Remember 2022? When ChatGPT launched and everyone thought Google was toast?

The narrative was simple: AI chatbots would kill Google Search. Why click through pages of links when you could get instant answers? Investors panicked. Regulators circled. The stock was cheap, and for good reason.

Fast forward to today. Alphabet’s stock has risen 60%, adding $1.3 trillion in market value. The company’s now knocking on the door of a $4 trillion valuation. Even Warren Buffett’s Berkshire Hathaway showed up with a $4 billion bet.

What changed? Three letters: TPU.

The monopoly everyone missed

Here’s what most people got wrong about Google. They saw it as an ads company under threat. They missed the monopoly hiding in plain sight.

While everyone was busy worshipping Nvidia’s GPUs (those expensive chips powering AI), Google quietly built something different. Something called Tensor Processing Units, TPUs.

Think of it this way. Nvidia’s GPUs are Swiss Army knives. They do everything, train AI models, power self-driving cars, run quantum simulations. Versatile, powerful, ridiculously expensive.

Google’s TPUs? Scalpels. Designed for one thing: deep learning. And apparently, they’re very, very good at it.

The $100 Billion Signal: Inside Google’s Record Quarter

Q3 2025 was when everything clicked. Alphabet posted its first-ever $100 billion quarter. Revenue hit $102.3 billion (up 16% year-over-year). Earnings per share? $2.33, a record, despite eye-watering AI spending.

But here’s where it gets interesting. Google Cloud, the division selling TPUs, grew 34% to $15.2 billion. The company signed more billion-dollar deals in nine months than in the previous two years combined.

The big number? A $155 billion backlog. That’s future commitments from companies lining up to buy Google’s services. And a lot of that interest? TPUs. (Note: The company is yet to start selling TPUs to third parties).

Apple used TPUs to train Apple Intelligence. Anthropic signed up for potentially one million TPUs. Meta’s in talks for a deal worth billions.

Morgan Stanley estimates Google could make seven million TPUs by 2028. If just 500,000 go to external customers, that’s $13 billion in extra revenue by 2027.

Vertical Integration: Why Google Can Undercut Nvidia

The genius of the TPU play

Here’s why this matters more than people realize.

First, Google is reducing its dependence on Nvidia. Potentially far fewer supply chain headaches. Better profit margins. And crucially, it can undercut competitors on cloud pricing because it controls the entire stack.

Second, it’s not just going to be selling TPUs. It’s selling a complete AI infrastructure package, hardware, software, and the works. Vertical integration at its finest.

But wait, what about Nvidia?

Here’s the twist most people miss: TPUs aren’t replacing GPUs. They’re complementing them.

Even Anthropic, despite its massive Google TPU deal, just bought $30 billion of computing power from Microsoft Azure (running Nvidia chips). OpenAI signed a $38 billion deal with AWS for Nvidia’s latest hardware.

The AI infrastructure market is projected to hit $7 trillion by 2030. There’s room for everyone. Companies use TPUs for specialized tasks while relying on Nvidia’s GPUs for flexibility.

The ‘Moonshot’ Payoff: SpaceX, Waymo, and Anthropic

And here’s what really flies under the radar: Google’s venture bets are paying off spectacularly.

SpaceX? Google owns roughly 10%. SpaceX just raised at an $800 billion valuation, pushing Google’s paper gain to $40-60 billion. And SpaceX plans to IPO in 2026.

Waymo completed 14 million rides in 2025 alone, tripling last year’s volume. It’s now valued at $45 billion. More importantly, its real-world driving data feeds directly into Gemini’s training, giving Google an edge OpenAI can’t match.

YouTube subscriptions and Google One? Hit $12.9 billion in Q3, running at a $50 billion annual rate. That’s a massive cash flow machine financing everything else.

Gemini 3: From ‘Factual Errors’ to ‘Deep Thinking’

Remember Google’s embarrassing “Bard” chatbot that kept making factual errors? That’s history.

Gemini 3, launched in November, added reasoning capabilities; it can “pause and think” before answering complex queries. Tests show it’s currently the best model available.

