Q2 surprised positively on revenue growth and deal wins with $1.3 bn of net new deals. This leads us to raise our constant currency (CC) revenue growth expectations to the top end of the guidance of 6-8% y-o-y in FY19F vs. 6.6% earlier and raise FY20F by 1pp to 7.4% y-o-y, after incorporating: (i) Fluido acquisition and Temasek JV ($52 mn in annualised run rate on our estimates); and (ii) net new deal flow of $1.3 bn.

However, what keeps us cautious is:

(i) despite 10% INR depreciation, with almost all of the growth coming from high gross margin yielding digital (up 33.5% y-o-y), 100bps improvement in offshore effort and improvement in fixed price percentage, gross margins are down 90bps y-o-y, suggesting underlying margin pressures; (ii) outlook for 2H margins is even weaker with higher skew of investments in sales, digital & localisation, large deal transition costs, residual wage hikes and efforts to control attrition.

Thus, we moderate our Ebit margin estimates by 60-80bps in FY19/20/21F to 23.7/23.3/22.9%. Further, we are not convinced on some of the larger deal flow generating company level margins given significant people takeover and nature of work involved. Retain Reduce; prefer HCLT (Buy)/CTSH (Neutral).

Q2: Strong growth & deal wins; but weaker margins & margin outlook

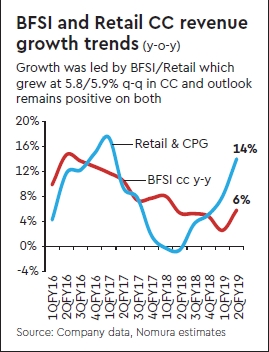

CC revenue growth of 4.2% (vs. 2.8% q-o-q estimate) and won $1.3 bn in net new deal flow. Growth was broad-based across geographies and verticals with BFSI/Retail leading. Outlook is positive on demand across verticals ex of healthcare. Flattish Ebit margins q-o-q at 23.7% (vs. 24.4% estimate) and no raise in guidance was a negative. 130bps increase over two quarters in subcontractor costs to 7.4%, efforts to minimise attrition which is ruling at 23% on quarterly annualised basis and residual wage inflation were key drags.

Growth higher; margins lower; EPS & TP unchanged

We raise our revenue growth expectations to reflect Q2 beat and better deal wins, but lower margins to account for weaker

outlook and Q2 miss. We look for 7/10% USD revenue/EPS CAGR over FY18-21F. Our target price is unchanged at Rs 670 (based on 16x 1-year forward EPS up to Sep-20F of Rs 41.6). Our target multiple is at a 20% discount to our target multiple for TCS. We believe after transitory benefits of INR depreciation in FY19F, earnings growth should lag revenue growth leading to valuations moderating.

Highlights of mgmt commentary

Demand: INFO indicated good demand environment in the US, Continental Europe, UK and Australia, which is reflected in strong deal wins in the last two quarters and, hence, the company remains comfortable with its growth outlook of 6-8% y-o-y in CC terms in FY19F.

Deal wins: Infosys reported strong deal wins of $2 bn+ in Q2FY19, of which 63% were net new. Infosys won 12 large deals, of which 3 were in BFSI, 3 in Manufacturing, 2 in Hi-Tech and 1 each in Retail, Communication, Energy and Other verticals. Geography-wise, 7 deals were in North America, 4 in Europe and 1 ROW.