Over the past year, silver has quietly outshone many traditional assets, catching the attention of both traders and long-term investors.

While gold often steals the spotlight during uncertain times, 2025 has seen silver carving its own story, powered by a mix of industrial demand, green energy expansion, and shifting global monetary cues.

But here’s the real question: Is silver still a smart investment choice for retail investors in 2025?

In this editorial, we’ll connect the dots between ETF inflows, India’s record imports, and global monetary shifts to see if silver’s comeback is a real structural story or just another shiny distraction.

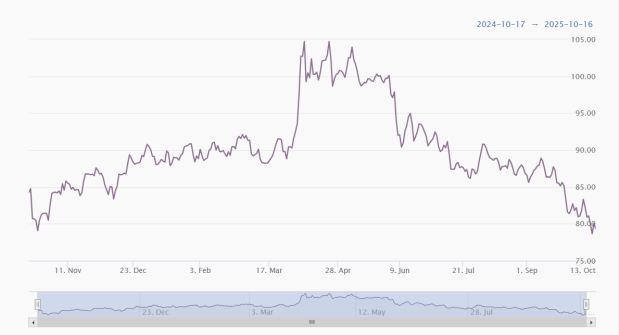

Silver’s Price Performance

A Breakout After Years of Consolidation

After lingering in a broad consolidation phase for much of the previous decade, silver broke decisively higher. Internationally, it surged past US$ 50 per ounce.

In India, the rally was even more pronounced: MCX silver futures touched record highs above Rs 160,000 per kg, and spot prices in physical markets climbed toward Rs 180,000 per kg.

How Silver Outperformed Gold and Equities in 2025

To put silver’s rally into perspective, here’s how it stacks up against gold and Indian equities in the same timeframe.

Silver vs Other Assets

| Asset Class | Return (Oct 24 – Oct 25) |

| Silver | + 80% |

| Gold | + 60% |

| Nifty 50 | + 2% |

Silver’s outperformance is stark. Even though gold posted robust returns, it was consistently outpaced by silver’s sharper ascent.

Meanwhile, equities in India (via the Nifty 50) saw only modest gains, reinforcing silver’s role as a valuable diversifier in volatile times.

What’s Powering Silver’s Global Rally?

Silver’s performance hasn’t been random; it’s rooted in several overlapping global forces.

You need to know about these forces…

More Than Money: Silver’s Dual Identity

Unlike gold, of which the vast majority ever mined is held as an investment or in jewellery, a significant portion of silver is consumed by industry.

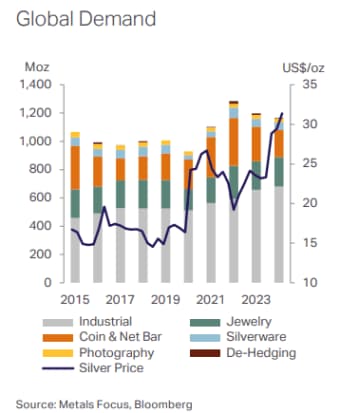

Industrial applications now account for over half of all annual silver demand, a fundamental distinction that anchors its value to global economic growth and technological innovation.

Global Silver Demand

This means that while silver will rally alongside gold on monetary concerns, its price is also supported by tangible, non-speculative, and often inelastic physical demand from manufacturers.

The Green Revolution’s Silver Vein

Silver’s industrial demand is not just broad; it is concentrated in some of the world’s most critical and fastest-growing sectors, where it is often non-substitutable due to its unique properties of conductivity and durability.

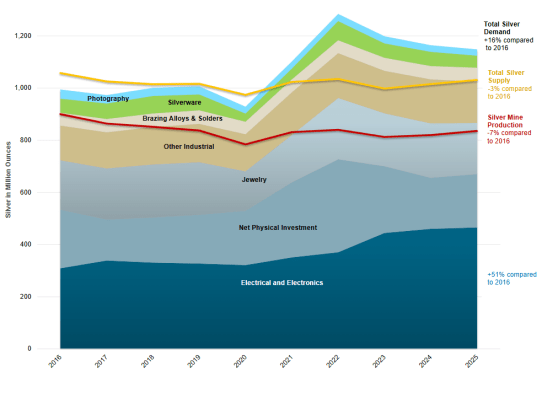

Silver Demand Continues to Outpace Supply (2016-2025)

- Solar Panels (Photovoltaics): The global transition to renewable energy is a voracious consumer of silver. Silver paste is an essential component in photovoltaic (PV) cells for conducting electricity. The solar sector alone now consumes nearly 20% of the total global silver supply, and this demand is projected to grow exponentially as nations accelerate their decarbonization efforts.

