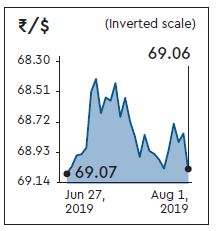

The rupee fell 26 paise to close at Rs 69.06 against the greenback on Thursday after the Federal Reserve — for the first time since 2008 — cut its benchmark interest rates by 25 basis points (bps) , which subsequently led to the dollar getting stronger.

The local currency on Thursday fell to Rs 69.25 but recovered 20 paise to end the day at Rs 69.06 — the lowest level since July 27 when it closed at Rs 69.07.

In light of the implications of global developments for the economic outlook as well as muted inflation pressures, the Federal Reserve on Wednesday decided to lower the target range for the federal funds rate to 2-2.25% for the first time since the global financial crisis in 2008.

On a 12-month basis, the overall inflation and inflation for items other than food and energy are running below 2%, the Federal Reserve committee said. However, this action supports the committee’s view that sustained expansion of economic activity, strong labour market conditions, and inflation near the committee’s symmetric 2% objective are the most likely outcomes, they added.

Federal Reserve chairman Jerome H Powell indicated that the committee may consider further rate cut as it will continue to monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion, with a strong labour market and inflation near its 2% objective.

Edelweiss Securities head of forex Sajal Gupta said: “Though the rate cut was announced, the commentary of the Federal Reserve committee was not dovish as they did not confirm if there will be further rate cuts. Hence, the market was not very happy with that, as a result, global equities and currencies reacted negatively while the Dollar Index went up.”

The dollar index rose 0.31% on Thursday after the Fed rate cut. The index went up 2.09% in the past 10 days as the market was expecting a rate cut.

Asian currencies reacted negatively, as the Chinese Renminbi fell 0.32%, Indonesian Rupiah fell 0.66% and Malaysian Ringgit fell 0.41%.

Anindya Banerjee, deputy vice-president for currency and interest rates with Kotak Securities, said: “Despite a heavy outflow in the equity markets by foreign portfolio investors, the rupee has been stable, looking forward, we expect it to move between 68 to 70, unless any risk aversion takes place in the global markets.”

The 10-year Indian benchmark bond yield rose 6 bps to 6.42% on Thursday against its closing level of 6.36% on the previous trading day due to the uncertainties on the government issuing sovereign bonds, as they said in the Budget 2019.

Mahendra Kumar Jajoo, head of fixed income, Mirae Asset Global investments, said that the yields went up on Thursday as the market booked profit after the rally of three consecutive days.

Yields can go as low as 6% by September end if the Reserve Bank of India (RBI) cuts its repo rate for the fourth time in the August monetary policy, which is much anticipated by the market experts, he added.

In July, yield on 10-year benchmark bonds fell 51 bps as a result of government’s plan to issue offshore sovereign bonds and 75 bps rate cut during the year by RBI with an expectation of further rate cut among market experts.