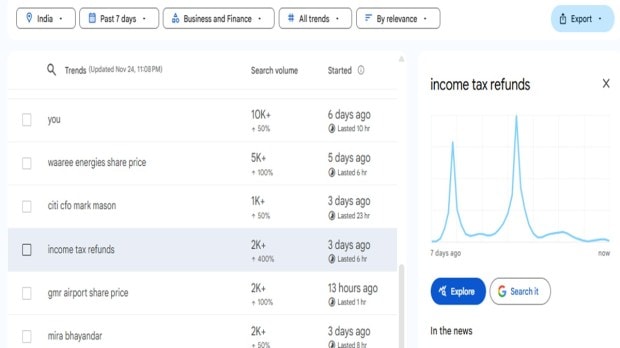

Income Tax Refunds: Income tax refunds were among the most searched terms in India over the last week. According to Google Trends, people extensively searched for questions like refund delay, income tax refunds, and “when will I receive my income tax refund?” A key reason for this is CBDT Chairman Ravi Agarwal’s recent statement, in which he stated that the department is conducting a detailed investigation into some high-value and red-flagged refund claims. This investigation is causing a temporary delay in the refund process.

Aggarwal clearly stated that all valid refunds will be issued by December. However, public concerns have not been allayed, as “Income Tax Refunds” continues to trend on Google Trends.

81.8 million ITRs filed, but 9.2 million returns still pending processing

According to government data available on the Income Tax Department’s portal: Over 81.8 million ITRs filed, 78.7 million returns verified, but only 69.5 million of these have been processed.

This means that over 92 million ITRs are currently pending processing, and refund delays are inevitable.

The CBDT Chief stated that returns where incorrect deductions have been claimed or claims are suspicious have been placed under extra scrutiny. The department has also advised some taxpayers to file revised returns.

Low-value refunds being issued

Ravi Agarwal said that small and low-value refunds are being issued. However, verification of high-value claims is taking time to prevent erroneous refunds.

He also reported that refunds issued from April 1 to November 10 declined by approximately 18% — only Rs 2.42 lakh crore in refunds were issued. Even after TDS rate rationalization, refund claims declined, reducing total refund outgo.

Department shows progress to reduce litigation

The CBDT Chairman explained that in previous years, factors like COVID had increased the backlog of tax appeals. However, this year, appellate authorities are working “overtime,” and so far, 40% more appeals have been resolved compared to last year. This means the department is rapidly clearing the pendency.

Why is ‘Income Tax Refunds’ trending on Google Trends?

Words like ‘ITR refund delay’, ‘When will the refund come?’, and ‘income tax refunds’ were among the top queries. This indicates that millions of people across the country are facing a backlog of refunds, creating growing uncertainty.

How to check income tax refund status?

Taxpayers can easily check their income tax refund status in two ways:

- From the Income Tax Portal

-Log in to http://www.incometax.gov.in

-Go to ‘e-File’

-Go to ‘Income Tax Returns’ → ‘View Filed Returns’

-Here you will see ‘Refund Status’.

- From the NSDL (TIN) Portal

-Go to https://tin.tin.nsdl.com/oltas/refund-status

-Enter PAN

-Select Assessment Year

-Fill the captcha and submit.

This will tell you whether the refund is processed, sent, or still in processing.

What is a belated ITR and what is the due date?

If you didn’t file your ITR by the due date (16 September 2025), you can file it as a belated return.

Last date for filing a belated return

31 December 2025

Penalty on belated return

Filing a belated return requires a late fee of Rs 5,000.

If your taxable income is less than Rs 5 lakh, the penalty is Rs 1,000.

Limitations on belated return

-Refunds may be delayed

-Losses (such as capital losses) cannot be carried forward

-Scrutiny risk increases slightly

-Therefore, experts always advise filing a belated return only when necessary.

Summing up…

There remains both concern and curiosity about income tax refunds. High-value refunds are under scrutiny, but the department has assured that legitimate refunds will be issued by December. Google Trends clearly shows that this issue is gaining national attention, and millions of taxpayers are still waiting for their refunds.