Why do so many people religiously read publications like The Financial Express, The Wall Street Journal, Economic Times, or Financial Times, or tune in to CNBC? The answer lies in their desire to keep tabs on their investments.

In today’s fast-paced world, people constantly check their phones, almost obsessively, to monitor whether the price of their investments is rising. This habit has become as addictive as scrolling through Instagram or TikTok.

The motivation is simple: they have invested in assets like stocks, gold, or real estate to safeguard their wealth against the slow erosion of purchasing power caused by inflation. As local currencies—whether it’s the Dollar, Rupee, or Euro—lose value over time, these investments offer a sense of financial security.

For many, staying informed through business media isn’t just a matter of curiosity; it’s a strategy to make better financial decisions in an unpredictable world.

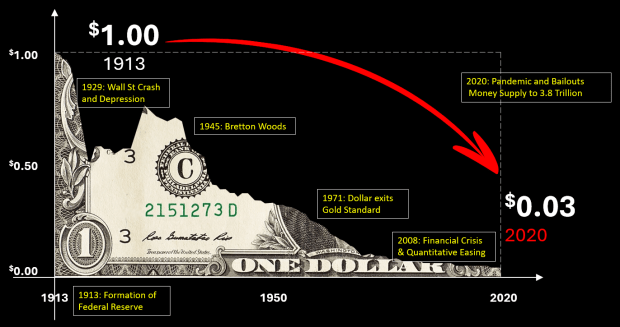

The chart above illustrates what has happened to the U.S. Dollar’s purchasing power over time—it’s steadily declined. The Indian Rupee tells an even harsher story. The Rupee, which traded at 25-30 Rupees range to the Dollar in 2000, fell to the 60s range by 2014 and hovers in the 80-90s range in this decade.

For most people, investing is not just about growth; it’s about survival. As inflation erodes the value of local currencies, individuals turn to historically appreciating assets like stocks, gold, and real estate to preserve their wealth. These investments act as a safeguard against the diminishing value of salaries and savings. After all, no one wants their hard-earned money today to lose its purchasing power tomorrow.

But what if the rules of the game were different? Imagine if stocks or gold consistently lost value every year—people would stop investing in them. Similarly, if the purchasing power of a currency continually increased, there would be no reason to invest at all. People would simply hoard cash, locking it away in vaults or even under mattresses.

Take, for instance, a Toyota Innova priced at Rs 20 lakhs today. If historical trends suggested its price would drop to Rs 10 lakhs in a year, would anyone buy it now? Likely not. Instead, they’d delay their purchase, preserving their wealth and allocating the difference elsewhere.

This behavior reflects the deep social and psychological relationship people have with money and investments. Whether it’s the allure of growth or the fear of inflation, it’s this dynamic that drives our financial decisions—and keeps us glued to the business pages and market updates.

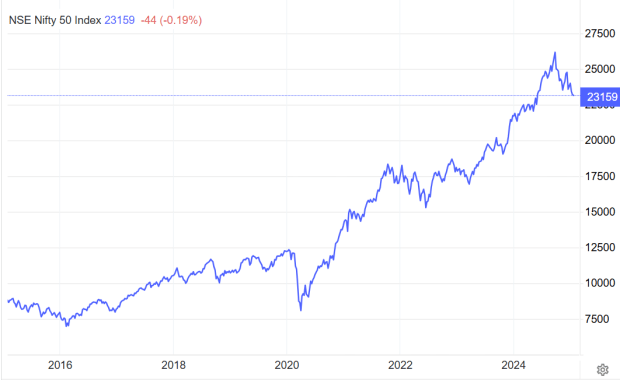

Let’s take a closer look at some broad categories of investments and their returns over the past 15 years.

The NIFTY 50 serves as a benchmark for the Indian stock market. The 10-year performance of this index paints a striking picture of growth. In 2015, the NIFTY 50 hovered in the 8,000s. Fast forward to 2025, and it has surged to approximately 23,000—nearly tripling in value.

This remarkable rise highlights the wealth-building potential of equity markets over the long term.

The chart below highlights the remarkable journey of gold prices in international markets over the past decade.

