We recently met the management of Gujarat Gas (GUJGA). In early 2019, sales volumes were down to 2.1-2.2mmscmd, but the closure of coal gasifiers has boosted current sales volumes to 3mmscmd at Morbi. Although ceramic manufacturers have shifted, they have not come forward to sign term contracts. Peak potential at Morbi is 6mmscmd. Although we have witnessed sudden increase in sales volume, sustainability of the increase depends on whether the judiciary leaves the order unchanged, amidst protests from ceramic manufacturers.

The NGT order would also influence future investments

Newer investments in Morbi and nearby areas are increasingly from larger, organised players. The National Green Tribunal (NGT) order should also bring a structural shift in investment projects towards greener fuels. Impact could be a precursor for other regions; the chemical/ pharma belt of Ankleshwar-Bharuch-Vapi is equally polluting. Competition from coal caused sales at Surat to decline from earlier peak of 1.8mmscmd to 0.8mmscmd. Emphasis on cleaner fuels should propel sales across the state.

Read | IndusInd Bank @ 25: Rs 100 invested in this Sensex stock in 1998 would have grown to this much today

Strong volume outlook

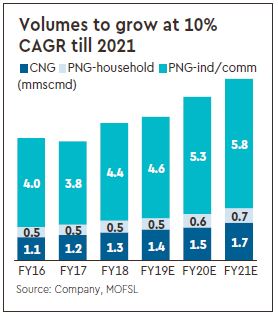

GUJGA has won six geographical areas in the recently concluded tenth round of City Gas Distribution (CGD) bidding and this should aid long-term volume growth. GUJGA has already commissioned 35 new CNG stations in FY19e and the number is likely to hit 60 by FY19-end. The company aims to open 100 CNG stations each year. Current breakdown across regions — Morbi (3mmscmd), Ankleshwar (1mmscmd), Vapi (0.5mmscmd), Surat (0.8mmscmd), Rajkot (0.5mmscmd), Surendranagar (0.2mmscmd) and additional 0.5mmscmd from other areas.

Also read | MSMEs out of the woods? Credit improves, NPAs fall as small businesses turn around

Valuation and recommendation

GUJGA is trading at 19.3x FY21 EPS of Rs 7.6. We raise our volume assumption to 7.4/8.2mmscmd in FY20/21 from our earlier assumption of 7.1/7.9mmscmd. We assume Ebitda/scm of Rs 3.9/4.0. Valuing the company at 24x (unchanged) FY21 EPS of Rs 7.6, we reiterate Buy recommendation on the stock with a target price of Rs 183 (earlier:Rs 165).