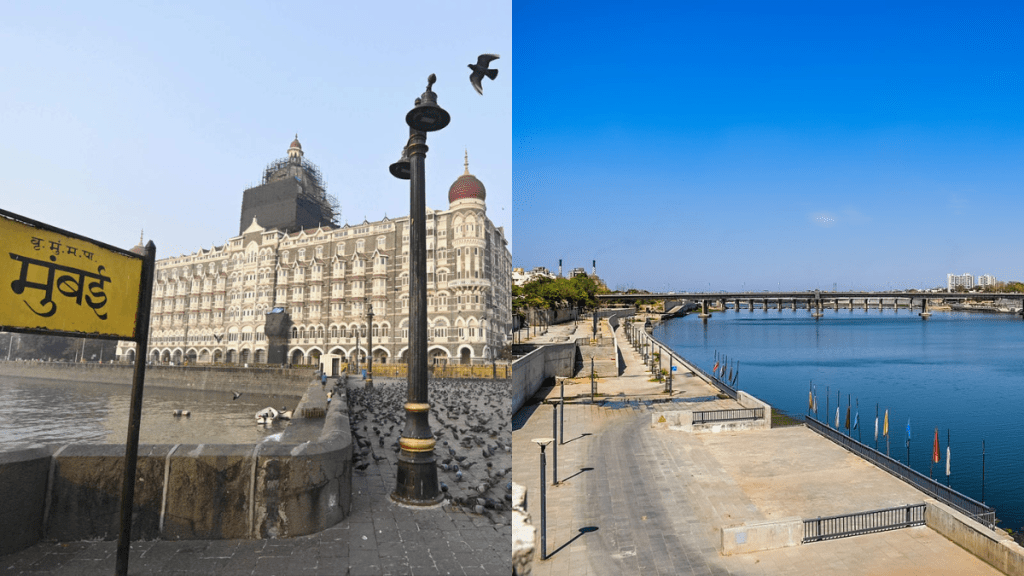

In a recently unveiled report by Knight Frank India, the renowned property consultant, a comprehensive assessment of India’s living affordability has revealed Ahmedabad as the most affordable city and Mumbai as the most expensive city to reside in. The Knight Frank Affordability Index, a crucial measure of the proportion of income allocated to housing expenses, has shed light on the intricate balance between economic growth and citizens’ well-being in these cities.

Ahmedabad: A beacon of affordability

Taking the lead as the most affordable city, Ahmedabad has captured attention for its exceptional affordability index. With an EMI-to-income ratio of 23%, an average household in this Gujarat city only needs to dedicate a fraction of their income to home loan EMIs. This favorable rating has positioned Ahmedabad as the pinnacle of affordable living among India’s major cities.

Mumbai’s staggering expense

On the opposite end of the spectrum, the vibrant metropolis of Mumbai has earned the distinction of being the most expensive city to call home. The staggering EMI-to-income ratio of 55% signifies that residents in Mumbai allocate over half of their earnings to home loan EMIs, highlighting the formidable housing challenges faced by those in India’s economic hub.

Affordability Index in other major cities

Hyderabad secures the second spot in the list of the most expensive cities, with an EMI-to-income ratio of 31%. The Delhi National Capital region follows closely behind, where residents must allocate 30% of their income to meet home loan EMIs. Bengaluru and Chennai share the next rank, each with an EMI-to-income ratio of 28%. Pune and Kolkata are neck-and-neck, both requiring an average of 26% of household income for home loan EMIs.

Ahmedabad — 23 per cent ratio

Pune — 26 per cent ratio

Kolkata — 26 per cent ratio

Bengaluru — 28 per cent ratio

Chennai — 28 per cent ratio

Delhi-NCR — 30 per cent ratio

Hyderabad — 31 per cent ratio

Mumbai — 55 per cent ratio

Inflation’s impact on affordability

Over the past year, affordability has taken a hit across these cities due to a 250 basis points increase in the Reserve Bank of India’s key lending rate. As a result, the EMI-to-income ratios have risen by approximately 1-2 percentage points on average, amplifying the financial burden for residents. While the housing market has displayed resilience, further interest rate hikes could potentially strain homebuyer capacity and sentiments.

Knight Frank’s insight

Shishir Baijal, Chairman and Managing Director of Knight Frank India, commended the Reserve Bank of India’s handling of inflation but highlighted the potential challenges posed by rising interest rates. Baijal noted the market’s strength and the remarkable shift in demand for mid and premium segments within the residential sector. However, the 250 bps increase in policy rates has led to a 2.5% reduction in affordability across markets on average.

Affordability progression

Reflecting on the past, the spectrum of affordability among India’s top cities has evolved notably. From 2010 to 2018, the average apartment cost in Mumbai has decreased from 11 times the average household income to the current seven times, signaling a positive trend in housing affordability.

The Knight Frank Affordability Index gauges the proportion of income required to cover monthly housing EMI costs. The calculations assume a 20-year home loan tenure, an 80% loan-to-value ratio, a fixed housing unit area, and a median housing price. The index serves as a critical measure to assess housing affordability, guiding financial institutions in mortgage underwriting practices.

In summary, the recently released Knight Frank India report has illuminated the spectrum of affordability across India’s major cities, underscoring the intricate relationship between housing expenses, economic growth, and citizen welfare. As cities navigate the balance between affordability and aspiration, these insights will undoubtedly shape policy discussions and the housing landscape in the years to come.