Gold, often considered a safe haven during times of economic uncertainty, has appreciated significantly—from $1,200 per ounce to $2,800 per ounce. This represents a growth of almost two and a half times.

https://tradingeconomics.com/commodity/gold

This surge underscores gold’s enduring appeal as a hedge against inflation and currency depreciation. In a world where financial markets can be unpredictable, gold has continued to offer stability and long-term value, cementing its place as a key component in many investment portfolios.

For investors, the performance of gold serves as a reminder of its timeless role—not just as a precious metal but as a reliable store of wealth

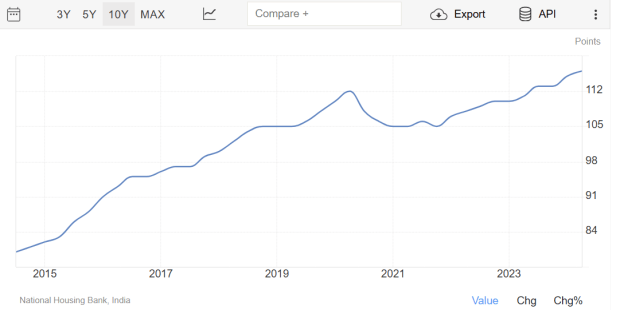

India’s real estate market has been on a remarkable growth trajectory, with the Real Estate Index reflecting an average appreciation of 50%. In certain key markets, the returns have been even more impressive, with property values appreciating by two to three times, signaling robust demand and investor confidence.

https://tradingeconomics.com/india/housing-index

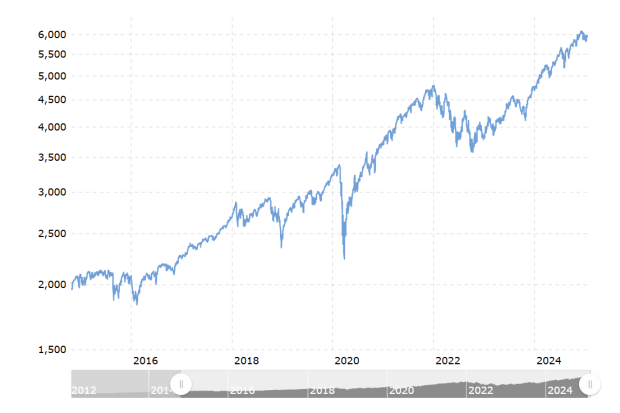

Meanwhile, across the Atlantic, the American stock market has mirrored a similar growth story. The S&P Index, which broadly represents the performance of the US stock market, has soared from the 2,000s to the 6,000s in recent years. This threefold surge underscores the resilience of the US economy and the strong performance of its equity markets, driven by technological innovation, strong corporate earnings, and accommodative monetary policies.

The median American house prices have gone from 240,000USD to 420,000 in 10 years.

Source : https://fred.stlouisfed.org/series/MSPUS

Literally every main known asset class has given a 2-3 times appreciation because of inflation and governments printing money indiscriminately be it bank bailouts or covid related bailouts and handouts.

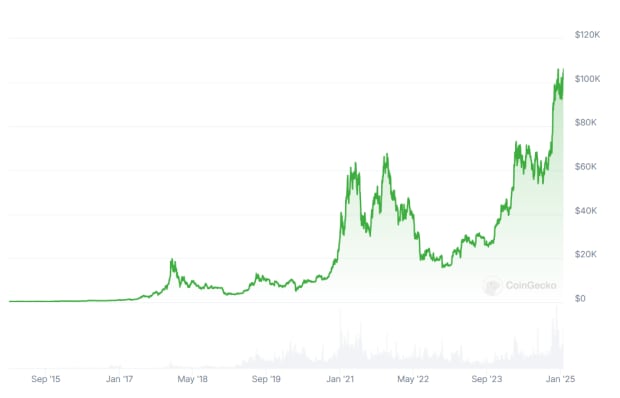

Let’s look at the bitcoin chart now for last 10 years

In the past decade, Bitcoin has gone from being a niche experiment in virtual currency to one of the most transformative financial assets in history. Its price has surged from just $300 to a staggering $100,000, marking an extraordinary 300-fold increase. The market capitalization of the crypto market has similarly skyrocketed, growing from a modest $3 billion to an unprecedented $4 trillion—a reflection of its global adoption and rising influence. To understand the scale, it took gold 5,000 years to reach 18 trillion dollar market cap. Bitcoin is at 2 trillion market capitalization within 15 years of existence.

