Warburg Pincus plans to acquire up to a 20% equity stake in Airtel’s DTH business for $350 mn (valuing it at $1.75 bn; 8x FY18e Ebitda), according to Airtel. Of this, 15% of the stake will be sold by Bharti Airtel and the balance by another Bharti entity. Airtel DTH had 13.5 mn subscribers as of September 2017 (21% subscriber market share among private DTH players).

Implications of stake sale

In FY2017, Airtel DTH reported revenue of Rs 34.3 bn and Ebitda of Rs 12.2 bn (35.6% margin). We expect revenue and Ebitda to grow 10% and 12% CAGR, respectively, over F17-20e. The transaction values the DTH business marginally ahead of our estimate ($1.65 bn) and the cash raised from the sale should enable Airtel to fund capex on the India wireless business (which was recently revised upwards).

Valuation

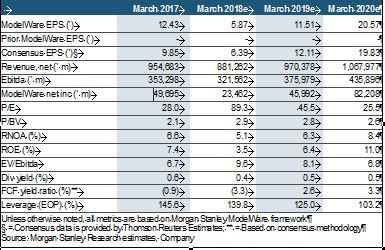

We use a probability-weighted DCF-based sum of the parts model – 70% base case, 25% bull case, 5% bear case to arrive at our price target of Rs 658/share. We assume a WACC of 11.6% and a terminal growth rate of 5% to arrive at each of the scenario values. Base case value—Rs 544/share; 70% weighting: In India wireless, we estimate that Airtel can add 22 million subscribers in FY18, and overall ARPU of Rs 146. We currently assume that revenue growth returns in FY19, and we expect 8% y-o-y over FY19/FY20. We expect growth momentum in Airtel’s Enterprise and Home services businesses to continue, driven by data growth and increased fixed broadband penetration, leading to respective 10% revenue CAGRs for FY17-20. We arrive at core EV of `575/share. We value Bharti Airtel’s 58% share in Bharti Infratel at Rs 113/share based on our DCF model for Bharti Infratel. We add the value of the South Asian business, at Rs 2/share, and the DTH business, at Rs 26/share. For the African business, performance is strong. We arrive at an EV of Rs 78/share.