The diverse nature of Godrej Agrovet’s (GOAGRO) various businesses de-risks its operations, enabling it to focus on growth, optimise capital efficiency and to maintain its competitive advantage. It undertakes dedicated R&D in existing products, focusing on improving yields and process efficiencies. The strength of the ‘Godrej’ brand and its association with trust, quality and reliability helps the company across segments, particularly in those involving direct sales to retail consumers.

In crop protection, GOAGRO is focusing on multiple product launches with category expansion; it has guided for 10 launches over the next 3-5 years with a potential of Rs 10 bn. Growth in Astec will be driven by capacity expansion; GOAGRO plans to invest Rs 350-400 m every year over the next 3-4 years in triazole chemistry. At a fixed asset turnover of 2-2.5x, it should aid in revenue CAGR of 15% over FY18-21.

Demand for palm oil in India is not a constraint as >90% of the domestic demand is imported. To augment the supply of fruits for palm oil manufacturing, the government has introduced a programme to promote its cultivation. Godrej Agrovet — India’s largest palm oil processor—is well placed to capitalise

on the opportunity offered by the programme; we expect revenue/Ebitda CAGR of 11%/12% over FY18-21.

Read Also| Metropolis Healthcare IPO sees stellar response on last day; Polycab issue subscribed 72% on Day 1

Low compound feed penetration, decline in fodder availability and increasing crossbred cattle should drive industry-wide growth for cattle feed. GOAGRO, a leading player in cattle feed, is at the forefront to tap this opportunity with the Indian poultry feed industry expected to grow at 14.9% CAGR over FY17-20. But, pure feed players like GOAGRO face stiff competition from integrators. We expect the animal feed segment to deliver revenue/Ebitda CAGR of 14%/12% over FY18-21.

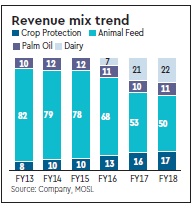

We expect consolidated revenue/ Ebitda CAGR (FY18-21) of 12%/16% to Rs 73 bn/7.0 bn. We initiate coverage on GOAGRO with Buy rating and SOTP-based target price of Rs 610.

Company description: GOAGRO is a diversified agri company with pan-India presence and operations spread across five business verticals. It comprises (i) the crop protection business, where it is a dominant player in plant growth regulators and triazole chemistry (via its subsidiary Astec Life Science), (ii) palm oil, where it enjoys leadership in India, (iii) animal feed— amongst the top players in cattle feed, (iv) dairy and (v) processed foods.