Restaurant Brands Asia (RBA) runs one of India’s fastest growing quick service restaurant chains – Burger King. Even as Burger King has become ubiquitous, with new stores cropping up every so often, RBA’s stock price has left investors hanging out to dry.

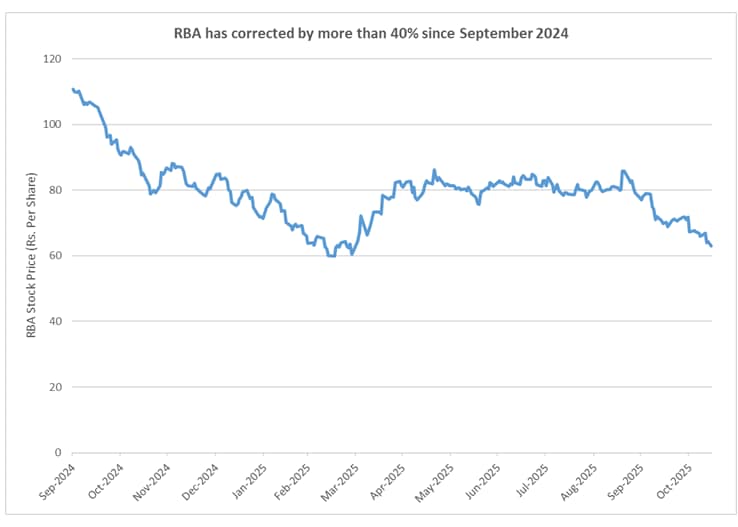

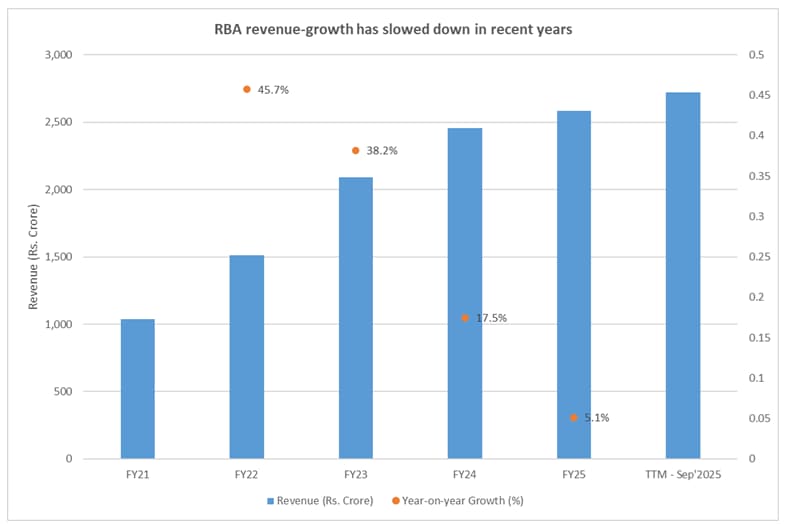

After meandering around its listing price for years, RBA’s stock has corrected by more than 40% since September 2024. Sure, growth has slowed down over the years, on a rising base – year-on-year revenue-growth has mellowed from 45.7% in FY21 to 5.1% in FY25.

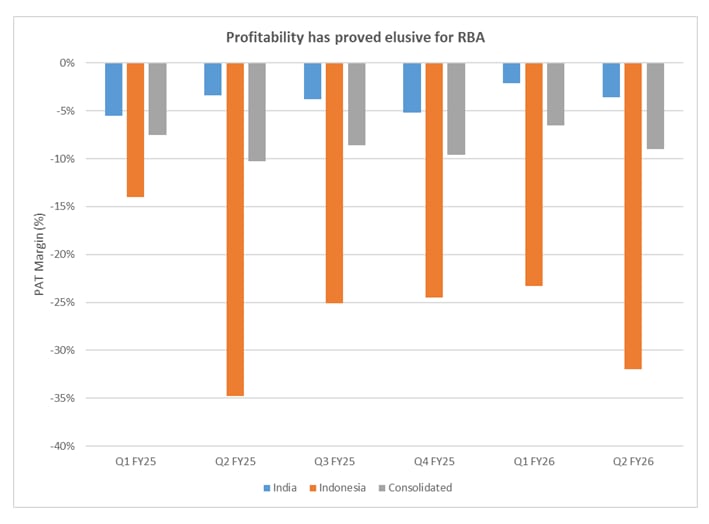

But what had spooked investors was the sharp expansion in losses in the September 2024 quarter – from Rs 49 to Rs 66 crore. You see, while India’s Burger King is RBA’s mainstay segment, it also operates stores in Indonesia. In fact, a fifth of the company’s revenues come from Indonesia, and the segment has been struggling in a tough geopolitical and competitive landscape.

