Evidence of this was found during search and seizure operations conducted in Maharashtra, Tamil Nadu, Delhi, Gujarat, Punjab, and Karnataka.

Which sections were most misused?

According to the department, exemptions and deductions under sections 10(14), 80GG, 80E, 80D, 80EE, 80EEA, 80G, 80GGA, and 10(13A) were claimed without eligibility. In some cases, employees of MNCs, PSUs, and government institutions were also found to be manipulating income and deductions to reduce their tax liability or obtain refunds.

Technology is tightening the noose

To detect these irregularities, the Income Tax Department is using data analytics, third-party data, intelligence gathering, and advanced AI tools. This has made it possible to identify not only new cases but also suspicious claims related to old records. What do taxpayers need to understand?

The sudden emergence of old tax demands indicates that the Income Tax Department is now in the mood to close even old cases. It is crucial for taxpayers to log in to the income tax portal regularly, not ignore any demands, and seek expert advice in a timely manner to present their case if needed.