- Electric Vehicles (EVs): The automotive industry’s shift to electrification is another major demand driver. Silver is indispensable in EV batteries, high-conductivity electrical connections, and advanced safety systems. Annual silver demand from the EV sector is forecast to exceed 90 million ounces, a figure that will climb in lockstep with EV adoption rates.

- Advanced Electronics and Connectivity: Beyond green energy, silver is a cornerstone of modern technology. It is an irreplaceable component in smartphones, semiconductors, and the infrastructure for 5G networks and Artificial Intelligence (AI) hardware. Each technological advance creates new and resilient streams of industrial demand for the metal.

The Structural Deficit

The most compelling component of the long-term positive trend for silver is the persistent and deepening structural deficit in its physical market.

For several consecutive years, global demand for silver has significantly outstripped the combined supply from new mine production and recycling.

Global Silver Supply vs Demand

In 2024, the market recorded its fourth consecutive annual deficit, amounting to a substantial 148.9 million ounces (Moz). Although this deficit fell by 26% year-on-year, it remained high, equivalent to 15% of global supply.

The cumulative deficit between 2021 and 2024 reached a staggering 678 Moz, equivalent to ten months of total global mine supply.

Projections indicate a fifth consecutive deficit in 2025. This chronic shortfall is systematically draining the world’s above-ground inventories of silver bullion, particularly in major trading and storage hubs like London.

This tightening physical market creates the underlying conditions for price volatility and sharp upward movements, as industrial and investment buyers compete for a shrinking pool of available metal.

It is this fundamental supply-demand imbalance that distinguishes silver’s bull case from gold’s.

Inside India’s Silver Rush: Why Domestic Demand is Booming

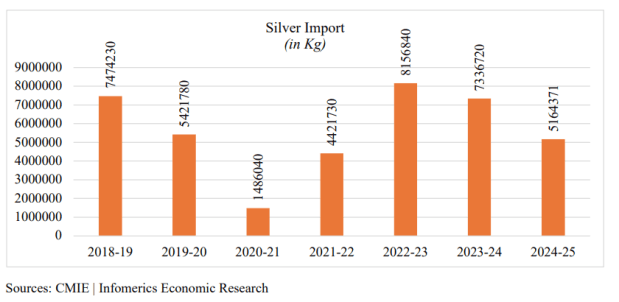

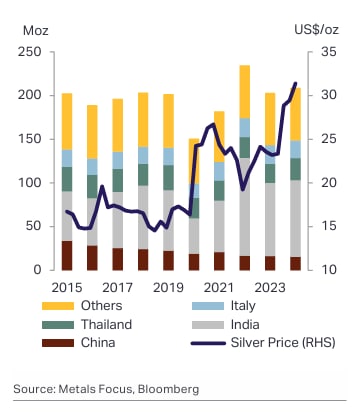

India is a major and unique market for silver because retail demand (coins, bars, jewellery), industrial use and festival/ritual buying overlap.

2024 saw record shipments into India but early 2025 showed volatility; imports fell materially in the first eight months due to tight global supply and high costs, before traders and banks began to step up shipments again as domestic demand intensified.

Silver Import Trend in India

Indian physical prices have traded at persistent premiums to international benchmarks because of logistics, local demand spikes (festivals like Diwali), and constrained domestic scrap supply.

During 2025, tight global availability and strong local demand pushed local premiums higher, sometimes into double-digit percentage territory, amplifying rupee returns for domestic investors.

On the other hand, India’s demand still has a large retail/jewellery and investment component compared with advanced economies, where industrial demand dominates.

