In my first two articles for this column, Global India Insights, I discussed a global reset—how global investments are moving out of the United States due to Trump’s unpredictability—and how India could attract an incremental ~US$200 billion as a result.

In my last piece, I put the US$ 200 billion in context of what foreign investors have already invested in India and made a provocative point that Foreign Investors are under-invested in India by a trillion dollars.

It shows the scale of the India opportunity and how foreign investors have missed out on allocating to India.

One major reason for that of course remains the fact that India is an emerging market. Most developed world investors have little to no allocation to emerging markets. Hence, even India does not receive the kind of foreign investments it deserves.

Investments in Emerging markets and hence India is perceived to be ‘risky.’ This column is an effort to change that perception, and I will argue in future pieces on why India deserves a standalone investment from global investors.

It is understood that with opportunity also come risks. India has been and remains amongst the best long-term opportunities. However, it matters on when, how, where in India you invest.

In this piece, I would opine that, of the investments that the foreign investors have already made in India, a substantial portion of that is ‘rolling the dice.’

Let me explain.

Foreign Institutional Investors (FII) India public market bet pays off

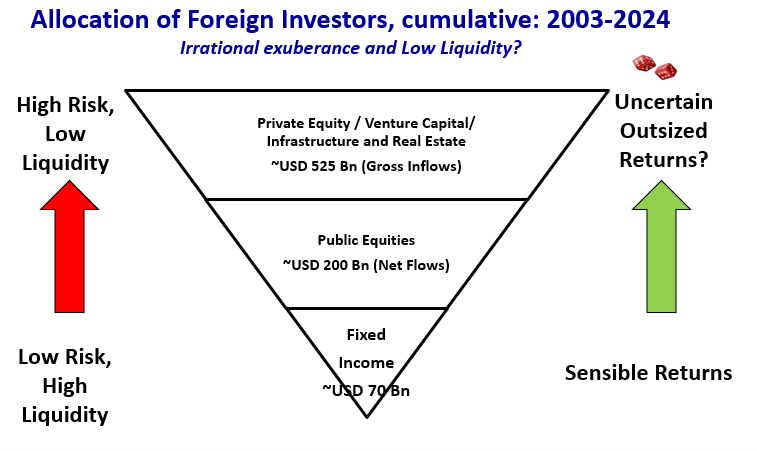

Since 2003, foreign investors have invested ~USD 200 billion (in net terms) in the Indian public equity market. The market value of that investments is ~USD 850 billion as of June 2025. As the growth in market value suggests and as is apparent in any global comparative chart of public equity markets, Indian public equities have been an excellent long-term asset class to invest in.

(source: NSDL FPI Monitor, IVCA Trend reports, RBI, Data is Annual Calendar year for 2003-2024)

In the same period (2003-2024), investments by foreign investors in Private markets in gross inflows have been ~USD 530 billion. Adjusted for exits, the cumulative investments are ~USD 320 billion. It is exceedingly difficult to estimate the current market value of these investments.

Private markets would include investments categorised as Private Equity, Venture Capital, Real Estate, and Infrastructure.

I source this data over the years from various IVCA reports on trends in private equity and venture capital industry. Some of the flows categorised may have been from global MNCs investing into India private and real assets. However, a significant portion of these investments, are still made directly by large asset owner investors like Sovereign wealth funds, Pension Funds, Insurance companies, Endowments and Foundations and/or by Global Private Equity and real asset investors like Blackrock, Apollo, KKR, Brookfield etc, and India focussed private market investing funds, who raise money from these large asset owner investors.

India is a large opportunity, and India indeed needs a lot of capital in the private markets to help build and scale businesses, create the physical infrastructure, and provide the commercial and residential real estate to fulfil the needs of a growing economy.

Some of the investments made by these financial investors in private assets would have been successful and made them the required rate of return.

Foreign Investors are rolling the dice to make bigger returns

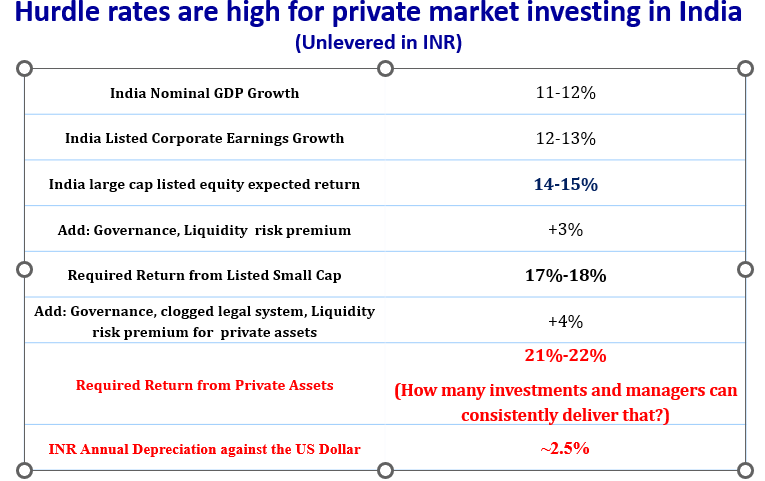

However, look at the table below. It is an illustration on the expected rate of return from India investments. Listed, Liquid public equities with a governance screen, has managed to deliver ~15% returns over the long-term. As you take on more risks of liquidity, governance, you would expect to earn more return.

When you invest in private markets, which are illiquid, the need to demand a higher expected rate of return increases given the increased risk of regulatory, political, and corporate governance risk. The hurdle rate of return then required for a sensible allocation is high.

Given this, a markedly higher allocation by foreign investors into private assets than public markets suggests that they are indeed ‘rolling the dice’ in the hope of higher returns.

Disclaimer:

Note: The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Arvind Chari is a Chief Investment Strategist and has been with Quantum Advisors India group since 2004. Arvind has over 20 years of experience in long-term India investing across asset classes. Arvind is a thought leader and guides global investors on their India allocation.

The views and opinions expressed in this article are his personal views.

You can follow Arvind on LinkedIN: https://www.linkedin.com/in/arvind-chari-879200aa/

His X handle is @arrychary