The Ministry of Housing & Urban Affairs has extended the Credit Linked Subsidy Scheme (CLSS) for middle income group (MIG) Scheme by another 12 months till March 31, 2020. Launched on December 31, 2016, the CLSS for MIG scheme covered beneficiaries of MIG seeking housing loans for acquisition/ construction of houses (including re-purchase) from banks, Housing Finance Companies and other such notified institutions.

The scheme covers two income segments in the MIG viz. Rs 6,00,001 to Rs 12,00,000 per annum for MIG-I and Rs 12,00,001 to Rs 18,00,000 per annum for MIG-II. In the MIG-I, an interest subsidy of 4 per cent has been provided for loan amounts up to Rs 9 lakh, while in MIG-II, an interest subsidy of 3 per cent has been provided for loan amount of Rs 12 lakh. Loans above Rs 9 lakh and Rs 12 lakh for MIG-I and MIG-II respectively will be at non-subsidised rates. The interest subsidy will be calculated at 9 per cent net present value (NPV) over a maximum loan tenure of 20 years or the actual tenure, whichever is lesser.

The scheme was originally launched to support acquisition/construction of house (including re-purchase) of 90 square meters and 110 square meters carpet area as per income eligibility. The Dwelling unit carpet area was initially revised to ‘up to 120 Sq.m’ and up to ‘150 Sq.m’ for MIG I and MIG II respectively in November, 2017 and further enhanced to ‘up to 160 Sq.m’ and ‘up to 200 Sq.m’ for MIG I and MIG II respectively in June, 2018.

A beneficiary family will comprise husband, wife, unmarried sons and/or unmarried daughters, while an adult earning member (irrespective of marital status) can be treated as a separate household.

To become eligible for the scheme, a beneficiary family should not own a pucca house (an all weather dwelling unit) either in his/her name or in the name of any member of his/her family in any part of India. In case of married couple, either of the spouses or both together in joint ownership will be eligible for a single house, subject to income eligibility of the household under the scheme. Moreover, the beneficiary family should not have availed of central assistance under any housing scheme from Government of India.

CLSS as a scheme has been performing tremendously well and as on December 30, 2018, total 93,007 beneficiaries have already received Rs 1,960.45 crore of subsidy.

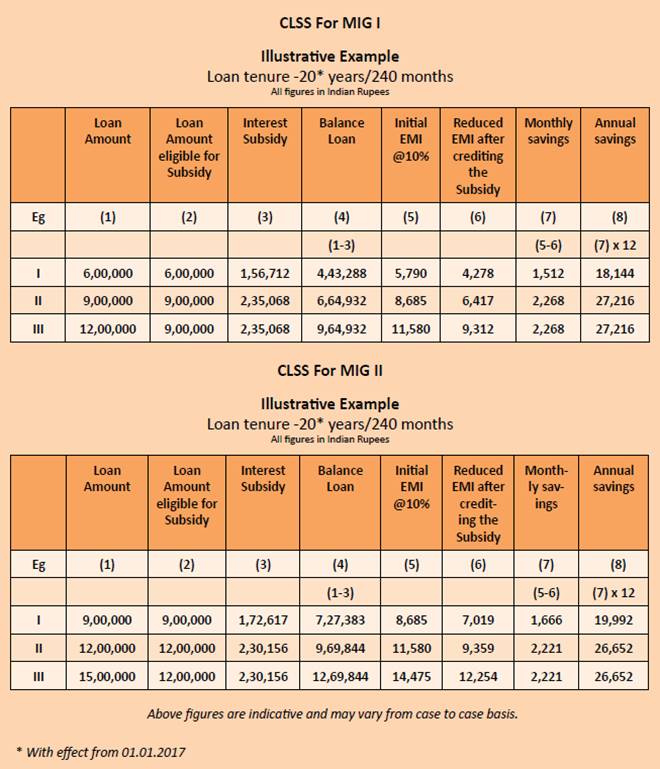

Following tables show how much you may save annually due to reduced EMI on different amounts of loans: