The Indian stock market rallied sharply today. The benchmark indices, Nifty and Sensex ended near record highs.

Positive news about an interest rate cut by the US Fed in December along with the proposed peace plan for Ukraine, gave a big boost to market sentiment. Of course, the market just needed a trigger to go higher. The real reason for the bullishness on Dalal Street is the relentless flow of funds from domestic investors, mostly retail, into the market.

The bullish sentiment is unlikely to end soon as there is no big negative trigger on the horizon that could derail the market momentum. Now, this doesn’t mean the market cannot fall. But it does meant that the broad direction of the

market remains up. Does this mean you should change your investing strategy?

No.

Investors should continue to look for fundamentally strong stocks trading at reasonable valuations. In the absence of such opportunities, it’s best to sit on cash rather than buying overpriced stocks.

But there is one thing that investors should keep in mind. As the market rises higher, stocks will get steadily overpriced. Soon enough, entire sectors will become overpriced. This will increase the overall risk of investing, even if investors do their due diligence.

What is the solution to this?

Defensive stocks.

What are defensive stocks?

Defensive stocks are the stock of companies that are considered non-cyclical. In other words, these companies don’t suffer from big declines in revenue during an economic downturn because the products and services they provide remain in demand during such times. These companies tend to have stable revenues and profits. They may not grow fast but their

financials are usually solid.

Thus, the stock market perceives these stocks as relatively less risky. Most of these stocks belong to sectors like pharmaceuticals, public utilities, healthcare, and FMCG. In India, these stocks are widely held as a part of many investors’ portfolios. Investors accept the potentially lower capital appreciation offered by these stocks in exchange for portfolio stability, higher dividends, and the likelihood of these stocks falling less than the market in economic

downturns.

Let’s look at three such stocks that can be a part of your 2026 watchlist…

#1 Hindustan Unilever (HUL)

Hindustan Unilever (HUL) is a subsidiary of Unilever, one of the world’s leading suppliers of food, home care, personal care, and refreshment products. The company has 50-plus brands under its roof spanning 15 categories – foods, beverages, cleaning agents, personal care products, water purifiers, and other fast-moving consumer goods.

It has one of India’s most extensive distribution networks comprising over 4,500 distributors and 8 million (m) retail outlets.

HUL holds either the top spot or a strong second position in most categories it operates. Its portfolio targets various market segments, including premium, mid-price, and economy. This sets it apart from competitors focused solely on premium or mass markets. The company’s products are present in 9 out of 10 Indian households. Forbes has rated HUL as the

most innovative companies in India and #8 globally. It’s a zero debt company with rock solid long-term fundamentals.

HUL Share Price – 1 Year

In the short term, the company is benefiting from falling commodity prices, which will support margins, as well as a good monsoon, and the recent tax cuts that have provided a boost to consumption.

The company is also profiting from good rural demand.

In the long term, the company is well placed to dominate the FMCG market in India despite the rising competition. A combination of strong brands, good cost control, a high quality management, will sure long term success.

The company has a long history of rewarding its shareholders with hefty dividends.

#2 Power Grid Corporation of India

Established in 1992, Power Grid is among the biggest public-sector undertakings (PSUs) in India. Despite its modest origins, the company has expanded rapidly to meet the country’s insatiable demand for electricity.

By carrying electricity through its nationwide grid network, the company acts as a connecting factor between power-generating companies and power-trading companies. When it comes to getting renewable energy to the home of every Indian, it has a pivotal role to play in the coming decades.

The company also ventured into EV charging infrastructure and is setting up charging stations across the country.

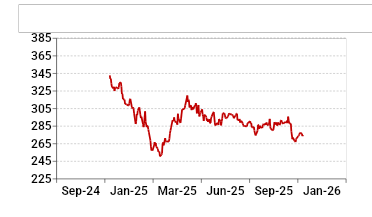

Power Grid Share Price – 1 Year

Going forward, the company plans significant investments in expanding the transmission network with a focus on interstate and intrastate projects. This aims to connect renewable energy sources, improve grid stability, and facilitate electricity trading.

Along with having a monopoly status, the company has rewarded its shareholders with hefty dividends over the years.

#3 Dr Reddy’s Laboratories

Dr Reddy’s Laboratories is an Indian multinational pharmaceutical company based in Hyderabad. It manufactures and markets a wide range of pharmaceuticals in India and overseas. The company’s expertise spans several therapeutic areas, including oncology, gastroenterology, and cardiovascular treatments.

Dr Reddy’s expanded its capabilities with the establishment of a new oncology API facility in Vizag. This new facility will support the company’s growing presence in the oncology sector. Additionally, the company has made significant progress in developing biosimilars and complex generics, particularly in its biologics API division.

Apart from growing the core business of generics, the company invested in businesses of the future under the three spaces of consumer health, digital therapeutics, and access to novel molecules.

Dr Reddy’s Labs Share Price – 1 Year

Dr Reddy’s diversified global presence, capability, and strong balance sheet make it a partner of choice for various business partners.

The company’s strong balance sheet provides financial flexibility to implement all its plans. The business generates strong cash flows that have grown inline with profits over the years. This has enabled the management to pay out hefty dividends.

The company is well placed to grow at a steady rate over the long term.

Should you invest in defensive stocks?

Defensive stocks can be a good option for investors who prioritise stability over growth. Investors who would like their portfolio to experience relatively low volatility are the ones interested in these stocks.

There is also the added advantage of regular cash flow in the form of dividends from these stocks. Dividends from defensive stocks tend to be significantly higher than dividends from growth stocks. Thus, investors close to or in their retirement may also find these stocks appealing.

However, there is no absolutely right or wrong way to invest. As long as you are looking for fundamentally strong stocks and buy them only when they are trading at reasonable valuations, you should do well in the stock market in the long term.

This principle applies to both high growth stocks as well as defensive stocks.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary