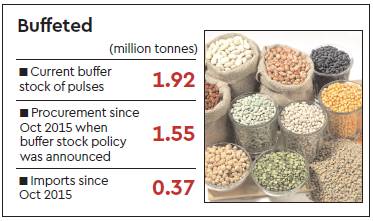

The government is grappling with the issue of disposing of more than 1.9 million tonnes (mt) of buffer stock of pulses. These stocks, the highest ever, were created mostly through domestic procurement but also imports since finance minister Arun Jaitley announced the policy in October 2015 to control a spike in prices. The worrisome aspect is that the step to sell pulses from buffer stocks to states and private firms through auctions have received lukewarm response mainly because of bumper pulses output of 22.4 mt in 2016-17 crop year (July-June) compared to only 16.35 mt in the previous year. Sources said that traders and farmers have substantial stocks from last year, which has pulled down the retail prices of pulses by more than 30% in comparison to the year ago period.

With the mandi arrival of kharif pulse crops — tur, urad and moong — for the current year (2017-18) set to begin by next month, the government needs to sell the stocks at the earliest or else the quality of stocks could deteriorate soon. Since the launch of buffer stock policy, only 132,000 tonnes of pulses have been sold in the market.

Out of around 1.55 mt of pulses such as moong, urad, arhar and masur purchased from farmers by agri-cooperative Nafed, Food Corporation of India and Small Farmers Agribusiness Consortium since the buffer stocks policy was announced, arhar procurement so far has been around 1.16 mt. Trade agencies such as MMTC and STC have imported around 400,000 tonnes of pulses for the buffer stocks so far.

However, the quality of around 200,000 tonnes of moong that was purchased a year ago by agencies could deteriorate soon as its shelf life is eight to nine months. Arhar can be stored for a year or so. “We have sought nod for selling pulses in the open market from the department of consumer affairs (DoCA). We also need to create space for the forthcoming new kharif crops,” Nafed managing director Sanjeev Kumar Chadha told FE. The farmers’ cooperative has purchased the bulk of pulses procured for buffer stocks, which was financed from the Price Stabilisation Fund being managed by DoCA.

“The mandi prices of pulses would continue to be depressed as the government would sell their stocks, thus hitting prices for the forthcoming crops,” said Nitin Kalantri, secretary, Maharashtra Dal Miller Association.

Nafed has urged states to distribute pulses through PDS using the Centre’s buffer stocks. Meanwhile, Karnataka has agreed to purchase around 100,000 tonnes of pulses from the buffer stocks during next 10 months. States like Andhra Pradesh and Tamil Nadu have shown interest in pulses purchase from Nafed. The Army has also agreed to lift around 70,000 tonnes of pulses from buffer stocks. Nafed would launch an e-auction platform shortly where traders could sell and buy other agricultural commodities as well.

According to agriculture ministry data, despite a decline in arhar, overall kharif pulses sowing till last week had been close to 4% more than 121.28 lakh hectares compared with last year, indicating another bumper output. Recently, the government had put imports of pigeon peas and arhar under the restricted category and fixed a quota of only 200,000 tonnes per annum. Traders have been asking for similar import restricts on other varieties of pulses as well.