Piramal Enterprises (PIEL) reported completion of DHFL’s acquisition after it paid Rs 342.5 bn to the latter’s creditors. This included an upfront cash component of Rs 147 bn and deferred component of Rs 195.5 bn paid via 10-year NCDs raised at 6.75% p.a. Principal on NCDs will be repaid at 5% p.a. for the first five years and 15% p.a. thereafter for the next five years.

As per the resolution plan, there was an additional carve-out consideration of Rs 38.1 bn from the available cash on Dewan Housing Finance’s (DHFL’s) Balance Sheet, leading to a total recovery of Rs 380.6 bn for its creditors and deposit holders. DHFL also has a Life Insurance JV with Pramerica. As shared by the mgmt earlier, it will be a two-step acquisition. Piramal Capital & Housing Finance (PCHFL), the HFC and the wholly-owned subsidiary of PEL, will first merge with DHFL and subsequently the combined merged entity would be renamed as PCHFL.

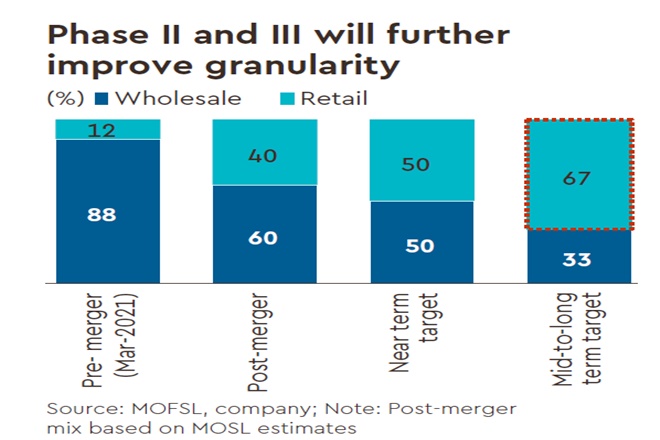

Post-merger, the Retail loan book will be 5x of PIEL’s current Retail loans and the retail-to-wholesale mix will be 40:60 (MOSL estimate). Mgmt said it will improve this mix to 50:50 in the near-term (within one-year) and 67:33 over the mid-to-longer term. This will lead to a significant improvement in distribution footprint, customer franchise, and liability profile. While Phase I (consolidation) was a ‘trust me’ story, Phase II and III in PIEL’s transformation agenda has to be a ‘show me’ story, where PCHFL will have to scale up DHFL’s mortgage franchise and leverage the platform to effectively cross-sell its other organic Retail products to the customer pool.

With the completion of the DHFL acquisition, incremental disbursements in FY22 would be driven largely by the Home Loan business and cross-selling of PIEL’s organic products to DHFL’s ~1m life-to-date customer base. Though there are still some moving variables, we have incorporated the consolidation of Dewan Housing’s loan book in PCHFL in our estimates. Post this, we forecast ~28% loan book CAGR over FY21-24e and ~13% CAGR over FY22-24e.

Valuation and view

Over the past two years, PIEL has: (i) strengthened its B/S by running down its Wholesale loan book; (ii) reduced the top 10 exposures; (iii) brought equity capital through multiple means; (iv) improved the texture of its borrowings by reducing CPs; and (v) fortified itself against contingencies, with ECL provisions at 5.8% of AUM.

Mortgage has the potential for multi-year strong growth. This would be complemented by PIEL’s organic multi-asset retail platform. Over the next three years, we expect the company to make meaningful inroads into Retail. Product diversification within Retail would help the company deliver strong growth and lower concentration risk. We expect the Financial Services business to deliver ~2.3% RoA/10% RoE over the medium term (post DHFL acquisition). We have maintained our target multiple of 1.8x for the Financial Services business. Using SoTP, we arrive at TP of Rs 3,150 (Jun’23e based). We maintain Buy.