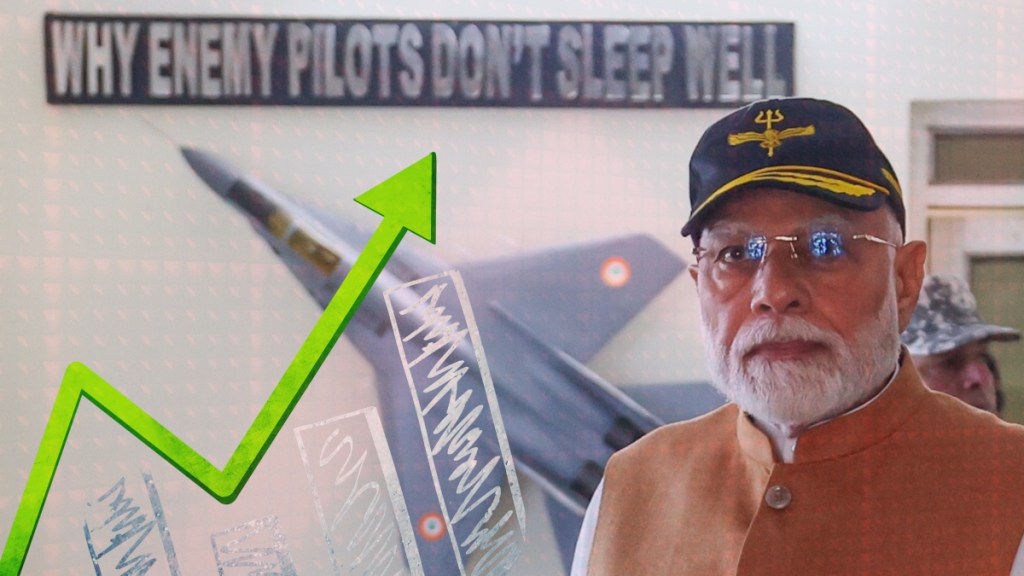

Indian defence stocks continue to be in the spotlight. The share prices have skyrocketed in Tuesday’s trade session as Prime Minister Narendra Modi called for ‘Made in India’ military gear.

Shares of Defence companies surge

The share price of Bharat Dynamics surged the highest among the defence stocks, jumping 9.4% to Rs 1,718 on the National Stock Exchange.

The share price of Bharat Electronics, recently added to the Nifty 50, rose 4.6% to an intra-day high of Rs 337.75. It was the top gainer in the Nifty 50.

Hindustan Aeronautics share price gained 4.6% to trade at an intra-day high of Rs 4,645.

Other defence stocks like Kaynes Technology, Cochin Shipyard, Mazagon Dock Shipbuilders, Avantel, Paras Defence & Space Technology, Astra Micro, Data Patterns, and many others followed suit.

PM Modi’s push for Made in India

One of the big reasons why defence stocks are surging is primarily due to Prime Minister Narendra Modi’s push for ‘Made in India’ defence equipment. He has urged India to become a self-sufficient military power. He said that the country has proved its dominance in modern warfare. Now, it must take the leadership in defence innovation through home-grown technology.

Following this, the stock price of defence companies like Bharat Dynamics, Bharat Electronics, Hindustan Aeronautics, and many others rose as much as 8%.

PM lauds India’s defence prowess

PM Modi’s remark on indigenous defence gears came while he was addressing the nation after India completed Operation Sindoor. “We have proven our dominance in new-age warfare,” said PM Modi in his first address to the nation since Operation Sindoor.

“We have always defeated Pakistan on the battlefield, and today we have demonstrated our superiority in modern warfare. India has showcased its excellence in new-age warfare. The time has come for ‘Made in India’ defence equipment. We have adopted a zero-tolerance policy towards terrorism,” added Modi.

Operation Sindoor

During the three-day-long Operation Sindoor, the Indian military inflicted significant damage on Pakistan’s military forces, which included downing fighter jets with advanced technology and damaging military installations near Islamabad.

India retaliated against Pakistan’s missiles and drone attacks. India cleared out terror camps based in Pakistan and Pakistan-Occupied Kashmir.

Chinese defence stocks slide

However, in comparison to the stellar run by Indian defence shares over the past few sessions, Chinese defence stocks have plunged over 9% in trade today after the recent upmove. As Financial Express.com reported earlier, key Chinese defence stocks like AVIC Chengdu Aircraft, makers of China’s J-10C fighter jet were among the biggest losers and ended Tuesday’s session on Hang Seng with sharp 9% losses on Tuesday. Interestingly, these counters had seen significant run-up last week.

Chinese military shipbuilder stocks under pressure

Shares of several other counters like China State Shipbuilding Corporation fell over 4%. Chian Ship Building is a key manufacturer of civilian as well as military vessels. Zhuzhou Hongda also slumped 6%. The company makes key military electronic components. Pakistan is a key market for Chinese defence equipment. The bulk of Pakistan’s defence equipment imports including J-10C, are from China. Between 2019-2023, 82% of Pakistan’s defence imports were from China. This is up sharply from 51% between 2012-2019.