Shares of companies of the Adani Group continued to fall on Wednesday after the Supreme Court’s verdict on Tuesday that Adani Power and Tata Power were not entitled to compensatory tariff for the higher price of imported coal. The companies can, however, be compensated for any change in Indian law, the apex court said, asking the power regulator to look into the matter.

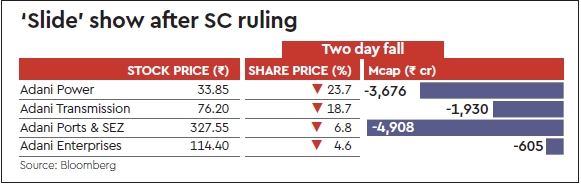

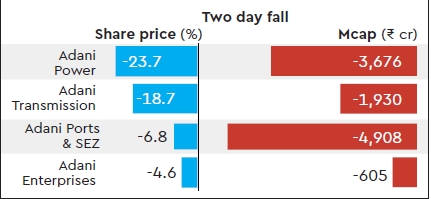

Adani Power lost 9% of its value on Wednesday to close at `33.85 on BSE, the lowest level in the last three months. The group has lost over `11,000 crore of market value in the last two trading sessions; the market capitalisation fell by 10% to 1 lakh crore on Wednesday.

The stock of the flagship company – Adani Enterprises – saw a decline of 5.4% on Wednesday. Adani Transmission has lost 18.7% in two sessions, while Adani Ports & SEZ has lost 6.7%.

The market capitalisation of Adani Ports was eroded by `4,908 crore after analysts raised concerns of a possible reduction in coal imports by Tata power and Adani Power through the Mundra port. These two firms together contributed 16% of coal volumes at Mundra port in FY16.

“Volumes at Mundra port, run by Adani Ports and Special Economic Zone, may be impacted if Tata Power and Adani Power decide to reduce coal imports after a court order on power tariffs” Goldman Sachs noted in a report.

The Adani Power stock fared worse than Tata Power since it had already recognised revenues from higher power tariffs since early 2014. Nomura Financial Advisory wrote the company may have to write off at least `3,500 crore, while Tata Power may avoid a hit as it hadn’t assumed higher tariffs in its earnings.

The erosion in the value of group companies resulted in a $492- million reduction in its promoter’s wealth. According to the Bloomberg Billionaires Index, Gautam Adani, the tenth richest billionaire in the country, boasts a net worth of $6.7 bn, as on Tuesday.

The benchmark Sensex has gained 0.23% in the last two days to close the session at 29,643.48.