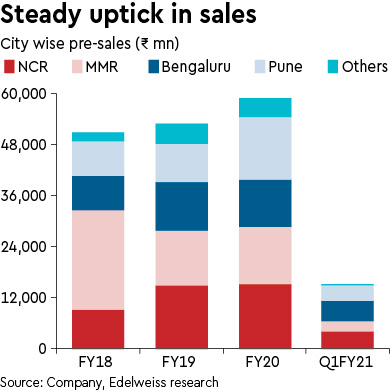

Godrej Properties (GPL) clocked robust pre-sales of ~Rs 15.3 bn (up 71% y-o-y, down 36% q-o-q) in Q1FY21 aided by its 10:90 payment plan. With just one project launched during the quarter (versus 17 in FY20), ~93% of sales came from existing inventory. Covid-19 impacted both execution and collections, leading to negative operating cash flows. That said, GPL has a robust launch pipeline of ~15.4msf for FY21; however, the pandemic can prolong the disruption into the near term. We continue to follow the old accounting standard; maintain Buy with a revised TP of Rs 1,069 (Rs 1,058 earlier) while rolling forward the valuation to December 2021e.

Healthy sales performance despite muted launches: GPL’s new sales in Q1FY21 were aided by: (i) digital tools; (ii) NRIs, who accounted for ~50% of bookings; and (iii) the 10:90 payment plan. Work has resumed on almost all sites post-lockdown.

Leverage inches up q-o-q: Limited construction activity impacted collections adversely (down 70% q-o-q); consequently operating cash flow slipped into red while net cash outflow was at ~Rs 6 bn. Leverage rose q-o-q with the company ending the quarter with net debt of Rs 17.5 bn. Net debt to equity stands at 0.37x (0.24x in Q4FY20).

Outlook: Robust long-term prospects—As highlighted earlier, RERA-driven consolidation bodes well for GPL, which is well placed to maintain its leadership in the realty space. While Covid-19 will mar near-term performance of realty players, we believe GPL’s strong brand and lean balance sheet will enable it to continue to gain market share. We maintain ‘BUY/SO’.