Despite global market volatility in 2025, signs of recovery are emerging, particularly in the fertiliser sector. Stocks like FACT and Paradeep Phosphates, after significant declines, are showing bullish potential. With the monsoon season approaching, these stocks could offer strong growth opportunities as demand for fertilisers rises.

The global and domestic markets have experienced significant volatility this year. Since the start of 2025, the India VIX has surged by 120%, and the S&P VIX has risen by 140%, leading to substantial price corrections across indices and stocks. However, with broader market sentiment improving and price levels stabilising, certain sectors and stocks show signs of a potential turnaround. With the monsoon season approaching, fertilizer stocks could be worth considering for investors.

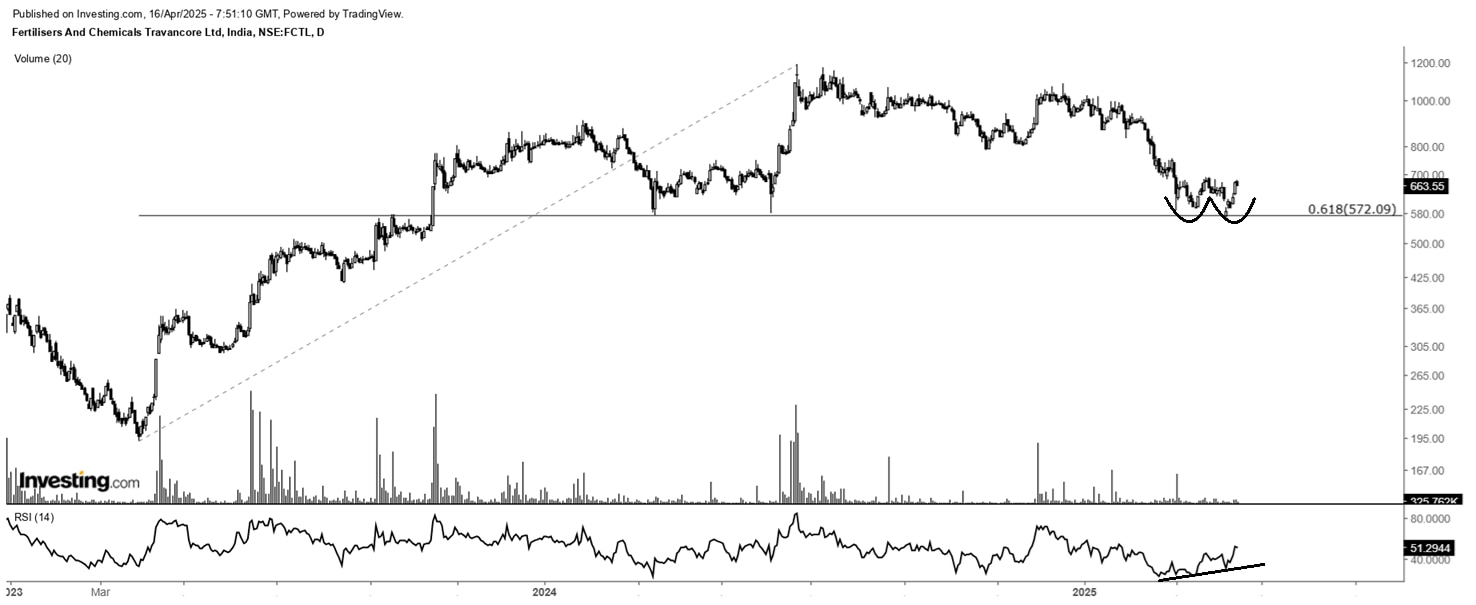

FACT: A Potential Bullish Reversal After a 52% Decline

FACT has faced a sharp 52% decline from its peak in June 2024, with its price dropping from ₹1,187 to ₹565. Despite this, recent price action suggests a potential trend reversal, as the stock has shown a strong rebound from these lower levels. This could indicate renewed investor interest and the beginning of a bullish phase.

Key Technical Indicators Supporting FACT’s Reversal:

- Fibonacci Retracement: Following the deep correction, the stock has recently found support at the 50% retracement level, a classic signal of bullish sentiment and trend reversal.

- Double Bottom Pattern Breakout: The price is currently forming a double bottom bullish reversal pattern, which suggests a shift towards an uptrend.

- Volume Dry-out: During the recent price correction, we observed that volumes were not increasing, indicating a potential reversal in trend.

- Strengthening RSI Momentum: The 14-period Relative Strength Index (RSI) has crossed above the neutral 50 mark, showing bullish divergence and suggesting further upside potential.

Outlook for FACT

FACT delivered an impressive 494% return from April 2023 to June 2024 but has since entered a corrective phase, with its price dropping from ₹1,187 to ₹565. However, early signs of recovery are emerging. The stock has formed a significant bullish reversal with a double bottom pattern and is currently trading above a key Fibonacci level. Additionally, the 14-period RSI shows bullish divergence, suggesting that FACT may be poised for an upward movement.

