Some families pass down recipes. Mine passed down a financial advisor. For 15 years, Arvind Uncle was the man who knew our portfolios better than dad knew our birthdays.

But last month, I committed the ultimate family sin: I replaced him.

I told my father, “Sorry, I’m not calling Arvind Uncle for my investments anymore. I’ve found an alternative.”

Now see, I’ve grown up watching my parents discuss ‘safe options’ over long hours. Investing, for them, was a human handshake and a cup of chai. My version of investing looks nothing like that.

Naturally, my dad’s face froze mid-meal. The silence that followed was brutal. And honestly, I wasn’t sure if I’d just made the smartest or the stupidest financial decision of my life.

Could an app really replace decades of human intuition? That’s what I set out to find. And over the next few months, I discovered just how different money feels when it’s managed by a machine.

From Chai to Charts

My father felt the pinch: “You’re letting a computer handle your savings?”

He wasn’t mocking me; it was genuine confusion.

But for me, this shift made sense. My generation grew up with algorithms curating what we watch on Netflix and what songs we hear on Spotify. To us, it’s not strange to think an algorithm might also understand our money.

And the data backs this up:

- 70% of Gen Z and millennials use fintech apps to budget or invest.

- A 23% CAGR rise of the global digital finance app market indicated structural changes in investor behaviour.

My dad placed his trust in a person, my generation places its trust in data and automation.

Why algorithms earned my trust

I began investing at 23. Young, naive and ignorant like many of my age. Initially, I was guided by a human advisor, chased YouTube tips, and reacted to every market wobble.

Even with traditional guidance, I found my emotions were still driving decisions.

After a few years, a friend recommended a robo-advisory platform. Supposedly it was ‘doing very well’.

Here are 4 things that changed for me:

| Lower cost | Traditional advisory costs 1-2% AUM annually. My robo-platform charges appx 0.5%. |

| Personalisation | The algorithm builds a portfolio based on my age, income, risk profile and financial goals. |

| Consistency | Human advisors wait for “the right time.” My platform rebalances automatically without emotion. |

| Engagement & Management | I got timely reminders for loan payments, no ‘oops months’. Plus, the interactive platform helped me track financial goals empowering me to take control of my money. |

*Disclaimer: Robo-platforms in India only handle investment advice and not full financial planning.

My ₹1 Lakh Experiment

To test whether an algorithm could really replace a human advisor, I invested ₹1 lakh through a robo-advisory platform with one simple brief: “I’m 33, ready for moderate risk, and investing for the next 10 years.”

