By Brijesh Bhatia

The “Year of the Snake” is a term derived from the Chinese zodiac, which plays a significant role in the lives of many individuals, especially in East Asia. And as we will learn today, it also appears to have some corelation, if not causation, with how stock markets behave across the world.

But first…

What is the Year of the Snake?

The Chinese zodiac consists of a 12-year cycle, with each year associated with an animal sign. These signs are Rat, Ox, Tiger, Rabbit, Dragon, Snake, Horse, Goat, Monkey, Rooster, Dog, and Pig. Each sign is believed to influence the personality traits, fortunes, and life paths of people born under that sign. In the Chinese zodiac, the Year of the Snake comes once every 12 years and is considered the sixth sign in the cycle.

The Snake is often associated with wisdom, charm, and elegance but also with caution, secrecy, and introspection. It is a year that calls for strategic thinking, taking calculated risks, and being alert to opportunities and dangers. The snake’s energy is believed to foster growth, but only if individuals and entities carefully navigate potential pitfalls.

The Historical Year of the Snake

Historically, the Year of the Snake has witnessed significant positive and negative events in various sectors, including politics, culture, and economics. Some years associated with the Snake sign have seen prosperity and stability, while others have been marked by volatility and uncertainty.

Key Events in Past Snake Years:

- 2013—Year of the Water Snake: This was a year of cautious optimism and significant global events. The U.S. Federal Reserve began tapering its quantitative easing program, raising concerns over global liquidity. In China, President Xi Jinping focused on economic reforms and anti-corruption measures. Geopolitical tensions, particularly over the Syrian Civil War, dominated international discussions. Despite these challenges, global stock markets showed positive performance, reflecting a year of strategic caution and gradual recovery.

- 2001—Year of the Metal Snake: During this period, the global economy faced a downturn, culminating in the aftermath of the dot-com bubble. The year ended with the September 11 terrorist attacks, which caused massive shockwaves throughout the world’s financial systems. However, some recovery started to take shape as markets began to adapt to new realities.

- 1989—Year of the Earth Snake: This year marked pivotal global economic changes. The stock markets experienced volatility, with political events such as the Tiananmen Square protests in China. While the year was challenging for specific global markets, long-term investors found potential for growth as economies gradually recovered.

- 1977 – Year of the Fire Snake: In the U.S., the 1970s were a period of economic difficulties with stagflation—high inflation and high unemployment—causing instability. The 1977 Snake year was no exception, but it laid the groundwork for policies addressing these issues in the following decades.

While each Snake year presents unique challenges and opportunities, patterns of uncertainty and volatility, followed by gradual recovery, have often been observed.

The Dow Jones and Sensex in the Year of the Snake

The stock market performance in the Year of the Snake can be heavily influenced by domestic and international factors and the general economic conditions that prevail during the year.

The Dow Jones Industrial Average (DJIA) and the Year of the Snake:

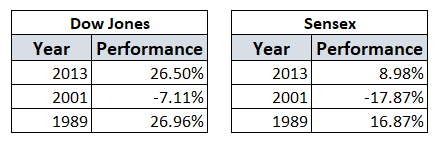

Looking at the U.S. stock market, represented by the Dow Jones Industrial Average, the Year of the Snake has shown a variety of results, reflecting broader economic conditions and global events.

- 2013 (Water Snake): The year saw a cautious economic recovery. The Federal Reserve tapered its quantitative easing program, boosting market confidence but raising concerns. The Dow Jones hit record highs while political gridlock persisted. Geopolitically, the U.S. dealt with tensions over Syria. Overall, it was a year of strategic adjustments and cautious optimism for the economy.

- 2001 (Metal Snake): As mentioned earlier, 2001 was a year marked by the dot-com bubble bursting and the tragic September 11 attacks. Despite the initial decline in the market, Dow Jones ended the year with a modest recovery as investors began to re-enter the market in the latter half. However, the overall growth was subdued compared to other years, reflecting the broader economic environment of the time.

- 1989 (Earth Snake): The year 1989 saw the Dow Jones achieving moderate growth as the U.S. economy continued its post-recession recovery from the early 1980s. However, political uncertainties, particularly in Eastern Europe and the Middle East, created volatility in global markets. Despite these concerns, the market closed the year with an overall positive performance.

Sensex and the Year of the Snake:

The Sensex, representing the Indian stock market, also experienced fluctuations based on both domestic and international factors during the Year of the Snake.

- 2013 (Water Snake): In India, the Year of the Water Snake (2013) saw economic challenges, including slow growth, high inflation, and a weakening rupee. The government implemented measures to reduce the current account deficit and attract foreign investment. Politically, the rise of the Aam Aadmi Party (AAP) reflected public demand for change. Despite volatility, the Sensex showed resilience, aided by government reforms, marking the year as one of cautious optimism and efforts toward economic stability.

- 2001 (Metal Snake): In India, political and economic reforms characterised the early 2000s, yet the global downturn impacted the market due to the tech bubble burst. The Sensex struggled during 2001 but eventually gained momentum in the following years as India continued its economic liberalisation journey.

- 1989 (Earth Snake): In 1989, the Indian economy was still under the influence of the “License Raj.” However, as the government introduced small economic reforms, the Sensex demonstrated resilience, with a steady upward trend despite global volatility.

While historical data suggests a mixed performance in the Year of the Snake for both indices, the overarching theme tends to reflect a combination of initial challenges, followed by periods of recovery and growth as markets adjust to new circumstances.

Sectors to Watch for Investment in the Year of the “Wood” Snake

The Snake year 2025 is called the Wood Snake and is associated with growth, renewal, and creativity, as the Wood element enhances the Snake’s natural wisdom and strategic thinking.

The 2025 will likely encourage innovation and long-term planning, fostering opportunities for industries focused on sustainability and technological advancement.

In the stock market, sectors like green energy, technology, and healthcare are expected to perform well, with particular emphasis on clean energy, electric vehicles, and biotechnology. Companies investing in eco-friendly solutions and cutting-edge technologies may grow strongly as global trends shift toward sustainability and digital transformation. The Wood Snake’s strategic and cautious nature suggests that investors should focus on companies with solid foundations, forward-thinking leadership, and a commitment to long-term value creation.

The Year of the Snake offers a mixed yet intriguing potential for stock market performance, influenced by global and domestic factors. While history shows periods of volatility and uncertainty in the Snake years, there also tend to be opportunities for growth as the year progresses.

Disclaimer

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

As per SEBI guidelines, the writer and his dependents may or may not hold the stocks/commodities/cryptos/any other assets discussed here. However, clients of Definedge may or may not own these securities.

Brijesh Bhatia has over 18 years of experience in India’s financial markets as a trader and technical analyst. He has worked with the likes of UTI, Asit C Mehta, and Edelweiss Securities. Presently he is an analyst at Definedge.

Disclosure: The writer and his dependents do not hold the stocks discussed here. However clients of Definedge may or may not own these securities.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.