Taking a broader view, over a 15-year time frame, Bitcoin’s journey is even more astonishing. From a humble beginning priced less than $0.01 per coin, it has appreciated to $100,000, delivering returns of 10 million times its original value. To put it simply, no asset in history has provided the common man with such an unparalleled opportunity for wealth creation.

In the world of investing, pre-IPO stocks often deliver astonishing gains, but they remain out of reach for the average individual, accessible only to accredited investors or venture capitalists. In contrast, the crypto market has been a game-changer, offering equal opportunities for ordinary investors and venture capitalists alike to reap similar rewards.

In India, around 9 crore people—roughly 6% of the population—hold stocks. The million-dollar question is, how many of them have diversified their portfolios to include a blue-chip cryptocurrency like Bitcoin? If they haven’t, what held them back? Was it fear, government regulations, accessibility or simply a lack of knowledge that made them miss the boat in this revolutionary asset class? Is there still time to get onboard?

Have you ever wondered if Bitcoin was a fraud or a Ponzi scheme based on reports you read? This was a common allegation during Bitcoin’s early days, even voiced by Jamie Dimon, CEO of JPMorgan Chase and one of the world’s most powerful bankers. A Ponzi scheme typically pays returns to early investors using the money of later entrants. Bitcoin, however, makes no such promises. It doesn’t guarantee price increases or decreases—it’s a free-market innovation. Its value is purely determined by demand: if more people want it, its price goes up.

Unlike stocks or companies, Bitcoin lacks cash flows, meaning you can’t perform a present value discount analysis to determine its worth. In this sense, Bitcoin is like gold. When you buy gold, there’s no guarantee its price will rise; owning an ounce of gold today simply means you’ll have an ounce tomorrow, whether its price skyrockets to $10,000 or plunges to zero. Bitcoin operates in much the same way. Owning one Bitcoin today guarantees only that you’ll have one Bitcoin tomorrow, regardless of whether its price remains $100,000 or vanishes to zero.

Yet, Bitcoin differs from gold in a crucial way: tangibility. Gold is a physical commodity you can hold and touch. Bitcoin, on the other hand, is a virtual monetary asset—a purely digital entity that exists only in cyberspace, challenging traditional concepts of ownership and value.

Why are people willing to pay 100,000$ for something they cannot even touch? Is this like the tulip mania and bubble of the 1600s? Tulips were a craze in Europe in 1600s and the speculative futures contract market prices rose at an astronomical manner from 1636 November till 1637 February and it crashed and a ton of investors lost money. It was not a spot price bubble but a futures contract bubble. Bitcoin network has been up and running for 15 years and its spot price is now at 100,000$ as of January 23rd, 2025.

To explore the question of reality and intangibility, let’s consider email. Is email real? Unlike the handwritten letters of 30 years ago, you can’t physically touch an email. Yet, it serves its purpose: you can read the message it conveys and respond to it using a browser client like Gmail, Yahoo, or Outlook. Its tangibility doesn’t matter—its functionality does. The email exits on machines as 1’s and 0’s on in some data center.

Now, let’s extend this logic to money. Should money be something tangible, or is it enough that it can be stored securely and spent when needed? With an assets like Bitcoin, you don’t hold a physical coin in your hand, it exists as 1’s and 0’s on multiple machines across the globe but you can see your balance in your digital wallet and send fractions of a Bitcoin to anyone, anywhere in the world. Just like email revolutionized communication, Bitcoin has redefined our concept of money, proving that being intangible doesn’t make it any less real.

In a series of articles following this introduction, which I believe has piqued your interest into bitcoin using prices and return, I will be regularly writing about bitcoin, the philosophy and technology behind it, other cryptos, NFTs, smart contracts, government regulations, the important events that shaped the industry just to educate the traditionally finance savvy public about this space and this new asset class. There will be no investment advice.

You can write to me at nithin@financialexpress.com or ask questions in the comment section and I will answer them here as part of the articles so that you can form an educated opinion about bitcoin and the crypto market.

Nithin Eapen is a technologist and entrepreneur with a deep passion for finance, cryptocurrencies, prediction markets and technology.

Disclaimer – The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.