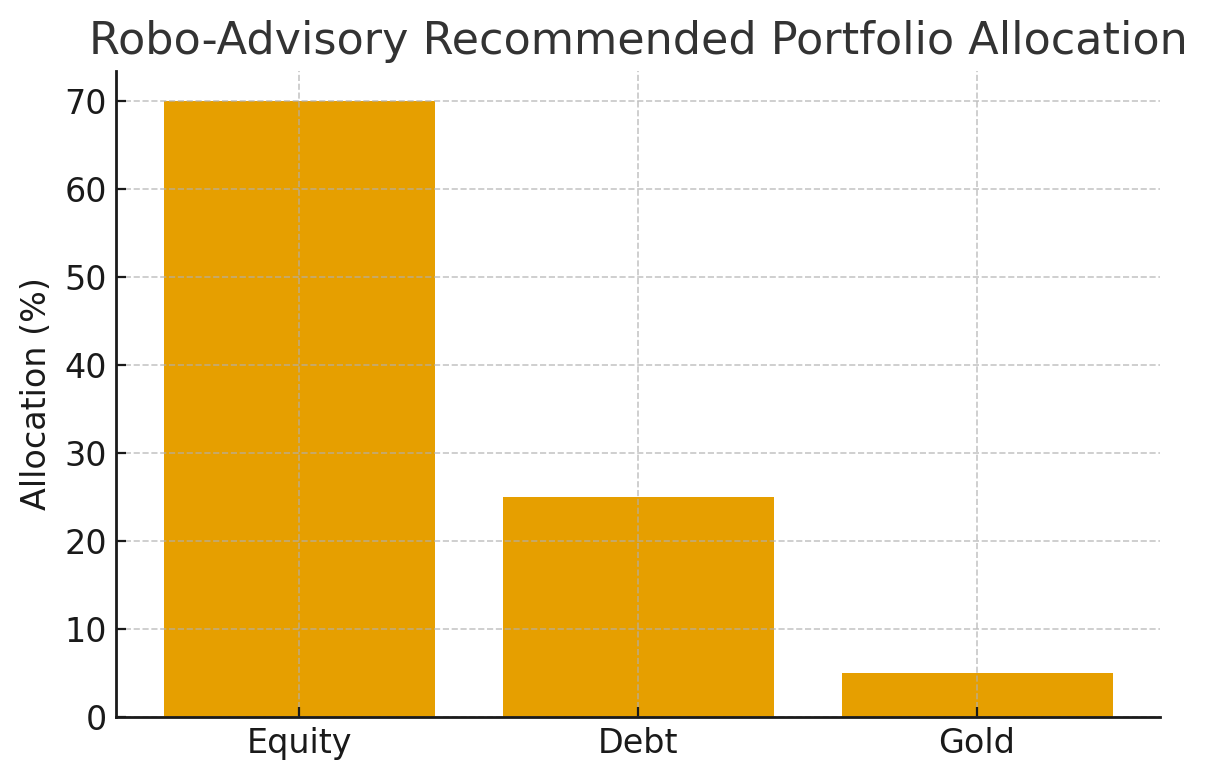

The platform responded with a portfolio that was nothing like my dad’s. It was clean and mathematically balanced: 70% equity, 25% debt, 5% gold.

The graph below shows exactly how my money was allocated on Day 1. No “beta, let’s wait till markets settle.”

A year in, the returns weren’t surprising, but it was steady. And more importantly, my behaviour changed. I stuck to the plan and beat my own impulses.

What algorithms can’t do, yet

After using the platform for two years, here’s what became clear:

- They can’t read our life context. An app doesn’t know my child’s school fee is due or why I need to pause my SIP for a month.

- They don’t understand emotional goals. For anyone, investing isn’t just math. It’s security, dignity, and giving my family a better future. Algorithms can’t feel that.

- Automation has regulatory limits. In India, robo platforms face compliance constraints: rebalancing or tax-loss harvesting often need explicit user approval.

- They miss nuance in personal priorities. Sudden expenses, changing ambitions, shifting responsibilities, a machine can’t anticipate these without me telling it first.

That’s where humans still matter.So, once a year, I sit with my CA, review taxes, adjust long-term goals, and talk through the “why” behind my money decisions.

But for day-to-day discipline? The algorithm wins. It takes care of asset allocation, rebalancing, and reminders.

Why the hybrid model makes sense – In the real world

My parents see money as something sacred. Like thousands of other older Indians who still rely on gold and fixed deposits. Equities make up just 5.8% of an average Indian household’s total assets.

I, on the other hand, choose to embrace an increasingly growing trend of mutual funds. In fact, 52% of the younger generation like me, between 22 – 35, choose SIPs to invest in mutual funds.

So, whose approach is better?

The answer is neither. I view money as a tool that can be optimised and grown through data. It is true that globally and in India, pure robo-advisors struggle with sustainability:

- Acquisition costs are high

- Revenue per user is low

- Regulations limit full automation

- Many standalone robos have folded

Which is why hybridadvisory models outperform pure-robotic ones. So yes, I did replace my Arvind Uncle with an algorithm. But I never eliminated human context, I simply shifted his role.

Because in the end, the combination of logic and empathy is what worked to keep my money on track.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult a qualified professional before making investment decisions.

Sneha Virmani is a content strategist and writer with over a decade of experience. She is an alumna of Lady Shri Ram College, Delhi University (Economics & Psychology). Sneha specialises in storytelling-led content strategies and consumer education campaigns. Her work brings context and clarity, with a no-jargon approach designed to engage everyday readers.