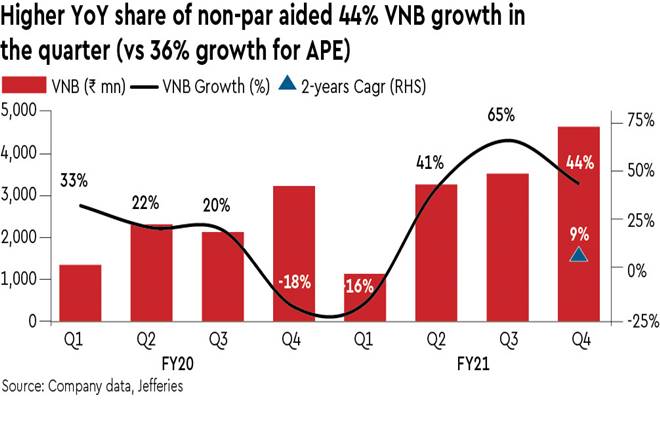

For Q4FY21, Max Life reported VNB of Rs 4.6 bn, up 44% y-o-y (2yr Cagr of 9%), in line with our estimate. This was led by 36% premium growth & 130bps y-o-y expansion in margin to 24%; q-o-q fall in margin is partly due to Covid reserving. Stability of banca. partnership with Axis and adequate reserving towards Covid (>4x of FY21 Covid-claims) offer visibility of growth and EV. We expect VNB to normalise tad lower and see 18% Cagr over FY21-24 with FY22 ROEV of 21%.

Premium growth and margin expansion drive VNB growth: Max posted strong 44% y-o-y growth in VNB. On q-o-q basis margins were down by 450bps, largely as it made additional reserves towards Covid risks arising from business written this year. Premium growth in Q4 was driven by non-par segment (up 165%) and rebound in Ulips (up 41%) whereas Par and protection were weak.

We also believe that the level of margins till 9MFY21 were above sustainable levels as Max got benefit from steeper yield curve on non-par business. Persistency ratio (13m) was up 100bps y/y at 84% and posted operating RoEV of 18.5%. Profit in FY21 was impacted by higher growth and also Covid costs; this should normalise.

Banca. tie-up and Covid reserve offer visibility: Axis Bank formed 63% of APE in FY21 and with the new arrangement as well as comfort on partnership with Yes Bank, we see Max well poised to deliver 17% Cagr in APE over FY21-24. Also, Max has built reasonable reserves towards risks arising from Covid with its reserves at Rs 5 bn being > 4x of Covid-linked death claims for FY21, which is higher than the other listed life insurers.

Maintain Buy: We raise our VNB forecasts for FY22-23 by 2-4% factoring in tad better margins and premiums and now see 18% Cagr in VNB over FY21-24. ROEV should stabilise around 21% in FY22. We raise TP to Rs 1,200 (Rs 1,040 earlier) based on 3x Mar-23 P/EV.