A year has gone by since then, but the situation seems to have worsened. With Rs 43 crore loss in the Indonesia business and a 75% quarter-on-quarter expansion of loss in the India business to Rs 20 crore in Q2FY26, consolidated loss still stands above Rs 60 crore. Is the bottom here yet, or should investors brace for more pain?

Pain persists in the Indonesia business

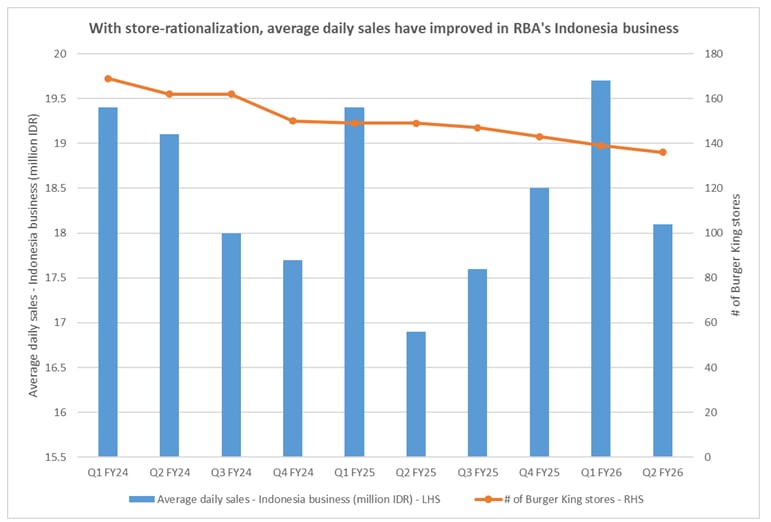

RBA’s Indonesia business has been a persistent drag. Even in the latest reported quarter, higher promotional expenditure plunged the segment back into losses. Compared to Rs 0.20 crore restaurant operating margin (ROM) reported in Q1FY26, the Indonesia business reported an ROM loss of Rs 6.3 crore in Q2FY26. Of course, thanks to rationalization of stores in the region, average daily sales (ADS) has picked up pace in recent quarters.

But the management has indicated that almost all non-performing stores in Indonesia have now been shut down. This is to say that growth hereon will be critically dependent on a stabilized geopolitical environment in the region. Following around two weeks of disruption towards the end of September, October was thankfully more stable.

RBA also runs Popeye stores in Indonesia, which have been struggling against intense competition from local as well as global players in the region. The management is likely to spend on marketing to improve brand-awareness, but is expected to otherwise prioritize profitability and refrain from any store-expansion.