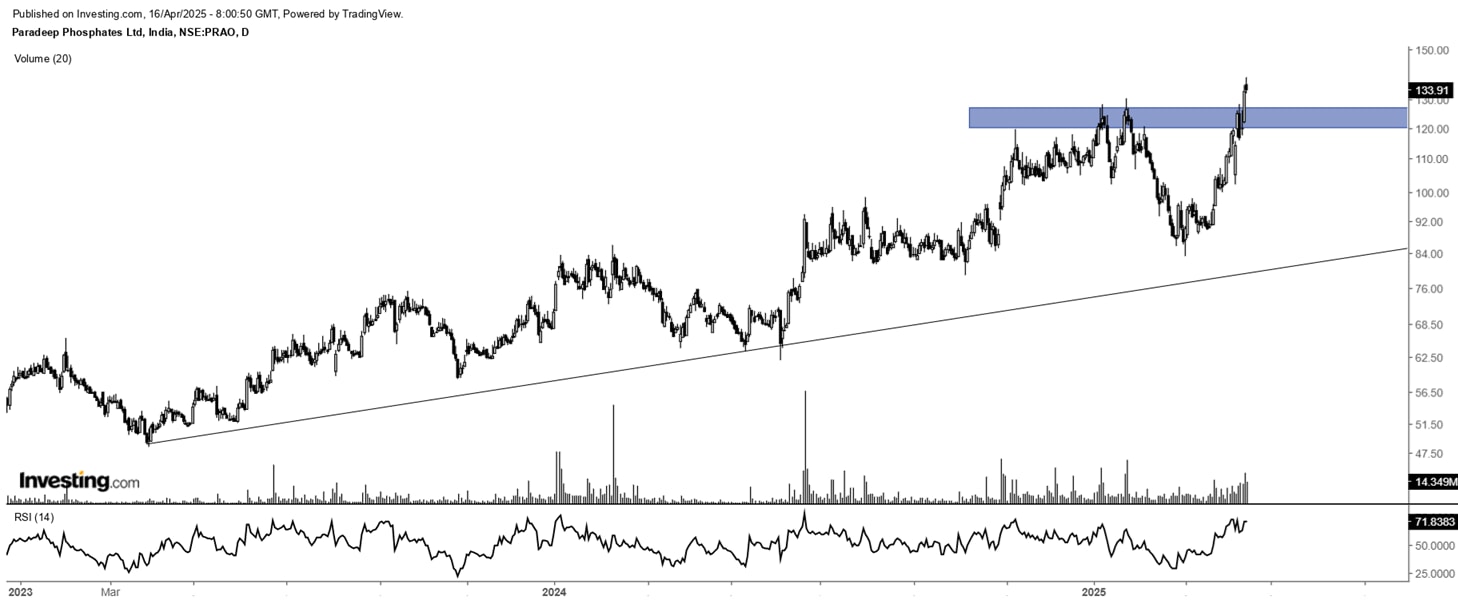

Paradeep Phosphates: Bullish Reversal in Play

Paradeep Phosphates experienced a 36% decline from January 2025 to March 2025. However, the stock has since bounced back, showing signs of a potential reversal. Bullish signals are emerging on the daily chart, indicating the possibility of the previous trend resuming, suggesting that a recovery phase may be underway.

Key Technical Indicators Supporting Paradeep Phosphates’ Reversal:

- Round Bottom Breakout: Paradeep has broken out from the classic rounding bottom pattern, reinforcing the potential for the previous trend to continue.

- Volume Surge Confirming the Breakout: The simultaneous rise in price and volume signals strong participation, validating the bullish momentum.

- Strengthening RSI Momentum: The 14-period RSI has moved above the 60 level, indicating bullish divergence and pointing to further upside potential.

Outlook for Paradeep Phosphates

Paradeep Phosphates delivered an impressive 169% return from March 2023 to January 2025. However, the stock has recently faced significant pressure, dropping from ₹130 to ₹84. Despite this correction, technical indicators are showing early signs of a potential recovery. The breakout above a key bullish pattern, coupled with rising volumes and a strengthening RSI, suggests that Paradeep could be positioned for a potential upside move.

Final Take

Both FACT and Paradeep Phosphates display strong technical signals pointing to a potential bullish trend in the fertiliser sector. These stocks are forming bullish chart patterns, exhibiting strengthening RSI readings, and showing key breakouts, all of which indicate increasing momentum and suggest a positive outlook.

With the monsoon season approaching, fertiliser stocks will likely benefit from increased demand due to fertilisers’ critical role in the agricultural cycle. This, combined with the technical indicators, makes these stocks an interesting opportunity for investors looking to capitalise on seasonal factors and technical momentum.

Disclaimer

Note: The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

As per SEBI guidelines, the writer and his dependents may or may not hold the stocks/commodities/cryptos/any other assets discussed here. However, clients of Jainam Broking Limited may or may not own these securities.

Kiran Jani has over 15 years of experience as a trader and technical analyst in India’s financial markets. He is a well-known face on the business channels as Market Experts and has worked with Asit C Mehta, Kotak Commodities, and Axis Securities. Presently, he is Head of the Technical and Derivative Research Desk at Jainam Broking Limited.

Disclosure: The writer and his dependents do not hold the stocks discussed here. However, clients of Jainam Broking Limited may or may not own these securities.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives and resources, and only after consulting such independent advisors if necessary.