More importantly, Google integrated AI across Search and YouTube. YouTube Shorts now generate more revenue per watch hour than traditional YouTube ads. AI-powered ad tools are improving conversion rates. This isn’t science fiction, it’s practical AI driving real revenue.

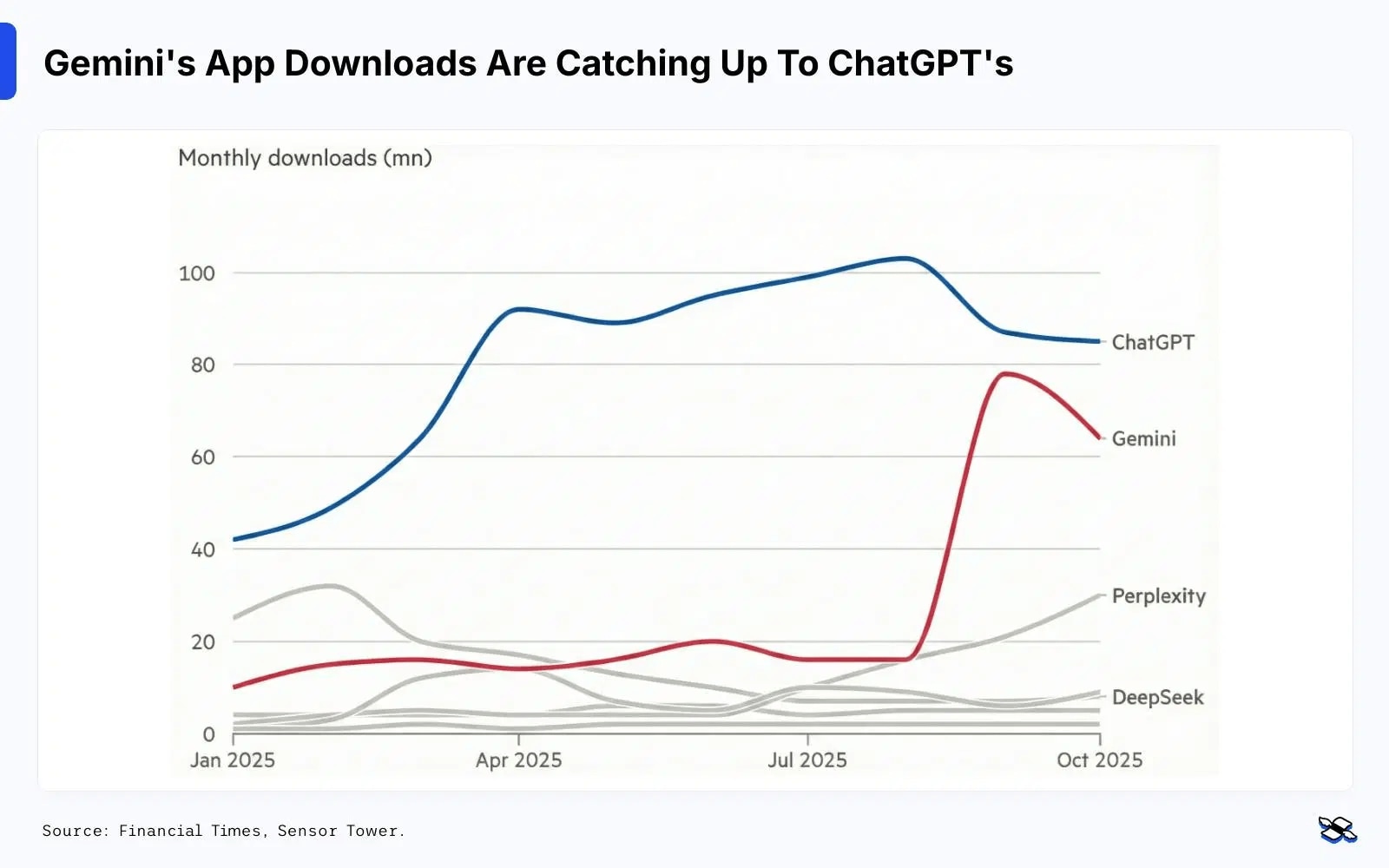

And the network effects are kicking in. Over 300 million paid subscribers across YouTube Premium and Google One. Search remains dominant despite doomsday predictions. Gemini downloads are now competing with ChatGPT.