Global Jewellery Fabrication Demand

That said, India’s industrial uptake (solar, electronics, manufacturing) is growing, making India sensitive both to global industrial cycles and to local retail sentiment.

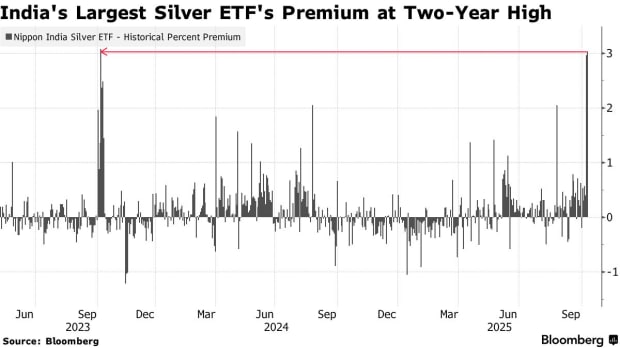

ETF Inflows – What They Signal

Exchange-Traded Funds (ETFs) have become a crucial barometer for gauging investor sentiment in the silver market.

In 2025, silver ETFs experienced strong inflows, reflecting a significant shift in investor behaviour. By mid-year, global silver-backed ETFs had added approximately 95 million ounces, surpassed the total inflows of the entire previous year and pushed total holdings to an all-time high of about 1.13 bn ounces, valued at over US$ 40 bn.

Locally, as of September 2025, silver ETFs in India collectively managed about Rs 135 bn, a substantial increase from previous years.

In 2025, silver ETFs in India delivered impressive returns, with some funds up 86.67%, outpacing equity benchmarks.

However, this growth has not been without challenges. The surge in silver prices led to premiums of up to 10% over the Net Asset Value (NAV) of ETFs.

This prompted several Asset Management Companies (AMCs) to temporarily halt new subscriptions to their silver ETFs to manage liquidity and ensure fair valuation.

India’s Silver Premium – Why it Matters

Before going into the details of the silver premium, let’s first understand it.

A silver premium refers to the difference between the domestic price of silver in India and its global benchmark price (typically the London Bullion Market Association or LBMA spot price).

This premium arises due to various factors unique to the Indian market.

- Logistics and Import Duties: Importing silver involves significant costs, including shipping, insurance, and customs duties, which increase the landed cost of silver.

- Supply-Demand Imbalance: India is a major consumer of silver, but domestic production is minimal. This reliance on imports, combined with high demand, often leads to supply shortages, driving up prices.

- Festive Demand: Festivals like Diwali and Akshay Tritiya see a surge in silver purchases for gifting and religious purposes, further straining supply and elevating prices.

- Investment Demand: In recent years, silver has gained popularity as an investment asset, leading to increased demand from retail and institutional investors.

In 2025, India witnessed significant fluctuations in silver premiums. During early 2025, premiums were relatively stable, hovering around 0.5% above global prices.

India’s Silver ETF Premium

By October 2025, premiums surged to 5.7%, with intraday spikes reaching up to 12%, reflecting heightened demand and supply constraints.

Additionally, the festive season’s impact was evident in cities like Chennai, where silver prices soared past Rs 2 lakh per kilogram, a 28% increase over a fortnight, due to strong festive season demand.

Silver’s rise isn’t just about supply, demand, or ETF inflows. It’s part of a much bigger global narrative driven by inflation, the US dollar, crude oil prices, and interest rates, all of which act like hidden strings pulling silver’s price up or down.

Macro Factors Shaping Silver’s Path

Over the last year, silver has been caught in a tug of war between its safe-haven appeal and its industrial side.

And to understand where it could go next, you need to look at the three big macro levers:

Inflation Expectations

Globally, inflation began creeping back up, driven by higher energy costs and persistent core inflation in the US and Europe. The renewed interest in silver as a store of value against global monetary uncertainty.

However, India tells a different story.

Domestic inflation has eased to multi-year lows, thanks to lower food prices and stable crude oil prices. This means that for Indian investors, silver’s appeal isn’t purely about inflation protection right now, but rather about diversification and long-term industrial potential.