India business offers hope

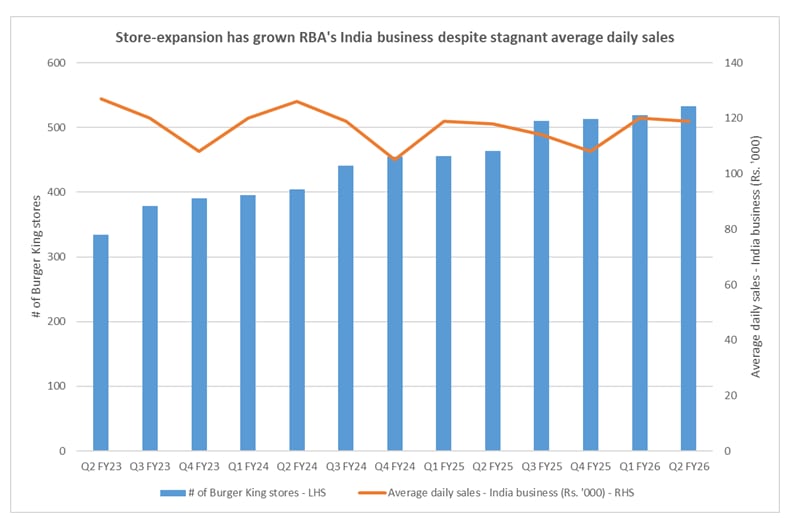

Burger King has been doing well in India, primarily owing to store-expansion. In the September quarter, revenue from its India business came in at Rs 570 crore, a 16% year-on-year increase on a 15% expansion in footprint to 533 stores. Same-store-sales-growth (SSSG) was 2.8%, and ADS grew by only 0.8% as newer stores dragged down the metric. The management remains committed to add 60-80 stores every year, and meet its target of 800 restaurants by FY29.

The India business is also expected to benefit from GST 2.0, to capitalize on which, the management has invested towards menu-innovation. This has already borne fruit in October, and is expected to continue throughout Q3 on the back of winter holidays.

Cost conundrum

At its heart, Burger King is a value-focused brand. While it has premium offerings as well, it has seen customers moving towards value ranges in recent quarters. So, even as the company struggles with stubborn losses, it does not have the luxury of marking up the prices of its products to support margins.

Of course, a higher-margin menu-mix and supply-chain efficiencies can help. And they have. Gross margin for its India business expanded by 80 bps year-on-year to 68%. Even that for its Indonesia business picked up by 110 bps to 57%. The management targets a 70% overall gross-margin by FY29.

That said, manpower costs and other overheads have resulted in shrinking EBITDA margins. The company’s strategy to add interns and college graduates for lobby service in restaurants has added to its manpower costs. Labor costs increased more than 18% in Q2FY26 over the same period last year, and shaved 70 bps off the EBITDA margin which came in at 13.6% in Q2FY26 against 14.2% in Q2FY25.

Meanwhile, interest as a percentage of sales has also increased, due to debt-funded store-expansion. Consolidated debt-to-equity has grown from 0.8x in FY22 to 2x in FY25. Result? Despite expansion in gross-margin and higher other-income, India business’ loss expanded from Rs 16.6 crore to Rs 20.2 crore year-on-year, taking its PAT-margin from -2.1% to -3.6%. On a consolidated level, aggravated by the Indonesia business, loss ballooned to Rs 63.3 crore and PAT margin to -9%.

Where do we go from here?

Revenue-growth is all but assured, provided the management sticks to its store-expansion glidepath. Sure, year-on-year growth won’t touch the highs of 45% seen around 2021. But thanks to an expanding urban middle-class, growth is expected to remain healthy. Growing digital penetration is also expected to push growth along, and Burger King has doubled down on digitization to capitalize on the tailwind. With exclusive app-only offers, 91% of dine-in orders at Burger King are already being placed through self-ordering kiosks and the Burger King app.

Profitability is a harder question to answer. As older stores mature and their ADS accelerates, the company’s margin-profile should improve. Cost-control initiatives and wider distribution are likely to help in the meanwhile. The company has also gone for aggressive expansion in its café-style stores – BK Café. Number of BK Cafes have almost tripled to 507 stores in two years, and their growth is expected to be margin-accretive.

On the flip side, however, the Indonesia business remains prone to geopolitical and competitive strain. Cost-control initiatives are expected to save Rs 20 crore in FY26. But with store-closures almost completed, and marketing spends on the rise, profitability in the Indonesia business is not expected any time soon.

In India, the delivery channel has dragged down profitability. Q2FY26 saw delivery revenues grow 16%, while profits grew by just about 1%. The company has taken a two-pronged approach to fix this. While it is working with food aggregators to improve delivery efficiency, it has continued to push for higher dine-in traffic through focused value offers. Still, analysts do not expect consolidated PAT-breakeven until FY28.

Of course, following steep price-correction, the stock’s valuation at 7.7x EV/EBITDA based on Motilal Oswal’s FY27 estimates, offers comfort. A possible divestment of the Indonesia business can also trigger an upward rerating.

Disclaimer:

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ananya Roy is the founder of Credibull Capital, a SEBI-registered investment adviser. An alumnus of NIT, IIM, and a CFA charter-holder, she pens her views on the economy and stock markets.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article. Clients of Credibull Capital may or may not own these securities.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.