The spending spree

Of course, there’s a catch. Google’s spending is absolutely bonkers.

Capital expenditure for 2025: $91-93 billion. Most of it going toward TPUs and data centers. CEO Sundar Pichai calls it “front-loading the next decade of computing.” The logic? Under-investing in AI is riskier than over-investing.

But here’s the thing: unlike many competitors drowning in debt, Google’s financing this with cash. Operating margins hit 32.2%, the highest in a decade. The company generates $400 billion in annual revenue with ridiculous cash flow.

Still, if AI growth slows, Google would be stuck with billions in depreciating servers.

The regulatory shadow

Then there’s the regulator problem. The September 2025 ruling allowed Google to continue paying Apple to be the default search engine, payments that reportedly used to total $25 billion annually.

And here’s the upside: regulators backed off breaking up Google partly because they believe AI competition (ChatGPT, Perplexity) could naturally challenge its dominance. The very threat that scared investors in 2022 became Google’s regulatory shield in 2025.

The valuation question

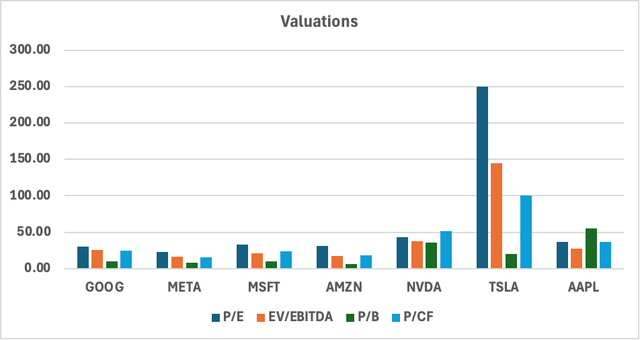

After this year’s rally, Alphabet trades at 30.5 times earnings, the highest since 2017. That’s a premium to the S&P 500’s 23.5 times.

Here’s a quick sum-of-the-parts: Google Cloud could be worth $600 billion. The moonshot portfolio (SpaceX, Waymo, Anthropic stakes) conservatively $100 billion. Core Search and YouTube? Around $3 trillion at current multiples.

The stock’s not screaming cheap anymore. Future gains will need to come from actual execution, not multiple expansion.

The bottom line

So can Alphabet continue this trajectory? The case for “yes” is compelling.

The AI infrastructure market is exploding. Google’s positioned near perfectly with both hardware (TPUs) and software (Gemini). Its venture bets are hitting. YouTube’s crushing streaming competitors. And despite spending $93 billion this year, margins are at decade highs.

The risks? Regulatory uncertainty, insane capital expenditure with unclear returns, and the perpetual threat that advertising could shift away from traditional search.

But here’s what matters: Google proved the doomsayers wrong. It’s not an ads company on the decline. It’s a diversified tech giant controlling critical AI infrastructure.

The wait-and-see approach of 2022 (whether deliberate or not), while everyone panicked about ChatGPT, turned out to be genius. Google’s network effects are stronger than anyone realized. And those TPUs? They might be the secret weapon that keeps the money machine humming for years.

Is the stock expensive after doubling? Sure. Will it double again in 2025? We don’s know. But if you believe AI infrastructure is the next decade’s growth story, and Google can execute on TPUs, subscriptions, and cloud deals, this looks like a solid stock to track.

Just don’t expect the fireworks we saw this year. Those $93 billion worth new data centers need time to print money.

Sonia Boolchandani is a seasoned financial writer She has written for prominent firms like Vested Finance, and Finology, where she has crafted content that simplifies complex financial concepts for diverse audiences.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.