When a stock price remains high, it can deter smaller i.e. retail investors from buying shares. A stock split reduces the price per share by increasing the number of shares outstanding. This makes the stock seem more affordable to a wider investor base.

By increasing the number of shares available at a lower price, stock splits generally lead to higher trading volumes. This enhanced liquidity makes it easier for investors to buy and sell shares, improving market efficiency and narrowing bid-ask spreads.

One IT company that has announced this investor friendly stock split measure recently is Coforge.

Let’s take a look at some of the details:

Key Details

- Stock split ratio: 1 share of Rs 10 face value split into 5 shares of Rs 2 each

- Total shares outstanding post-split: 33.43 crore shares

- Purpose: Improve liquidity and affordability for investors

- Record date: June 4, 2025

- Completion Expected within three months from announcement.

Recent Development

To Acquire Rythmos Inc (US-based)

Coforge is acquiring 100% of Rythmos Inc., which operates in the US and India (Hyderabad and Coimbatore).

The deal is an all-cash transaction valued at a maximum of US$ 48.7 million (m). This is about Rs 4.24 billion (bn).

Coforge will pay an upfront amount of US$ 30 m. Rythmos specialises in big data, cloud, and enterprise AI/ML solutions, particularly serving the airlines industry, which aligns with Coforge’s strategy to enhance its data practice and cloud engineering capabilities.

Acquires TMLabs Pty Ltd (Australia-based)

Coforge’s Australian subsidiary has acquired TMLabs Pty for an initial payment of AUD 20 m (around Rs 1.09 bn).

TMLabs is a cloud software consultancy focused on implementing the ServiceNow platform and operates primarily in Australia.

The acquisition was completed in April 2025.

Signs Deal with Sabre Corporation

Coforge has signed a landmark US$ 1.56 bn multi-year deal with Sabre Corporation, a leading US-based travel technology company, to extend and deepen their partnership over the next 13 years.

Under this agreement, Coforge will play a key role in accelerating Sabre’s product delivery and innovation roadmap, with a strong focus on developing AI-enabled travel technology solutions.

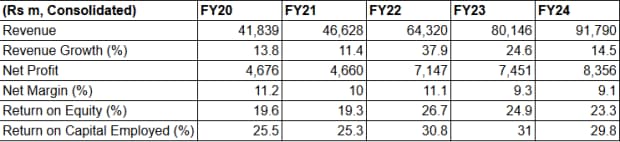

A Close Look at the Financials

Coforge has grown consistently over the last many years, with average 5-year return on equity (ROE) at 22.8%. The 5-year average return on capital employed (ROCE) has been 28.5%.

The company also performed well for the fourth quarter ending March 2025.

Revenue was Rs 34.09 bn, up 47.1% year-on-year (YoY) and 4.7% quarter-on-quarter (QoQ) in rupee terms. In constant currency terms, revenue grew 43.8% YoY and 3.4% QoQ.

The net profit in Q4 2025 was Rs 2.61 bn, up 16.5% YoY and up 21% QoQ.

What Next?

Coforge’s 12-month signed order book is up 47.7% YoY, with a total order book of US$ 3.5 bn, setting the stage nicely for FY26.

The company secured five large deals in Q4 FY25 across North America, the UK, and the APAC region.

Coforge is leveraging artificial intelligence, particularly generative AI (GenAI), to drive revenue growth. AI-based solutions are featured in large deals, improving productivity in legacy modernisation programs.

The company will put a strategy in place to expand technological offerings and its geographic footprint with the help of the recent acquisitions.

Both acquisitions are expected to enhance Coforge’s position in cloud services, AI, and data engineering, particularly in the travel and airline sectors.

The US$ 1.56 bn multi-year deal with Sabre Corporation, has also strengthened its presence in the travel vertical.

How Shares of Coforge Have Performed Recently

The share price of Coforge has gained 31% in the past one month.

However, in 2025 so far, the share price is down a little over 12%. On the other hand, in the past one year, the share price has surged 83%.

The stock touched its 52-week high of Rs 10,017.95 on 30 December 2024 and its 52-week low of Rs 4,540.85 on 15 May 2024.

Coforge Share Price 1-Year

About Coforge

Formerly known as NIIT Technologies, the company is an Indian multinational information technology company based in Noida, India, and New Jersey, United States.

The company operates in 23 countries with 30 global delivery centers.

Coforge is a global digital transformation solutions provider that partners with clients to deliver innovative solutions through deep domain expertise.

It serves industries like banking and financial services, travel, transportation and hospitality, insurance, healthcare and life sciences, retail and consumer goods, and government.

The company focuses on intelligent automation, AI/ML, and cloud solutions to modernise legacy systems, enhance customer experiences, and improve operational efficiency.

It helps clients implement scalable, secure infrastructure and AI-powered analytics to drive real-time decision-making and compliance.

Investors should evaluate the company’s fundamentals, corporate governance, and valuations of the stock as key factors when conducting due diligence before making investment decisions.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must