Dubai remains one of the most ‘affordable’ luxury home destinations in the world. A report published by Knight Frank titled, ‘Dubai Residential Market Review Winter 2022-23’ has revealed that the bulk of Dubai submarkets have house price to income ratios of under six times annual incomes. Globally, the threshold that is considered affordable is usually six-times your annual household income, which is approximately the level of mortgage most banks are willing to extend.

Also Read: Top international cities for Indians looking to buy a home abroad

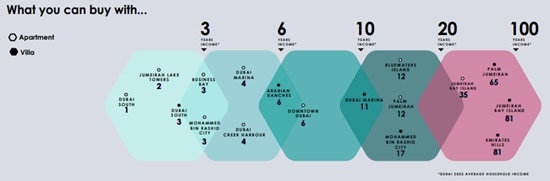

The report analysed the ratio of average income to average house prices across Dubai, by neighbourhood, in order to determine how affordable the mainstream market is. Our analysis suggests that the bulk of the city remains ‘affordable’.

The outliers are our three prime luxury submarkets: The Palm Jumeirah, Emirates Hills and Jumeirah Bay Island – the only three neighbourhoods where house prices are in excess of 20-times average household incomes.

The majority of international buyers are drawn to Dubai’s unrivalled sun-sea-sand lifestyle, which typically comes with villa or waterfront purchases, and this is where demand is expected to increase.

At around AED 3,200 psf, or about US$ 870 psf, Dubai’s Prime residential neighbourhoods remain amongst the most affordable in the world. This combined with the high quality of residential product now available in the upper echelons of the market, is cementing Dubai’s position as one of the world’s leading second homes markets. Developers are responding, with contemporary homes, complete with extensive use of glazing and ultra-modern finishes transforming the residential landscape. Dubai is quickly moving away from the days of Mediterranean themed homes, with ultra-modern developments quickly starting to dominate,” says Andrew Cummings, Partner – Head of Prime Residential, Knight Frank.

Also Read – Dubai Residential Market: Villas outperform apartments but values still below 2014 peak