The assets under management (AUMs) of infrastructure investment trusts (InvITs) and real estate investment trusts (REITs) are expected to grow 15-20% on year in the next financial year to Rs. 7.5-8 trillion with the roads sector expected to corner 75% of the fresh inflows in these instruments, according to a report.

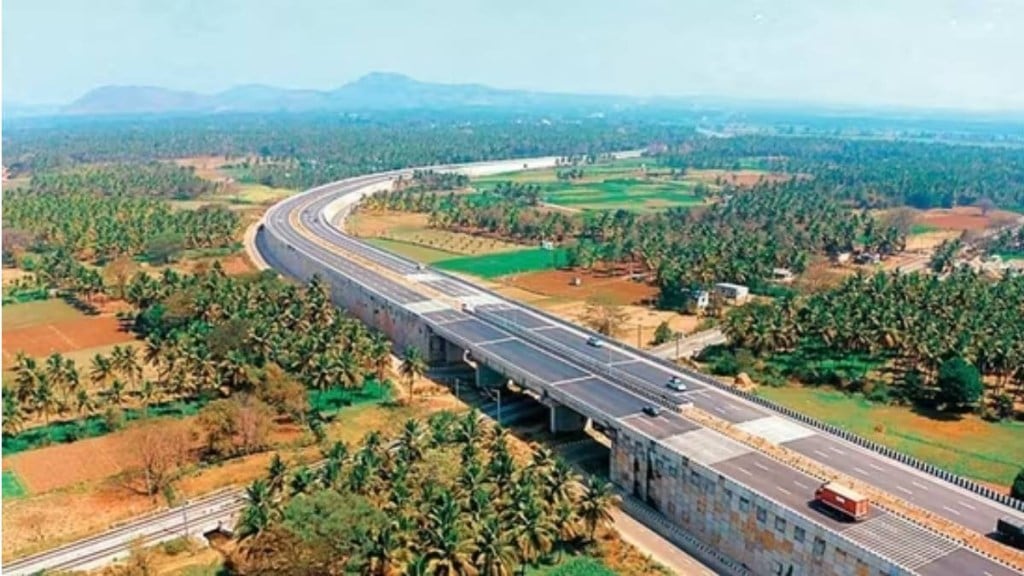

“The roads sector will continue to dominate, accounting for almost three-fourths of the 1-1.5-trillion additional AUM expected in FY25. This is due to the strong availability of road assets, driven by the healthy pace of infrastructure creation and many assets being ripe for monetisation,” said Manish Gupta, senior director, Crisil Ratings.

The momentum has continued this fiscal with Rs. 1.3 trillion added to AUM and half of it has gone to the roads sector. Of the total FY24 inflows, 55% was from six new trusts and the rest via asset acquisitions in the existing ones. The year also saw the launch of the first InvIT — Bharat Highways InvIT. The initial public offering of the InvIT was oversubscribed 8 times.

InvIT has also emerged as an important tool for monetisation of highways. In a single attempt, the National Highways Authority of India (NHAI) raised Rs. 15,700 crore by transferring 10 stretches to National Highways Infra Trust. This compares favourably to NHAI raising `15,968 crore by two rounds of monetisation through toll operate transfer (TOT).

This fiscal also saw new sectors such as retail malls, warehouses and renewables joining the InvIT and REIT bandwagon. The first REIT/InvIT was listed in 2018. Between FY21 and FY23, AUM has grown at a CAGR of 18%.

At present, 50% of the equity in trusts is held by foreign investors but participation by domestic peers is on the rise. The popularity of these investment vehicles has been supported by proactive regulatory changes such as allowing investments by insurance and pension funds, and decreasing the lot size to increase retail participation. Shareholding by retail investors in publicly-listed trusts rose to 18% in the first half of this fiscal from 12% in FY21.

Other fundamental features such as cap on leverage, mandatory distribution of 90% cash flow and the limit on proportion of under-construction assets benefit both investors and lenders, according to Crisil.

With regulatory leverage — ratio of debt to AUM rose from 49% to 70% —, the expansion in AUM has been accompanied by a modest rise in leverage as existing trusts have funded new acquisitions largely through debt.

“The consolidated leverage of InvITs and REITs has increased from 40% in FY21 to 46% currently and is expected to be 47-48% by FY25. Still, credit profiles are likely to be strong, supported by stable and predictable cash flows, long life and diverse pool of assets, and moderate to low counterparty risks,” said Nitin Bansal, associate director, Crisil Ratings, said.

The number of InVITs has gone up to 21 in FY24 from four InvITs in 2018-19. Now, four REITs are operational from one in 2018-19. Increasing the depth of debt markets along with a deeper understanding of operating and credit risks among investors and unitholders will help accelerate the growth of InvITs and REITs, according to the report.