By Ankur Mishra

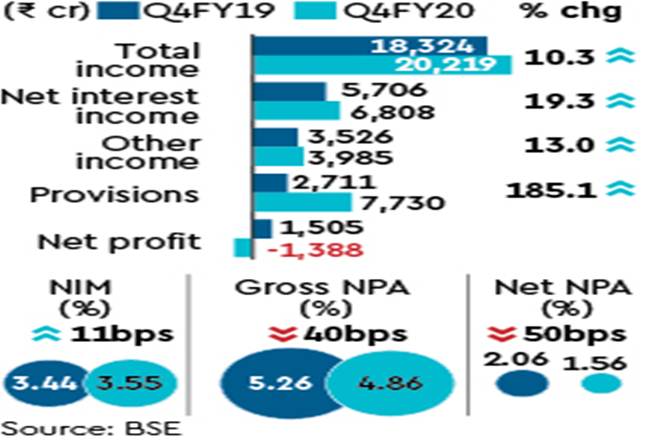

Axis Bank on Tuesday reported a loss of Rs 1,388 crore for the March quarter as the lender provided an extra Rs 3,000 crore due to the disruption from the pandemic. Total provisions for Q4FY20 jumped to Rs 7,730 crore, up 122% sequentially.

In Q4FY19, the private sector lender had reported a profit of Rs 1,505 crore.

Amitabh Chaudhry, MD & CEO, Axis Bank, said the lender would stay conservative, sacrificing growth if required. “As of now, things are looking quite dismal as we look out of our window… and when you look out of your window things are not great either,” he said.

The CEO, nonetheless, asserted that Axis Bank’s portfolio was performing fairly well in comparison with the portfolios of some other banks. “Based on RBI directions, we needed to make provisions of Rs 560 crore but we have put aside Rs 3,000 crore on account of Covid-19,” he said, adding this assessment was based on the current situation.

Chaudhry further said the bank does not need to raise any fresh capital as of now but refrained from providing any guidance on loan growth.

The bank’s advances grew 15% y-o-y to Rs 5,71,424 crore as on March 31, with retail loans up 24% y-o-y to Rs 3.05 lakh crore, accounting for 53% of the net advances. The net interest income (NII) grew 19% y-o-y to Rs 6,808 crore while the non-interest income grew 13% y-o-y to Rs 3,985 crore.

Asset quality improved and the bank recognised a smaller quantumof slippages of Rs 3,920 crore, compared with Rs 6,214 crore in Q3FY20.

The corporate slippages stood at Rs 1,839 crore.

The gross NPAs in Q4FY20 were Rs 30,234 crore or 4.86% against 5% in December 2019. The net NPAs were Rs 9,360 crore or 1.56% compared with 2.09% in December 2019.

As on March 31, the bank’s provision coverage, as a proportion of gross NPAs stood at 69%. The bank made aggregate additional provisions of Rs 5,983 crore in Q4FY20, including Rs 3,000 crore for the impact of the pandemic.

The overall additional provisions held by the bank towards various contingencies together with the standard asset provisions, translate to a standard asset coverage of 1.3% as on March 31.