So, while global investors are buying silver as an inflation hedge, Indian buyers are seeing it as a strategic asset, one that combines hedging power with real-world demand from green industries and electronics.

US Dollar

The US Dollar Index (DXY) has been firm through 2025, hovering near 105–107 levels.

A stronger dollar usually pressures silver, since it becomes more expensive for non-dollar buyers. But silver has been resilient, signalling that demand fundamentals are offsetting currency headwinds.

Interest Rate Direction: The Fed’s New Stance

Perhaps the most important macro cue right now is the US Federal Reserve’s recent signal against early rate cuts. After hinting at easing in early 2025, the Fed turned cautious as inflation stayed sticky.

Higher-for-longer rates generally weigh on non-yielding assets like silver and gold because investors prefer interest-bearing instruments.

But here’s the twist: When markets sense that rate cuts are delayed due to persistent inflation, silver often rallies as an inflation hedge.

So, while the Fed’s hawkish tone initially cooled investor sentiment, it also rekindled silver’s long-term narrative as a hedge in a world of uncertain policy moves.

Is Silver Still a Good Investment in 2025?

To understand this, we have to look at two core points…

What History Tells Us About Silver’s Cycles

If you look at silver’s price chart over the past five decades, it tells a fascinating story.

Each time silver has exploded, whether during the Hunt Brothers’ squeeze in 1980, the post-2008 stimulus era in 2011, or the current breakout past US$ 50/oz in 2025, it has been followed by long phases of correction and consolidation.

Silver Price Trend (1975-2025)

But 2025 feels different because this rally isn’t riding on speculative hype alone. It’s backed by structural tailwinds that didn’t exist before.

In 1980, the spike came from market manipulation.

In 2011, it was driven by QE (a policy where central banks inject money into the economy to stimulate growth) and paper demand.

But in 2025, silver’s foundation rests on something tangible, such as industrial demand from EVs, solar, and electronics.

That’s why this time, even after steep rallies, prices have found support quickly, a sign of fundamental strength replacing speculative spikes.

Silver-Gold Ratio: Why Silver Still Looks Undervalued

Historically, the silver-gold ratio (how many ounces of silver equal one ounce of gold) has been a strong indicator of relative value.

The long-term average sits around 60–65. In early 2024, it hovered near 85–90, suggesting silver was heavily undervalued relative to gold.

Gold Silver Ratio (1 year)

Even after the 2025 surge, the ratio remains above 70, indicating silver hasn’t yet caught up to gold’s relative value. That means silver’s rally may still be in its mid-cycle phase rather than a peak.

In Essence, Silver’s past rallies were like fireworks, strong but short-lived.

This time, the setup feels more like a slow-burning engine powered by real demand, structural deficits, undervaluation, and a shifting macro-order.

Whether prices stay elevated or corrects in the short term, the underlying logic points to a stronger long-term foundation than any of its previous cycles.

What Investors Should Keep in Mind?

Diversification Still Matters

In a portfolio dominated by equities and bonds, silver continues to play a strategic role. Its low correlation with financial assets makes it a strong diversifier, especially when inflation or global shocks hit risk assets.

Inflation Hedge

Silver does hedge against inflation, but it’s not as stable as gold. Its industrial dependence means it can swing both ways, rallying in demand cycles and correcting when global manufacturing slows.

Risks to Watch

- Volatility: Silver prices can move sharply in a single day because of speculative flows.

- Industrial Slowdown: If EV or solar demand cools, it directly hits silver consumption.

- Policy Uncertainty: Import restrictions or GST policy moves in India can impact domestic pricing and premiums.

Track the Premiums and Global Cues

India’s silver premiums, which recently touched multi-year highs, can tell you how tight local supply is.

So, pair that with global signals like ETF inflows, US yields, and inflation data, and you’ll get a much clearer picture of where silver might be heading next.

Conclusion

Silver remains a dynamic asset driven by industrial demand, inflation trends, and global liquidity shifts.

While short-term volatility persists, its long-term role as both commodity and store of value endures.

Investors should assess their investment horizon, risk appetite, and portfolio goals before taking exposure to silver or related instruments.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.