Indian Energy Exchange (IEX) logged 9% volume growth (excluding REC’s 14% growth) in Q1FY21 riding low spot pricing, new product launch and a slightly favourable base. We are enthused by the 0.5 bn unit volume of real time market product (RTM-new) in the first month (June) and it further bolsters confidence in our conservative FY21 volume estimate (9% growth).

We are constructive on the company’s diversification approach, which offers huge growth headroom and strong revenue visibility. We have realigned our volumes without changing the overall volume growth. Maintain Buy with TP of Rs 220.

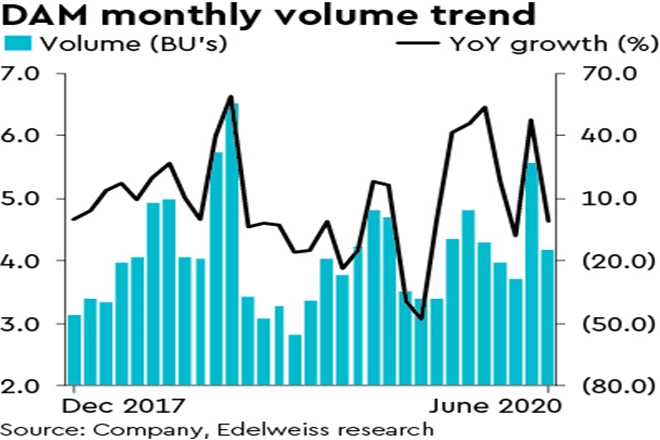

DAM product records 12% growth: With demand-supply disequilibrium, the average price traded at IEX for DAM contracts was down 25% at Rs 2.44/unit. This led to higher procurement from discoms and industrial customers. The TAM product posted 15% volume decline.

RTM exceeds expectations: The RTM (20-25 BUs annual market size) product was launched from June 1 and IEX managed to achieve 0.51 bn units with a clearing price of Rs 2.2, which was 5% lower than DAM price–sustainability key monitorable. Renewable Energy Certificate (REC) is on a weak footing (down 40% y-o-y).

Outlook: On growth path— Factoring in the strong ramp-up in RTM volumes, we have increased our estimates from 1.5 bn units to 3.0 bn units now and cut our TAM/REC volumes by 1.5 bn units for FY21/22. We are yet to build in any volumes or valuation from the gas exchange. We believe new product launches and gas exchange provide extra cushion to our conservative earnings estimates.