Yes Bank has focused on reducing asset quality challenges by accelerating provisions and cleaning up its balance sheet. We expect its gross impaired loans to fall to 9% by end-F23 from a peak of 22% in Mar-20. Further, unlike the previous cycle, the bank has focused on increasing the share of retail on both sides of the balance sheet. Indeed, the share of CASA + retail deposits currently amounts to 48% of total funding. On assets, retail/SME loans have increased to 66% vs. 44% in Mar-20.

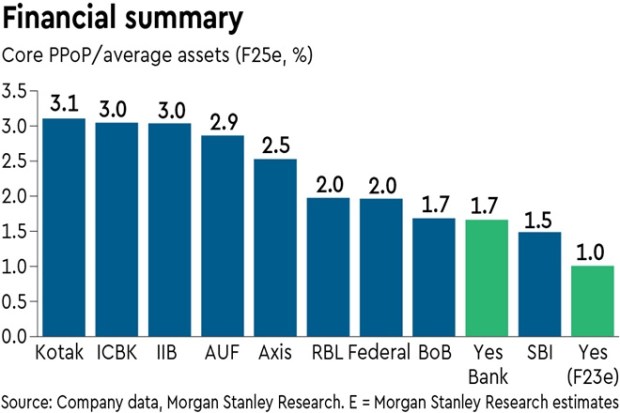

Having cleaned its balance sheet, we expect Yes Bank’s loan growth and margin profile to improve as the macro recovery gains pace. We expect loan growth to accelerate to a 20% CAGR in F23-25, vs. 15% in F23 . This, along with an improving share of retail/SME loans should help offset rising funding costs and drive higher margins to 3.2% by F25, vs. 2.6% in F23. Overall, we expect a core PPoP CAGR of >50% in F23-25, which, coupled with benign credit costs, will drive RoA improvement to 1% by F25, vs. an estimated 0.4% in F23.

Valuations, however, at 1.6x F24 book, are already pricing this in, we believe. More importantly, we see limited improvement beyond 1% RoA given high competitive intensity in retail deposits as well as assets.

Our PT implies 1.3x Dec-24 P/BV, which we think is fair in the context of 10% F25 RoE. Current valuations at 1.6x F24 book are already pricing in strong earnings over next few years. Much stronger execution on funding and/or high margin retail assets could lead us to revisit our thesis.