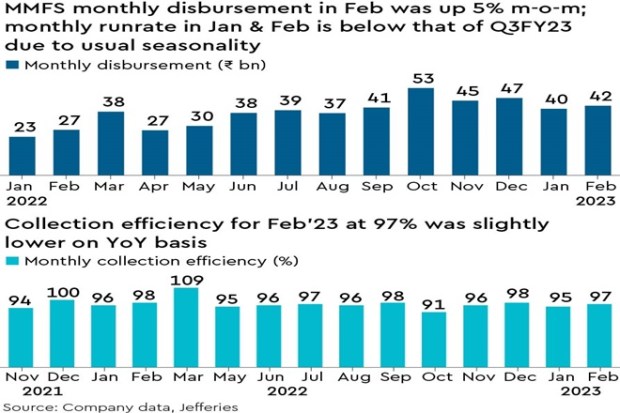

Mahindra & Mahindra Financial Services, the Indian rural NBFC popularly known as Mahindra Finance, released its monthly business performance for Februar. It was observed that company’s loan book rose 1.5% m-o-m led by 5% m-o-m (53% y-o-y) growth in disbursements.

Company’s collection efficiency was at 97% for February 2023 compared to 98% achieved in February 2022. Stage 3 assets were stable, but stage 2 assets fell m-o-m. Divergence in GNPA (RBI vs. IndAS) was lower at 1.6% of loans. Cyclical improvement in loan growth & asset quality at MMFS led by rural tailwinds appears priced in.

Also read: Investor appetite growing for low risk, tax efficient option

The write-offs of the company have remained high and need to fall consistently over time for the company’s return on equity (RoE) to improve further.