Infosys’ Q1 results were mixed with revenue growth surprising positively; however 80bps q-o-q fall in margins disappointed. Infosys has raised its FY22 revenue growth guidance by 200bps to 14-16% which can be raised further in our view. Management reiterated margin guidance of 22-24% which factors in upcoming wage hikes and deal transition costs. We tweak our FY22-24 estimates and maintain Buy with a revised PT of Rs 1,800/share based on 30x PE.

Revenues ahead; margins and profits miss estimates: Infosys’ Q1FY22 revenues of $3.8 bn, up 4.8% q-o-q in CC terms, were ahead of our estimates. However, Ebit margin of 23.7%, down 80bps q-o-q, and profit of Rs 52 bn, up 2% q-o-q, missed estimates, mainly due to higher-than-expected subcontracting costs and higher pass-through costs.

Broad-based revenue growth: Growth was fairly broad-based, with most verticals reporting healthy q-o-q growth in Q1. Communications (up 6.4% q-o-q), Retail (up 6.1% q-o-q), and Manufacturing (+5.8% q-o-q) continued to see recovery and drove growth. Revenue growth was healthy across regions, with both North America (+4.8% q-o-q) and RoW (+6.6% q-o-q) witnessing healthy growth. Digital revenues, up 10% q-o-q, continued to be the key growth driver.

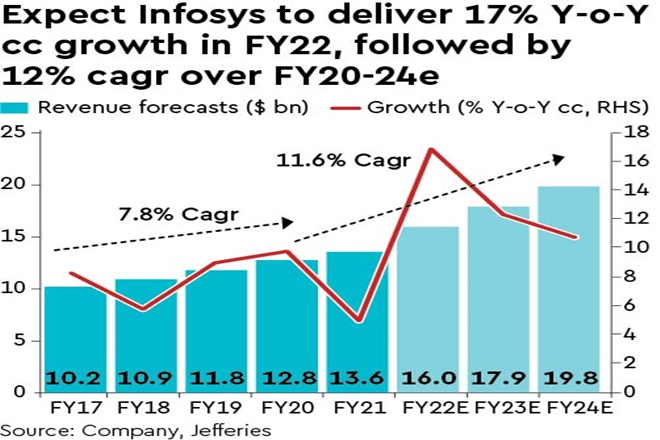

Healthy deal wins; FY22 growth guidance raised: Large deal bookings at $2.6 bn were up 22% q-o-q and c.30% of these were net new. Management highlighted that FS, Retail and utilities verticals are seeing strong traction. Infosys has raised its FY22 growth guidance by 200bps to 14-16%. Assuming a 5% q-o-q growth in Q2 on the back of Daimler deal, the upper end of guidance will imply a 1.5% CQGR in Q3-Q4, which looks achievable. We raise our revenues estimates by 1% and factor in 17% growth in FY22.

Margins disappoint: Infosys’ margins missed estimates mainly due to higher subcontracting costs (+130bps) which offset the benefit of higher utilisation (+40bps) and currency (+10bps). Lower than expected margins were the key reason for earnings disappointment. Mgmt reiterated the FY22 margin guidance of 22-24%, despite expectation of a pick-up in discretionary costs, wage pressures and deal transition costs. We have cut our margin estimates by 10-90bps to factor in the miss and our margin forecasts of 22.8% for FY22 is close to the mid-end of management guidance.

Maintain Buy: Infosys’ success on large deals has helped the company gain market share and will help accelerate its topline growth beyond its trend growth of 8-9%. While it witnessed topline growth of 7.8% CAGR over FY17-20, it is likely to deliver a higher 11.6% CAGR over FY20-24. We cut our FY22 earnings by 1% to factor in the margin miss but raise FY23-24 estimates by 2% on higher growth. Over FY21-24 we expect firm to deliver 13.5% $ revenue CAGR and 13% EPS CAGR. We retain Buy.