Finance Minister Piyush Goyal has made limited changes in personal income tax segment and has proposed to give total tax rebate on taxable income up to Rs 5 lakh and increased the standard deduction on salary income from Rs 40,000 to Rs 50,000, while keeping the current income tax slabs and deduction limits unchanged.

While the tax rebate will give relief to people in lower and lower middle income group, there is little to cheer for people having taxable income over Rs 5 lakh including senior citizens. However, increase in standard deduction for salaried people would provide marginal extra benefit, apart from the relief over tax rebate.

What is your post-Budget 2019 income tax outgo? Calculate now

If a salaried person fully utilise the 80C benefit of Rs 1,50,000, he/she don’t have to pay any tax on income up to Rs 7 lakh as the salary income would be reduced to Rs 5 lakh after the 80C deduction, coupled with the standard deduction of Rs 50,000. The tax-free salary amount would be even higher, if the person also enjoys benefits of health insurance u/s 80D, NPS contributions u/s 80CCD (1B) and the benefit of deductions on interest paid on home loan on buying a house.

Here are some tax relief calculations on income exceeding the taxable income eligible for tax rebate.

Calculation for salary income of Rs 7 lakh

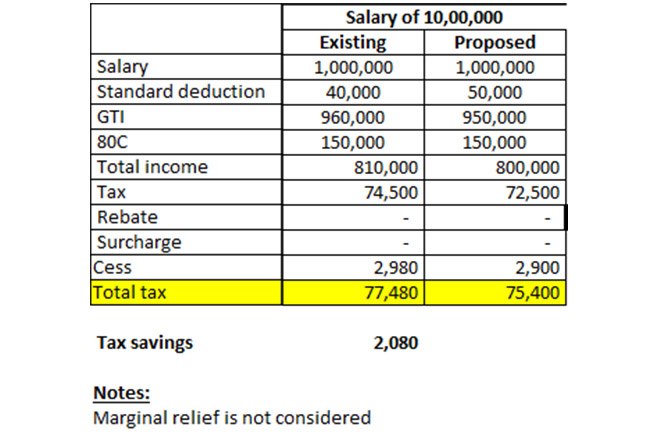

Calculation for salary income of Rs 10 lakh

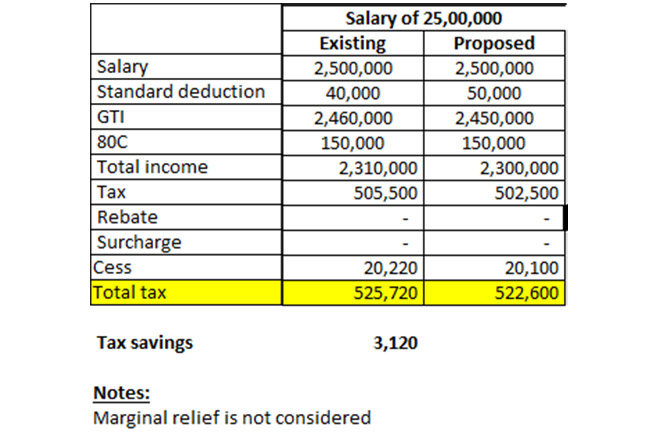

Calculation for salary income of Rs 25 lakh

Calculation for salary income of Rs 55 lakh

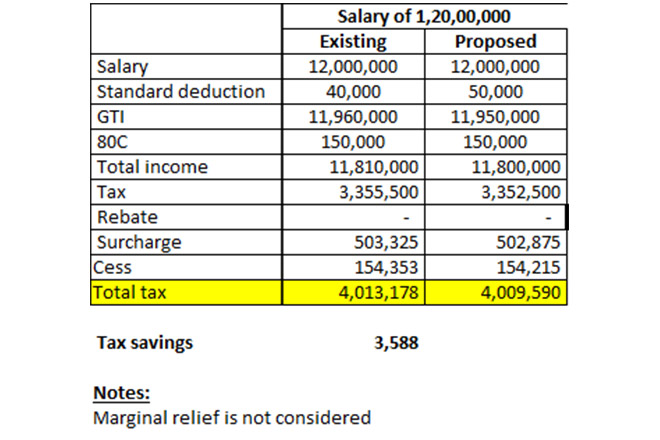

Calculation for salary income of Rs 1.2 crore

BUDGET 2019 INCOME TAX CALCULATOR